- United Arab Emirates

- /

- Logistics

- /

- DFM:ARMX

Aramex PJSC (DFM:ARMX) Has Some Way To Go To Become A Multi-Bagger

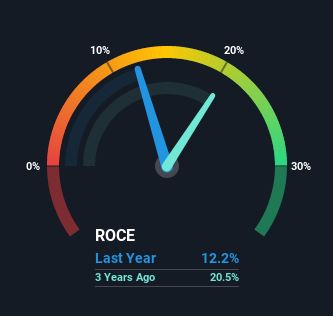

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. With that in mind, the ROCE of Aramex PJSC (DFM:ARMX) looks decent, right now, so lets see what the trend of returns can tell us.

Return On Capital Employed (ROCE): What is it?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Aramex PJSC, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.12 = د.إ454m ÷ (د.إ5.9b - د.إ2.2b) (Based on the trailing twelve months to June 2021).

Thus, Aramex PJSC has an ROCE of 12%. On its own, that's a standard return, however it's much better than the 9.8% generated by the Logistics industry.

See our latest analysis for Aramex PJSC

Above you can see how the current ROCE for Aramex PJSC compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Aramex PJSC.

What Does the ROCE Trend For Aramex PJSC Tell Us?

While the returns on capital are good, they haven't moved much. Over the past five years, ROCE has remained relatively flat at around 12% and the business has deployed 33% more capital into its operations. Since 12% is a moderate ROCE though, it's good to see a business can continue to reinvest at these decent rates of return. Over long periods of time, returns like these might not be too exciting, but with consistency they can pay off in terms of share price returns.

On another note, while the change in ROCE trend might not scream for attention, it's interesting that the current liabilities have actually gone up over the last five years. This is intriguing because if current liabilities hadn't increased to 37% of total assets, this reported ROCE would probably be less than12% because total capital employed would be higher.The 12% ROCE could be even lower if current liabilities weren't 37% of total assets, because the the formula would show a larger base of total capital employed. With that in mind, just be wary if this ratio increases in the future, because if it gets particularly high, this brings with it some new elements of risk.

The Bottom Line On Aramex PJSC's ROCE

To sum it up, Aramex PJSC has simply been reinvesting capital steadily, at those decent rates of return. In light of this, the stock has only gained 18% over the last five years for shareholders who have owned the stock in this period. So because of the trends we're seeing, we'd recommend looking further into this stock to see if it has the makings of a multi-bagger.

Like most companies, Aramex PJSC does come with some risks, and we've found 3 warning signs that you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DFM:ARMX

Aramex PJSC

Invests in freight, express, logistics, and supply chain management businesses in the United Arab Emirates, the Middle East, North Africa, Turkey, East and South Africa, Europe, North America, North and South Asia, and Oceania.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success