- Hong Kong

- /

- Energy Services

- /

- SEHK:3303

Discover Air Arabia PJSC And 2 Other Leading Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate mixed signals, with the S&P 500 achieving its best two-year stretch in decades despite recent economic concerns, investors are increasingly turning their attention to stable income sources like dividend stocks. In this dynamic environment, a good dividend stock is characterized by consistent payouts and resilience against market fluctuations, making them an attractive option for those seeking reliable returns amidst economic uncertainty.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.77% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.63% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.42% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.14% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 1973 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

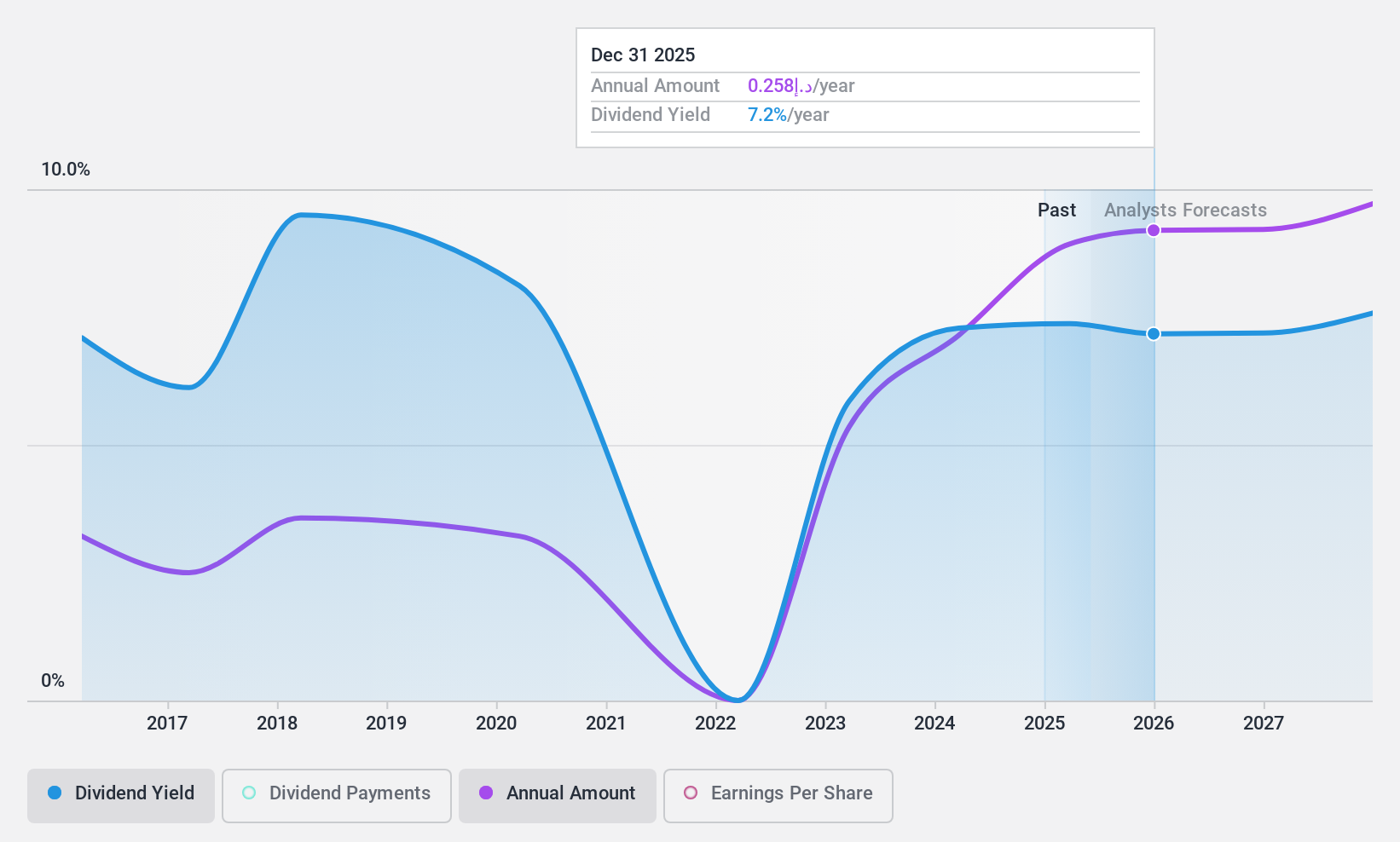

Air Arabia PJSC (DFM:AIRARABIA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Air Arabia PJSC, along with its subsidiaries, offers air travel services and has a market capitalization of AED14.51 billion.

Operations: Air Arabia PJSC generates revenue primarily from its airline segment, which amounts to AED6.14 billion.

Dividend Yield: 6.4%

Air Arabia PJSC's dividend yield is in the top 25% of the AE market, supported by a sustainable payout ratio with dividends covered by both earnings and cash flows. However, its dividend history over the past decade has been volatile and unreliable, despite some growth. The company's recent financial performance shows stable earnings with Q3 sales at AED 1.79 billion, indicating potential for continued dividend payments amidst a lower-than-market price-to-earnings ratio of 10.5x.

- Click here and access our complete dividend analysis report to understand the dynamics of Air Arabia PJSC.

- Insights from our recent valuation report point to the potential overvaluation of Air Arabia PJSC shares in the market.

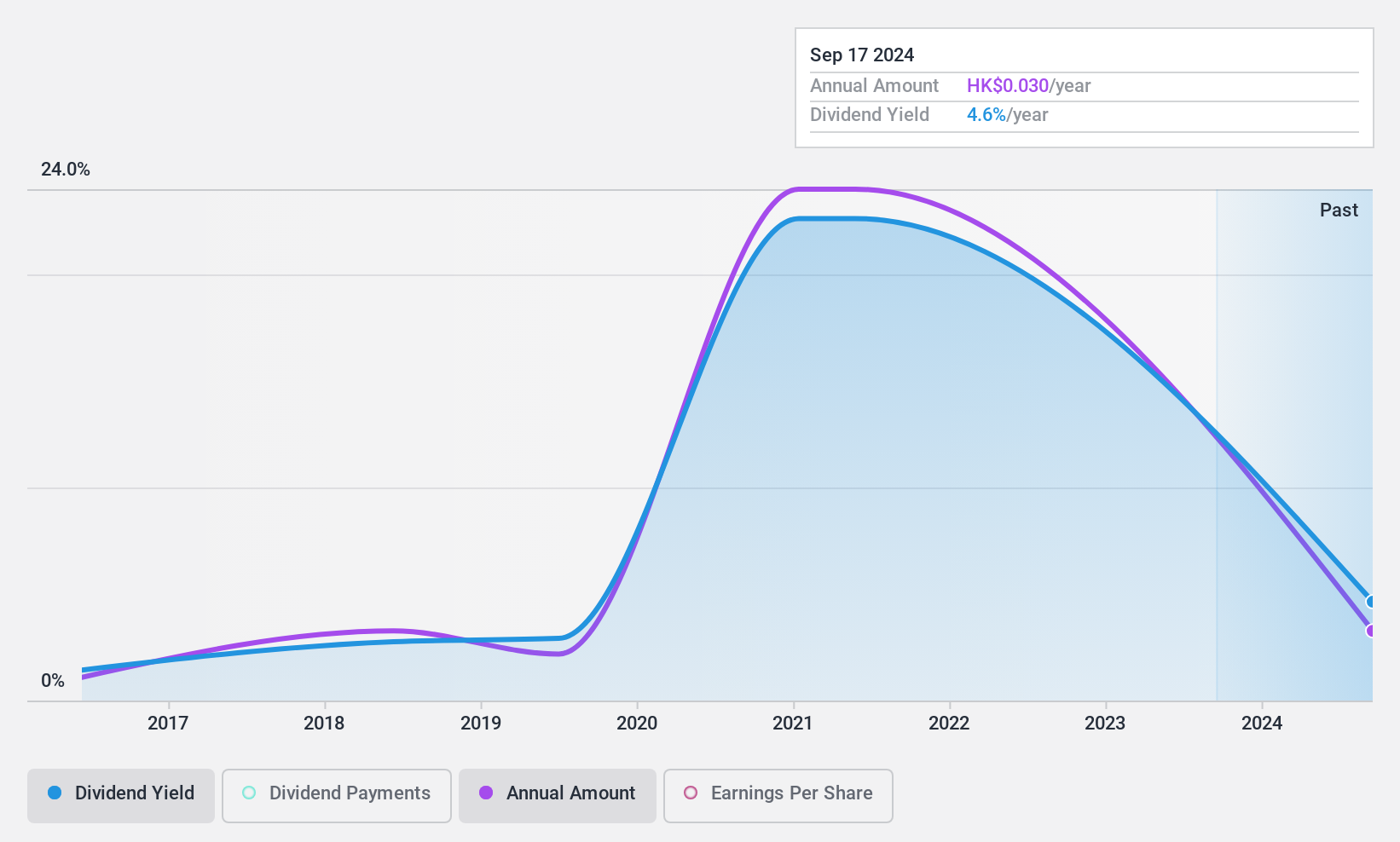

Jutal Offshore Oil Services (SEHK:3303)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jutal Offshore Oil Services Limited is an investment holding company involved in the fabrication of facilities and provision of integrated services for the oil and gas, new energy, and refining and chemical industries, with a market cap of HK$1.53 billion.

Operations: Jutal Offshore Oil Services Limited generates revenue primarily from the oil and gas segment, which accounts for CN¥2.98 billion, with additional contributions from the new energy and refinery and chemical segment totaling CN¥64.13 million.

Dividend Yield: 8%

Jutal Offshore Oil Services' dividend payments are well covered by earnings and cash flows, with low payout ratios of 15.5% and 24.1%, respectively. However, the dividends have been volatile over the past decade, making them unreliable despite recent significant earnings growth of US$26 million. The stock trades at a substantial discount to its estimated fair value but has experienced shareholder dilution recently, which may concern some investors seeking stable dividend income.

- Dive into the specifics of Jutal Offshore Oil Services here with our thorough dividend report.

- Our valuation report here indicates Jutal Offshore Oil Services may be undervalued.

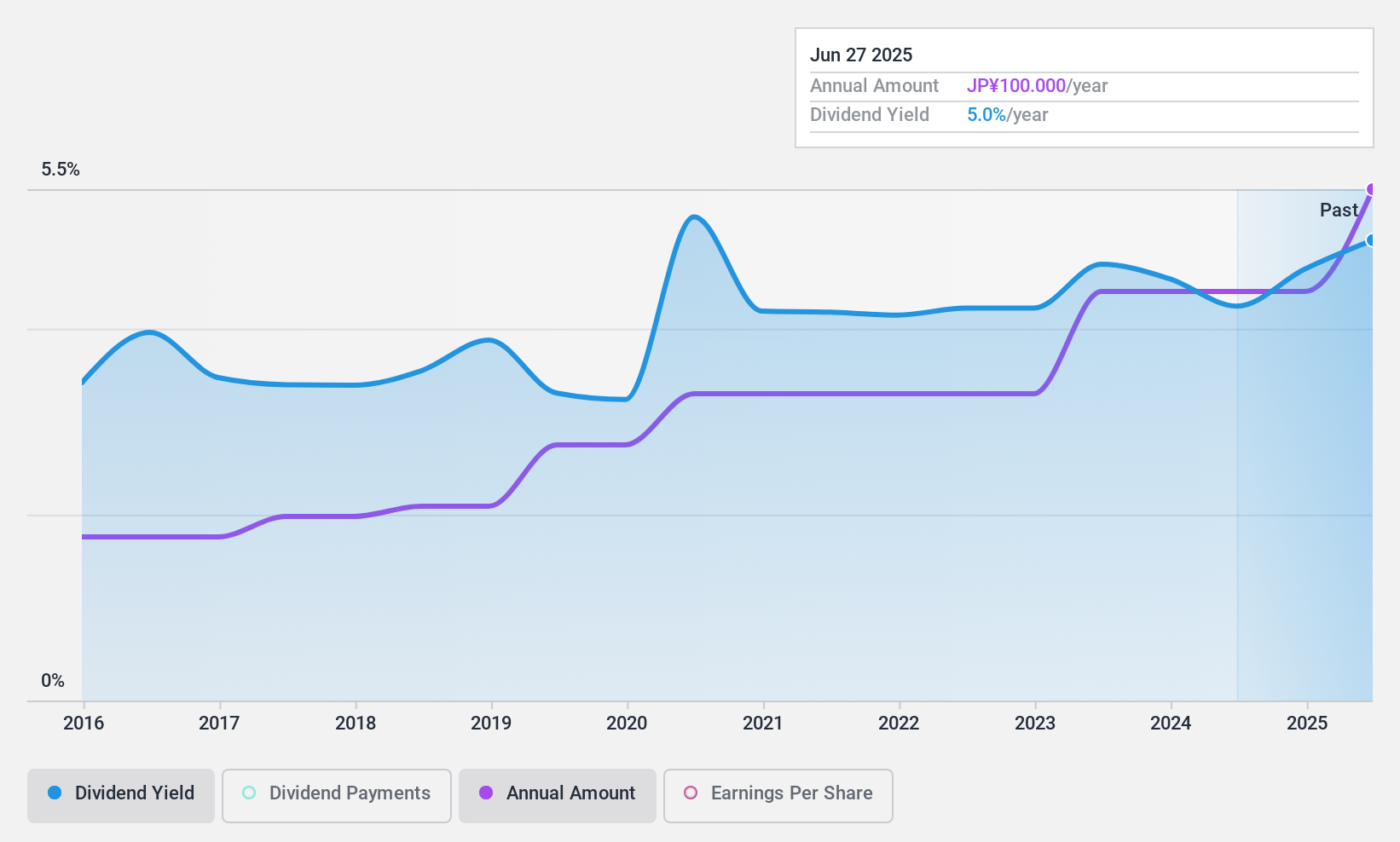

CAC Holdings (TSE:4725)

Simply Wall St Dividend Rating: ★★★★★★

Overview: CAC Holdings Corporation, with a market cap of ¥27.71 billion, operates through its subsidiaries to provide information technology services both in Japan and internationally.

Operations: CAC Holdings Corporation generates revenue through its Domestic IT segment, contributing ¥38.63 billion, and its Overseas IT segment, adding ¥15.59 billion.

Dividend Yield: 4.8%

CAC Holdings' dividends are supported by a reasonable payout ratio of 54.4% and cash flow coverage at 68.3%, indicating sustainability. The dividend yield of 4.77% is among the top in Japan, with stable and growing payouts over the past decade, including a consistent JPY 40 per share for year-end dividends in recent guidance. Trading at nearly 28% below estimated fair value, CAC offers an attractive opportunity for dividend-focused investors seeking reliability and growth potential.

- Click to explore a detailed breakdown of our findings in CAC Holdings' dividend report.

- Our valuation report unveils the possibility CAC Holdings' shares may be trading at a discount.

Key Takeaways

- Delve into our full catalog of 1973 Top Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3303

Jutal Offshore Oil Services

An investment holding company, engages in the fabrication of facilities and provision of integrated services for oil and gas, new energy, and refining and chemical industries.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives