Undiscovered Gems Three Promising Stocks To Watch This December 2024

Reviewed by Simply Wall St

As global markets continue to reach record highs, with small-cap indices like the Russell 2000 joining their larger peers in uncharted territory, investors are keenly observing how domestic policies and geopolitical factors shape market sentiment. Amidst this backdrop of economic dynamics and tariff uncertainties, identifying promising stocks requires a focus on companies that demonstrate resilience and potential for growth in evolving conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Al-Enma'a Real Estate Company K.S.C.P | 16.88% | -13.58% | 13.65% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Union Properties (DFM:UPP)

Simply Wall St Value Rating: ★★★★☆☆

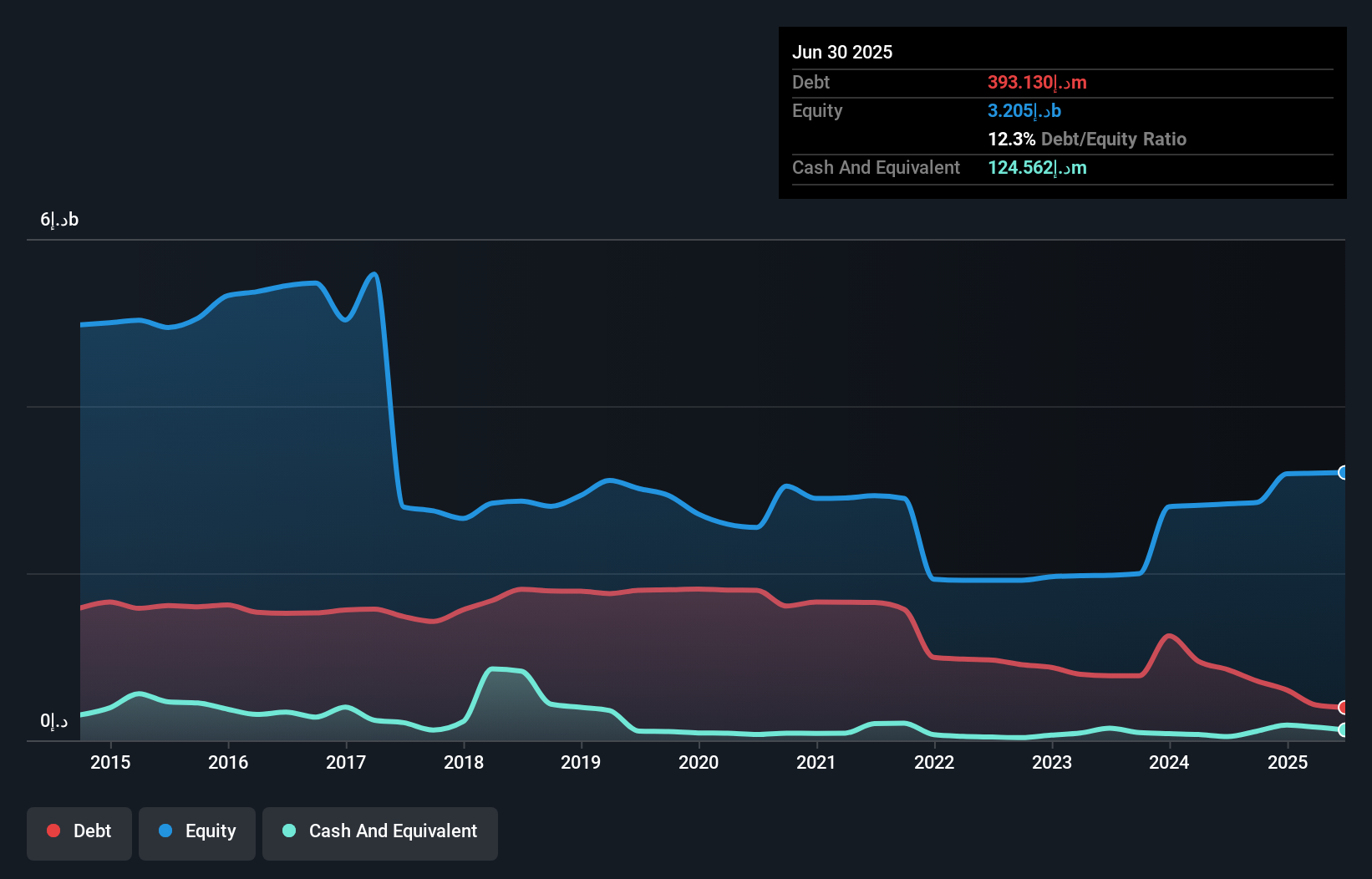

Overview: Union Properties Public Joint Stock Company, along with its subsidiaries, focuses on investing in, developing, managing, maintaining, and selling real estate properties mainly in the United Arab Emirates and has a market capitalization of approximately AED1.68 billion.

Operations: Union Properties generates revenue primarily from its Goods and Services segment, which accounts for AED452.07 million, followed by Real Estate at AED47.46 million and Contracting at AED33.26 million. The company's financial performance is influenced significantly by the Goods and Services segment due to its substantial contribution to overall revenue.

Union Properties, a relatively small player in the real estate sector, showcases a compelling mix of financial metrics and growth potential. The company’s price-to-earnings ratio stands at 2.2x, significantly lower than the AE market average of 13x, suggesting it trades at an attractive valuation compared to its peers. Over the past year, earnings surged by an impressive 983%, outpacing industry growth of 46.8%. However, challenges exist with interest payments not well covered by EBIT (0.5x coverage). Recent results show third-quarter sales at AED 123 million and net income slightly decreased to AED 18 million from AED 20 million last year.

- Take a closer look at Union Properties' potential here in our health report.

Review our historical performance report to gain insights into Union Properties''s past performance.

Hengsheng Energy (SHSE:605580)

Simply Wall St Value Rating: ★★★★★★

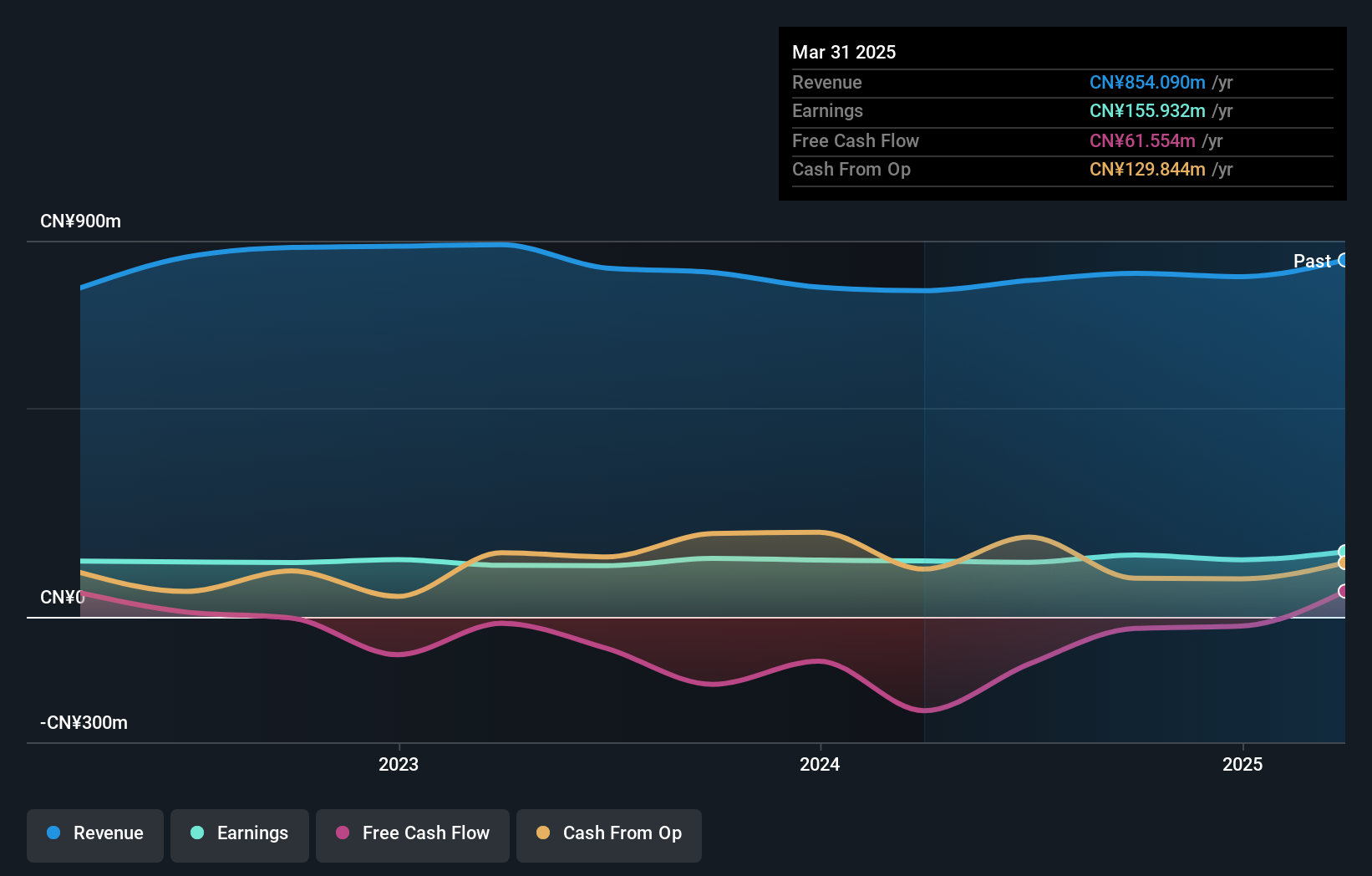

Overview: Hengsheng Energy Co., Ltd operates in the coal-fired thermal power sector in China with a market capitalization of CN¥2.90 billion.

Operations: Hengsheng Energy generates revenue primarily from the power and steam industry, amounting to CN¥822.06 million. The company's market capitalization stands at CN¥2.90 billion, reflecting its position in the coal-fired thermal power sector in China.

Hengsheng Energy, a smaller player in the energy sector, has shown promising growth with earnings rising by 5.7% over the past year, outpacing the Integrated Utilities industry average of 4.4%. Its debt to equity ratio has significantly improved from 72% to 33.9% in five years, indicating a stronger financial footing. The company also benefits from robust interest coverage with EBIT covering interest payments by a substantial margin of 29 times. Despite these positives, Hengsheng's recent financial results include a large one-off gain of CN¥66.7M impacting its earnings for the last twelve months ending September 2024.

- Delve into the full analysis health report here for a deeper understanding of Hengsheng Energy.

Evaluate Hengsheng Energy's historical performance by accessing our past performance report.

Chengzhi (SZSE:000990)

Simply Wall St Value Rating: ★★★★★★

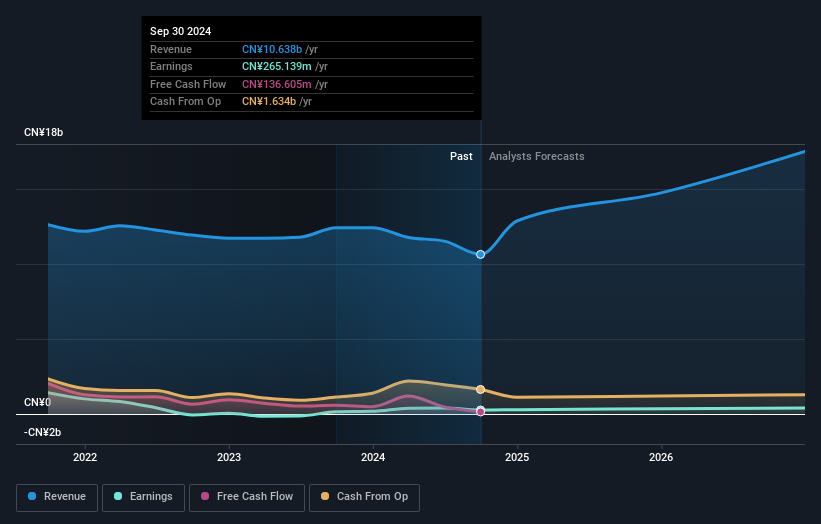

Overview: Chengzhi Co., Ltd. operates in the clean energy, semiconductor display material, medical healthcare, and life science sectors in China with a market cap of CN¥10.15 billion.

Operations: Chengzhi generates revenue primarily from its operations in clean energy, semiconductor display materials, medical healthcare, and life sciences sectors. The company has a market capitalization of CN¥10.15 billion.

Chengzhi seems to be carving a niche in the chemicals industry with its recent 76.5% earnings growth, outpacing the industry's -5%. Its net debt to equity ratio stands at a satisfactory 8%, indicating prudent financial management over five years, reducing from 32.2% to 26.7%. Despite sales decreasing from CN¥10.02 billion to CN¥8.24 billion for the nine months ending September 2024, net income rose significantly from CN¥130.71 million to CN¥218.45 million, showcasing resilience amidst challenges and bolstered by one-off items impacting results recently valued at CN¥150.7M loss in past year earnings reports as of September 2024.

- Click here and access our complete health analysis report to understand the dynamics of Chengzhi.

Gain insights into Chengzhi's past trends and performance with our Past report.

Taking Advantage

- Click through to start exploring the rest of the 4639 Undiscovered Gems With Strong Fundamentals now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000990

Chengzhi

Engages in the clean energy, semiconductor display material, medical healthcare, and life science businesses in China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives