As global markets navigate a mixed landscape with the S&P 500 and Nasdaq Composite achieving strong annual gains despite recent economic contractions, small-cap stocks continue to capture investor attention due to their potential for growth in an evolving economic environment. In this context, identifying promising small-cap stocks involves looking for companies with robust fundamentals and resilience amidst fluctuating market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Bank Ganesha | NA | 25.03% | 70.72% | ★★★★★★ |

| ASRock Rack Incorporation | NA | 45.76% | 269.05% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Union Properties (DFM:UPP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Union Properties Public Joint Stock Company is involved in investing in, developing, managing, maintaining, and selling real estate properties primarily in the United Arab Emirates and has a market capitalization of AED1.83 billion.

Operations: Union Properties generates revenue primarily from Goods and Services (AED452.07 million), followed by Real Estate (AED47.46 million) and Contracting (AED33.26 million).

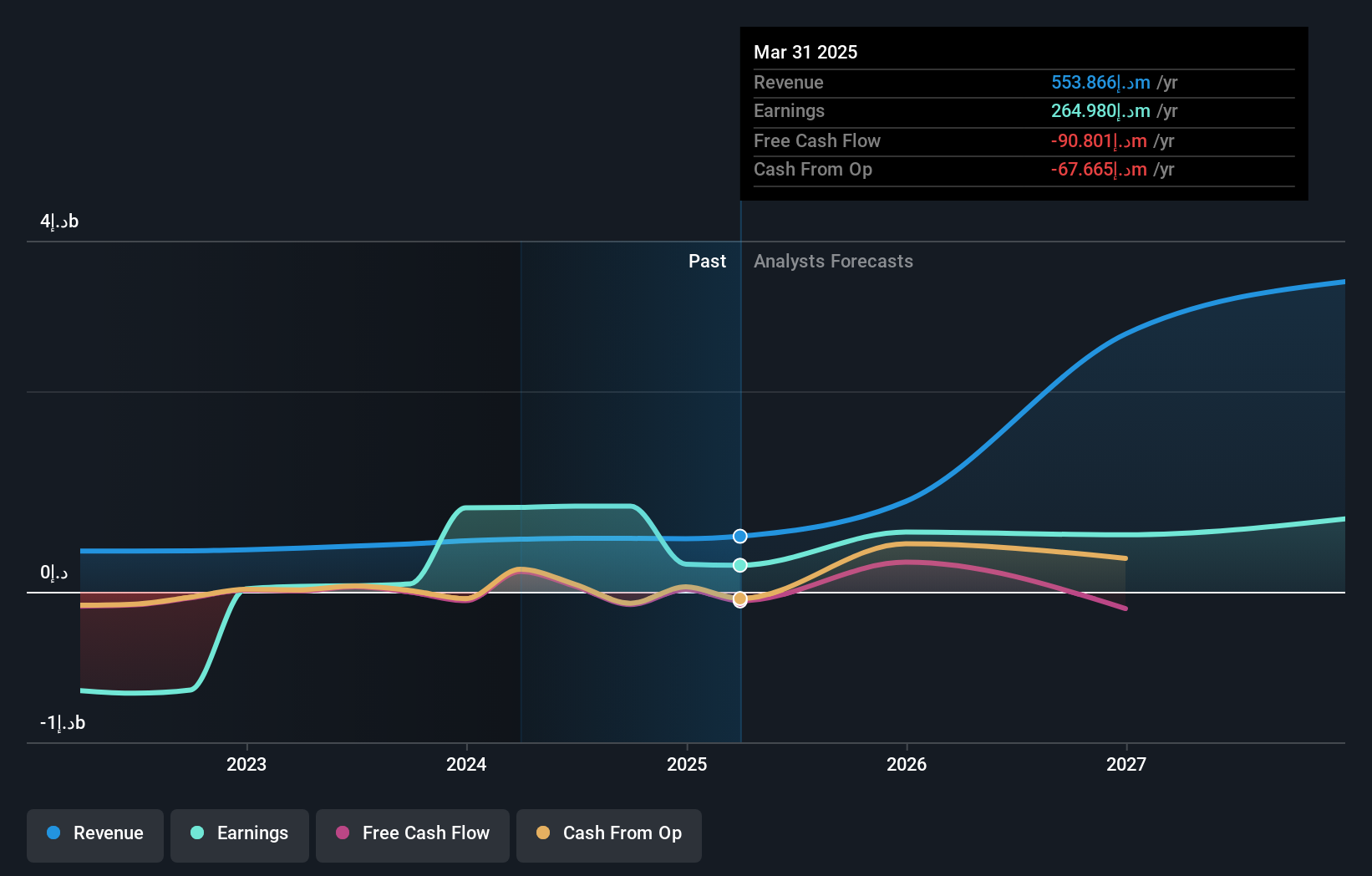

Union Properties, a relatively small player in the real estate sector, shows a mixed financial performance. Its earnings surged by an impressive 983% over the past year, outpacing industry growth of 46.8%. However, interest coverage remains weak at just 0.5 times EBIT against debt payments. The net debt to equity ratio stands at a satisfactory 21%, having improved from 61.5% over five years. Despite these gains, free cash flow is negative and earnings are projected to drop by an average of 50.6% annually for three years ahead, though revenue is expected to grow by about 64% per year.

- Unlock comprehensive insights into our analysis of Union Properties stock in this health report.

Examine Union Properties' past performance report to understand how it has performed in the past.

iFamilySC (KOSDAQ:A114840)

Simply Wall St Value Rating: ★★★★☆☆

Overview: iFamilySC Co. Ltd is an interactive branding company that connects content and products both online and offline in South Korea and internationally, with a market cap of ₩365.62 billion.

Operations: iFamilySC generates revenue primarily from its Cosmetics Business Division, which contributes ₩193.88 billion, while the Wedding Business Sector adds ₩4.61 billion.

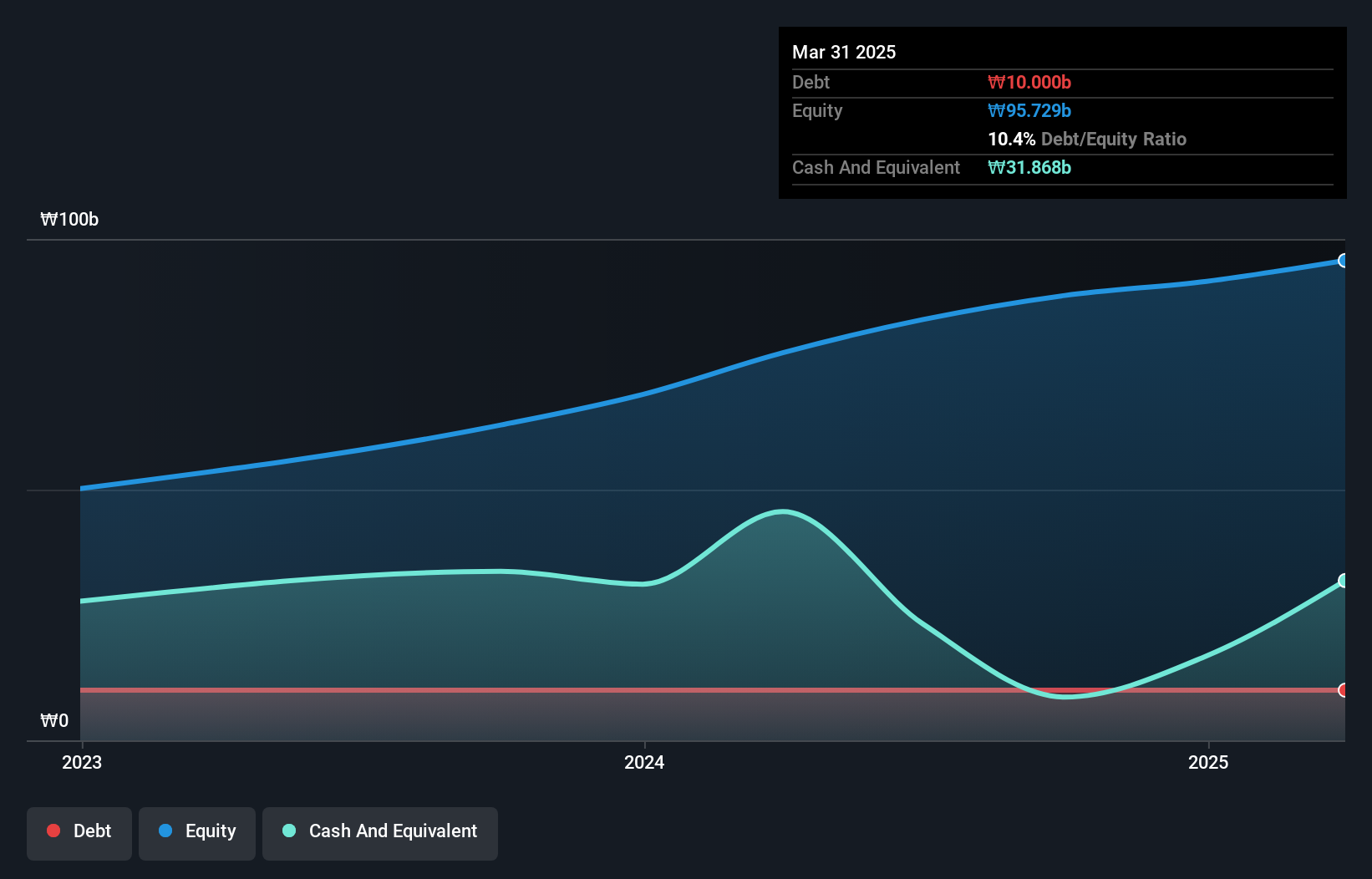

iFamilySC has shown impressive growth with earnings surging by 110% over the past year, surpassing the Specialty Retail industry's 48% rise. The company's net debt to equity ratio stands at a satisfactory 1.6%, ensuring financial stability. Despite its volatile share price in recent months, iFamilySC's high level of non-cash earnings suggests robust underlying performance. Recently, it completed a buyback of 117,000 shares for KRW 2.99 billion, reflecting confidence in its valuation and future prospects. Looking ahead, earnings are forecasted to grow annually by approximately 25%, hinting at potential continued upward momentum.

- Click to explore a detailed breakdown of our findings in iFamilySC's health report.

Assess iFamilySC's past performance with our detailed historical performance reports.

Cathay Consolidated (TWSE:1342)

Simply Wall St Value Rating: ★★★★★★

Overview: Cathay Consolidated, Inc. operates as a contract manufacturer of technical fabrics and finished goods in Taiwan with a market capitalization of approximately NT$8.36 billion.

Operations: Cathay Consolidated generates revenue primarily from its Plastics & Rubber segment, amounting to NT$2.49 billion.

Cathay Consolidated, a smaller player in its industry, has shown mixed financial performance recently. Its debt to equity ratio improved from 36.6% to 27.2% over the past five years, indicating better leverage management. Despite being profitable and having satisfactory net debt levels at 1.2%, the company faced a negative earnings growth of -5.9%, contrasting with the industry's average of 13.9%. Recent third-quarter results revealed sales of TWD 600 million and net income of TWD 114 million, both lower than last year’s figures, suggesting challenges in maintaining momentum amidst industry dynamics and internal changes like forming a Sustainable Development Committee led by new board members George Liu and Julia Cheng.

Turning Ideas Into Actions

- Reveal the 4666 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:UPP

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives