- United Arab Emirates

- /

- Software

- /

- ADX:PHX

Middle Eastern Penny Stocks To Watch In August 2025

Reviewed by Simply Wall St

Most Gulf equity markets have edged higher recently, buoyed by rising oil prices that have helped offset mixed earnings reports. In the context of these market dynamics, penny stocks—though often considered a niche investment—can still present intriguing opportunities for growth, especially when they are supported by strong financial health. This article will spotlight several Middle Eastern penny stocks that exhibit financial strength and potential for long-term success.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.71 | SAR1.48B | ✅ 2 ⚠️ 1 View Analysis > |

| Amanat Holdings PJSC (DFM:AMANAT) | AED1.17 | AED2.91B | ✅ 2 ⚠️ 2 View Analysis > |

| Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP) | TRY4.95 | TRY1.36B | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.50 | AED2.98B | ✅ 2 ⚠️ 3 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY2.88 | TRY3.1B | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.45 | AED392.7M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.87 | AED12.2B | ✅ 3 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.923 | AED561.42M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.918 | ₪216.93M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 77 stocks from our Middle Eastern Penny Stocks screener.

We'll examine a selection from our screener results.

Phoenix Group (ADX:PHX)

Simply Wall St Financial Health Rating: ★★★★★☆

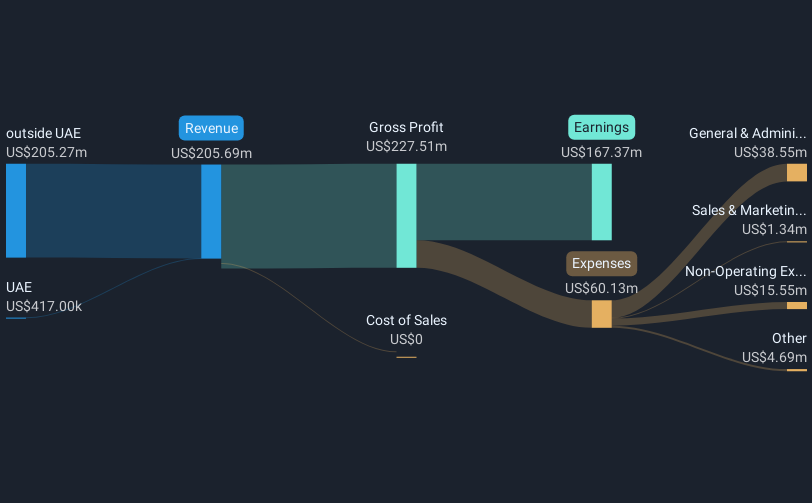

Overview: Phoenix Group Plc, along with its subsidiaries, offers crypto and cloud mining services across the United Arab Emirates, Oman, CIS, Canada, the United States, and other international markets, with a market cap of AED9.38 billion.

Operations: The company generates revenue of $145.94 million from its data processing segment.

Market Cap: AED9.38B

Phoenix Group Plc, operating in the crypto and cloud mining sectors, is currently unprofitable with a negative return on equity of -18.81%. The company's recent earnings report highlights a significant decline in revenue to US$29.63 million for Q2 2025 from US$51.48 million the previous year, alongside a net loss of US$29.17 million compared to a net income previously reported. Despite these challenges, Phoenix maintains strong short-term financial health with assets exceeding liabilities and satisfactory debt management indicated by its low net debt to equity ratio of 2.6% and well-covered interest payments through EBIT at 80.5x coverage.

- Click here and access our complete financial health analysis report to understand the dynamics of Phoenix Group.

- Gain insights into Phoenix Group's future direction by reviewing our growth report.

Union Properties (DFM:UPP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Union Properties PJSC is engaged in property investment and development with a market capitalization of AED3.71 billion.

Operations: The company generates revenue from three main segments: Contracting (AED39.35 million), Goods and Services (AED479.28 million), and Real Estate and Others (AED60.01 million).

Market Cap: AED3.71B

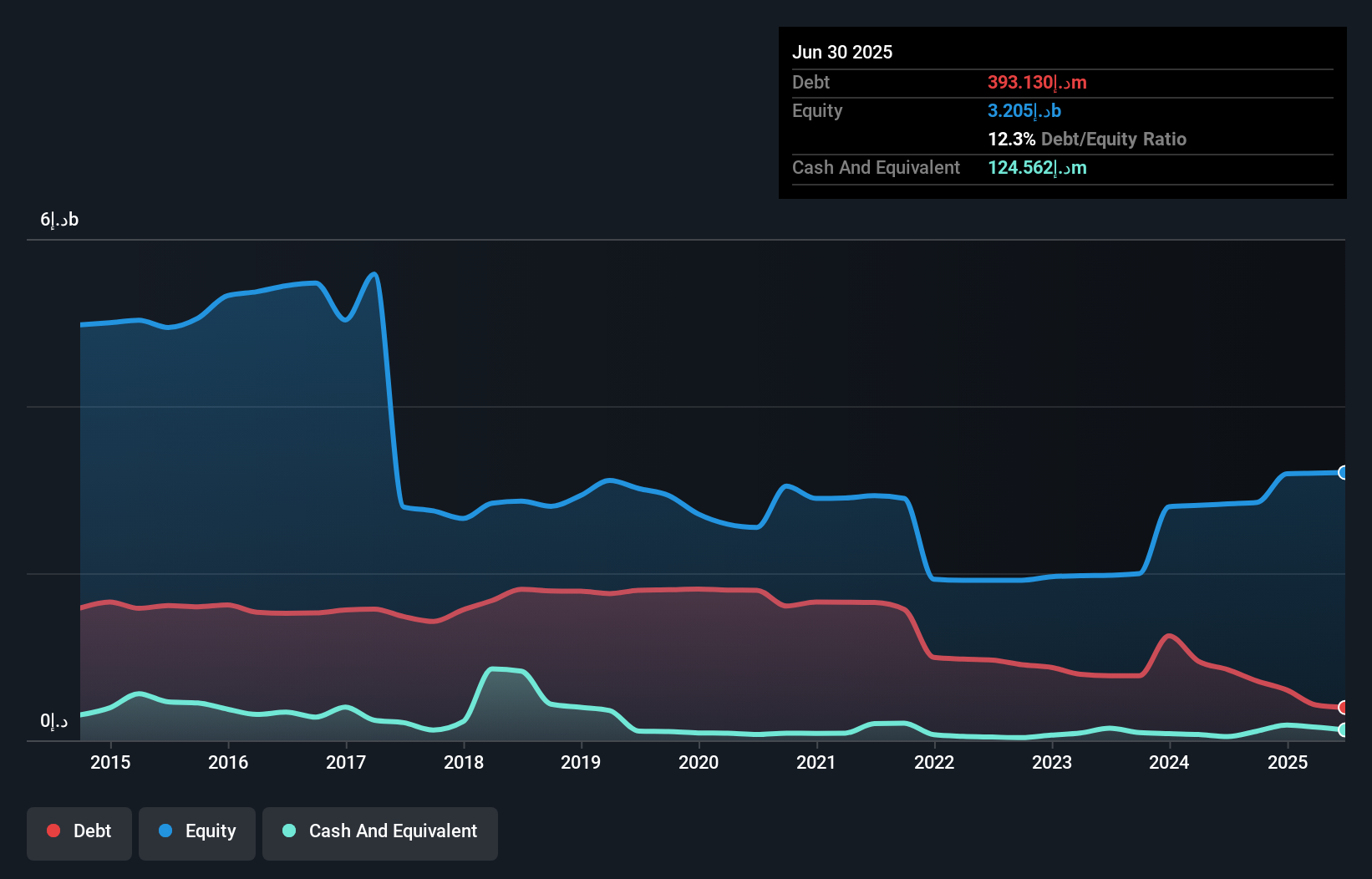

Union Properties PJSC, with a market cap of AED3.71 billion, has shown mixed financial performance recently. Despite achieving profitability over the past five years with earnings growing annually by 33.7%, its recent earnings report for Q2 2025 indicates a decline in net income to AED8.75 million from AED18.3 million the previous year, though sales increased to AED152.44 million from AED127.67 million. The company's debt management appears solid with a reduced debt-to-equity ratio and satisfactory coverage by operating cash flow; however, profit margins have decreased and interest payments are not well covered by EBIT, indicating potential financial pressures ahead.

- Get an in-depth perspective on Union Properties' performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Union Properties' future.

Utron (TASE:UTRN)

Simply Wall St Financial Health Rating: ★★★★☆☆

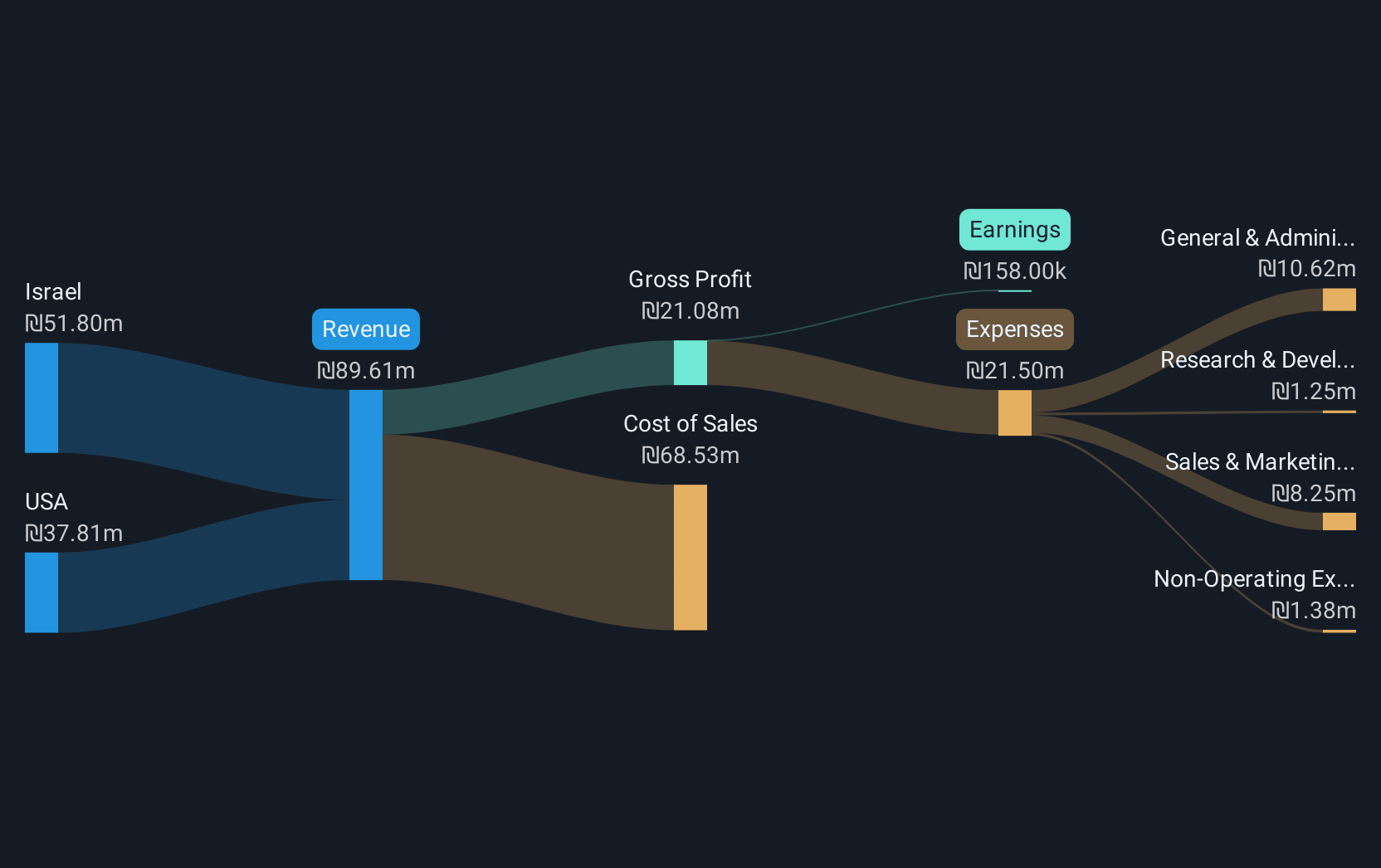

Overview: Utron Ltd specializes in the planning, development, production, construction, marketing, and maintenance of autonomous parking solutions and has a market cap of ₪101.51 million.

Operations: The company generates its revenue from the Heavy Construction segment, totaling ₪89.61 million.

Market Cap: ₪101.51M

Utron Ltd, with a market cap of ₪101.51 million, has demonstrated financial stability with short-term assets exceeding both short and long-term liabilities. The company's debt is well covered by operating cash flow, and it holds more cash than total debt. Despite these strengths, Utron faces challenges such as low return on equity at 0.3% and declining profit margins from 1% to 0.2%. Although the company has experienced negative earnings growth recently, its management and board are seasoned with average tenures of over three years each, potentially providing strategic stability in navigating future hurdles.

- Unlock comprehensive insights into our analysis of Utron stock in this financial health report.

- Evaluate Utron's historical performance by accessing our past performance report.

Seize The Opportunity

- Unlock more gems! Our Middle Eastern Penny Stocks screener has unearthed 74 more companies for you to explore.Click here to unveil our expertly curated list of 77 Middle Eastern Penny Stocks.

- Contemplating Other Strategies? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:PHX

Phoenix Group

Provides crypto and cloud mining services in the United Arab Emirates, Oman, CIS, Canada, the United States, and internationally.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives