3 Middle Eastern Penny Stocks With Market Caps Larger Than US$100M

Reviewed by Simply Wall St

As tensions rise over the Israel-Iran conflict, many Gulf markets have seen declines, reflecting investor caution amid regional instability. Despite these challenges, the Middle Eastern market continues to offer unique opportunities for investors willing to explore beyond traditional blue-chip stocks. Penny stocks, though an older term, still signify smaller or emerging companies that can provide significant value when backed by strong financials and growth potential.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Terminal X Online (TASE:TRX) | ₪4.526 | ₪574.83M | ✅ 2 ⚠️ 0 View Analysis > |

| Menara Ventures Xl - Limited Partnership (TASE:MNRA) | ₪2.84 | ₪13.05M | ✅ 1 ⚠️ 4 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.79 | SAR1.52B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.256 | ₪298.72M | ✅ 3 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.04 | AED2.06B | ✅ 3 ⚠️ 2 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.77 | TRY1.91B | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.24 | AED374.22M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.36 | AED9.99B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.72 | AED437.94M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.374 | ₪176.49M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 94 stocks from our Middle Eastern Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Al Khaleej Investment P.J.S.C (ADX:KICO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Al Khaleej Investment P.J.S.C. is a real estate and investment company based in the United Arab Emirates, with a market cap of AED417.90 million.

Operations: The company generates revenue primarily from its real estate segment, amounting to AED15.79 million.

Market Cap: AED417.9M

Al Khaleej Investment P.J.S.C., with a market cap of AED417.90 million, has faced challenges as its recent earnings report shows a net loss of AED1.88 million for Q1 2025, contrasting with a net income of AED4.61 million in the same period last year. The company's revenue from real estate stands at AED15.79 million, indicating limited growth potential in this segment. Despite having more cash than debt and covering interest payments comfortably, its profit margins have declined from 49.3% to 30.3%. Recent board changes and auditor appointments could signal strategic shifts amidst volatile share prices.

- Unlock comprehensive insights into our analysis of Al Khaleej Investment P.J.S.C stock in this financial health report.

- Gain insights into Al Khaleej Investment P.J.S.C's past trends and performance with our report on the company's historical track record.

Phoenix Group (ADX:PHX)

Simply Wall St Financial Health Rating: ★★★★★☆

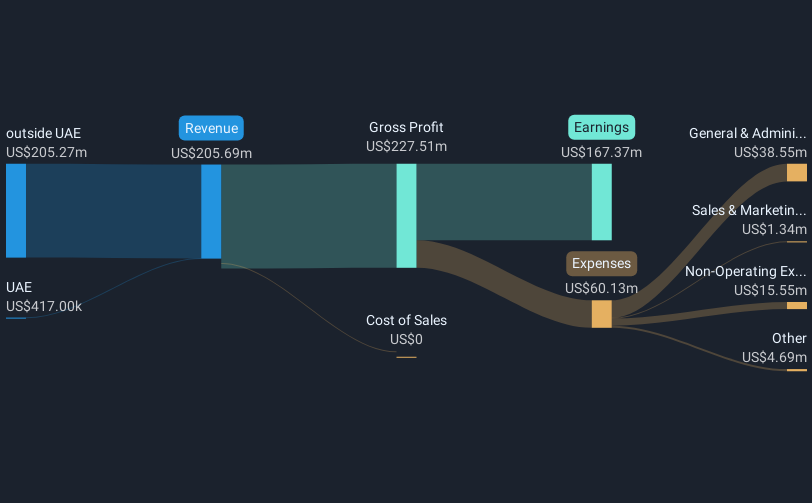

Overview: Phoenix Group Plc, along with its subsidiaries, offers crypto and cloud mining services across the United Arab Emirates, Oman, CIS, Canada, the United States, and other international markets with a market cap of AED7.32 billion.

Operations: The company generates revenue primarily from its data processing segment, amounting to $168.01 million.

Market Cap: AED7.32B

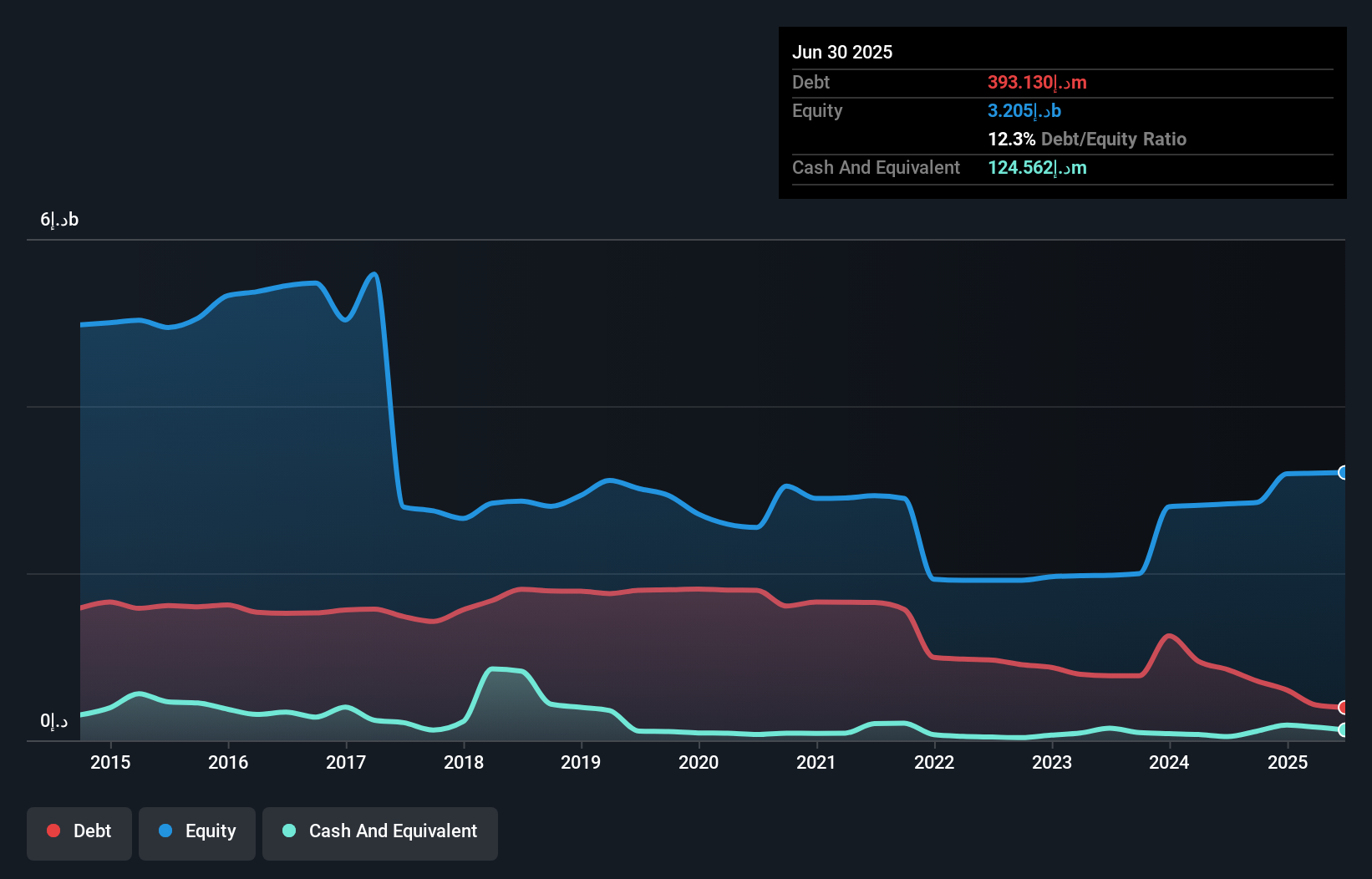

Phoenix Group Plc, with a market cap of AED7.32 billion, is navigating challenges as it reported a Q1 2025 net loss of US$153.6 million against US$66.15 million net income last year, reflecting volatility in its crypto and cloud mining operations. Despite this, the company maintains strong financial health with short-term assets exceeding liabilities and satisfactory debt levels supported by robust cash flow coverage. Recent expansion in Ethiopia adds significant capacity to its global Bitcoin mining operations, emphasizing sustainable growth through renewable energy sources. However, high share price volatility and ongoing unprofitability present concerns for potential investors in this sector.

- Dive into the specifics of Phoenix Group here with our thorough balance sheet health report.

- Examine Phoenix Group's earnings growth report to understand how analysts expect it to perform.

Union Properties (DFM:UPP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Union Properties (ticker: DFM:UPP) is a company that invests in and develops properties, with a market capitalization of AED2.67 billion.

Operations: The company generates revenue through its Contracting segment (AED29.39 million), Real Estate activities (AED54.50 million), and the provision of Goods and Services (AED469.97 million).

Market Cap: AED2.67B

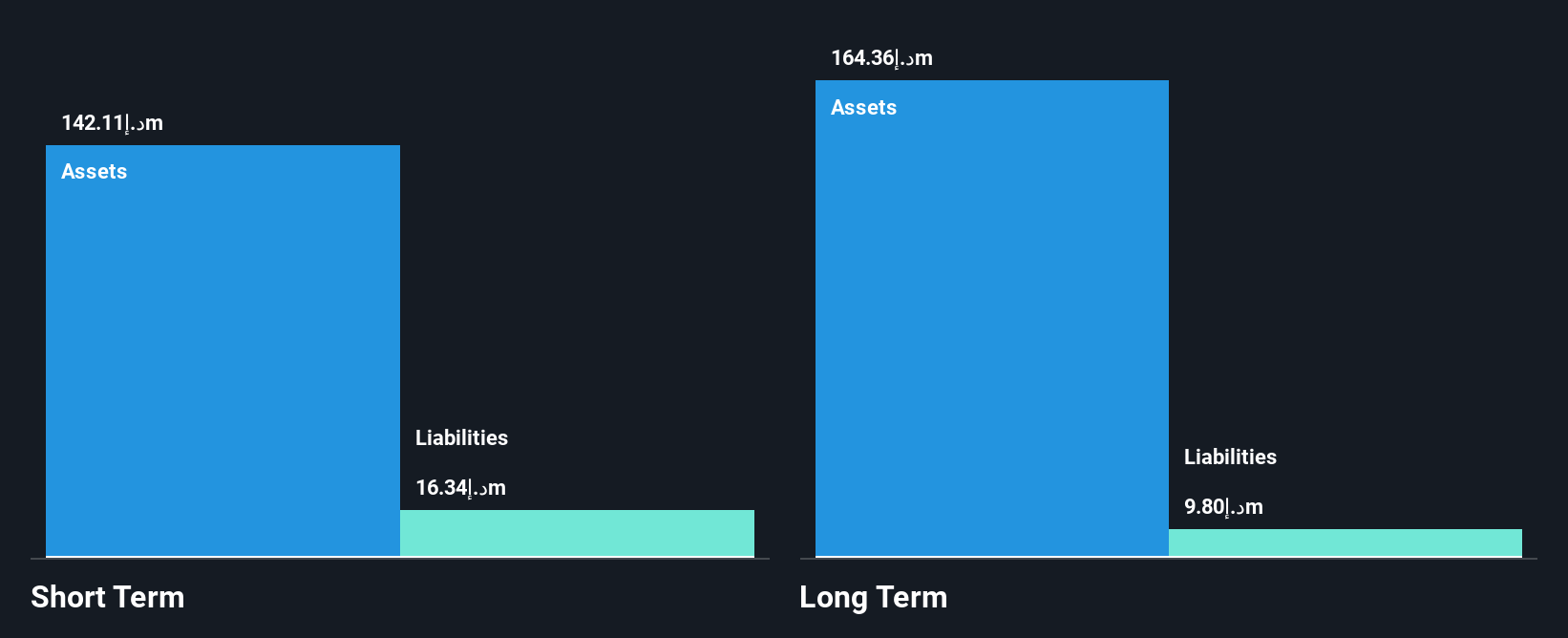

Union Properties, with a market cap of AED2.67 billion, faces challenges as its Q1 2025 net income dropped to AED5.81 million from AED16.47 million the previous year, despite increased sales of AED163.23 million. The company's financial health shows improvement with a reduced debt-to-equity ratio from 69.5% to 13.2% over five years and short-term assets exceeding both short- and long-term liabilities significantly. However, negative operating cash flow raises concerns about debt coverage, and recent large one-off gains impact earnings quality, while profit margins have declined compared to last year amidst stable weekly volatility in stock performance.

- Get an in-depth perspective on Union Properties' performance by reading our balance sheet health report here.

- Explore Union Properties' analyst forecasts in our growth report.

Summing It All Up

- Click through to start exploring the rest of the 91 Middle Eastern Penny Stocks now.

- Contemplating Other Strategies? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:UPP

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives