Three Undiscovered Gems in Middle East with Promising Potential

Reviewed by Simply Wall St

As Middle Eastern stock markets show resilience with most Gulf indices gaining ahead of corporate earnings, investors are keenly watching for signs of stability amid ongoing trade uncertainties and oil price fluctuations. In this dynamic environment, identifying promising stocks often involves looking for companies with strong fundamentals that can navigate the complexities of regional and global economic factors.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

RAK Properties PJSC (ADX:RAKPROP)

Simply Wall St Value Rating: ★★★★☆☆

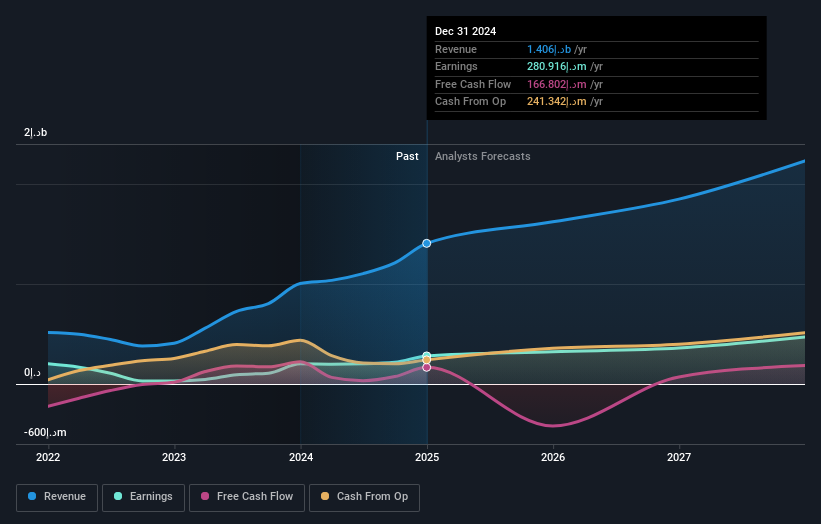

Overview: RAK Properties PJSC, along with its subsidiaries, focuses on investing in, developing, and managing real estate properties across the United Arab Emirates and has a market capitalization of AED3.70 billion.

Operations: RAK Properties generates revenue primarily from real estate sales, which account for AED1.15 billion, followed by hotel operations at AED199.76 million, and property leasing at AED60.61 million. The company's net profit margin is an important metric to consider when evaluating its financial performance and efficiency in converting revenue into profit.

RAK Properties, a notable player in the Middle East real estate market, has seen its earnings surge by 39% over the past year, outpacing the industry growth of 28%. The company's net debt to equity ratio stands at a satisfactory 14.5%, indicating prudent financial management. A significant AED62.7 million one-off gain impacted recent results, showcasing some volatility in earnings quality. Despite shareholder dilution last year and no proposed dividends for 2024, RAK Properties continues to expand with projects like SKAI on Raha Island and strategic alliances such as with Four Seasons for luxury developments at Mina.

- Navigate through the intricacies of RAK Properties PJSC with our comprehensive health report here.

Gain insights into RAK Properties PJSC's past trends and performance with our Past report.

Kayseri Seker Fabrikasi Anonim Sirketi (IBSE:KAYSE)

Simply Wall St Value Rating: ★★★★★☆

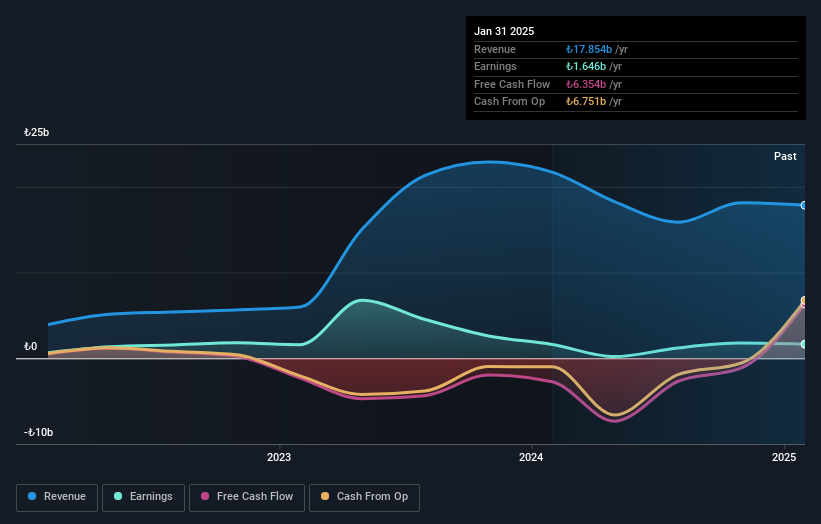

Overview: Kayseri Seker Fabrikasi Anonim Sirketi is engaged in the manufacturing and sale of sugar both within Turkey and internationally, with a market capitalization of TRY12.64 billion.

Operations: Kayseri Seker generates revenue primarily from sugar production activities, amounting to TRY16.39 billion. The company also engages in other activities contributing TRY2.97 billion to its revenue stream.

Kayseri Seker Fabrikasi Anonim Sirketi, a notable player in the food industry, has been navigating financial hurdles with mixed results. Over the past year, earnings grew by 1.8%, outperforming the broader food sector's -25.7% performance. However, a significant one-off gain of TRY 1.5 billion influenced its recent financials, highlighting potential volatility in earnings quality. The company's debt management appears prudent with a net debt to equity ratio of 20%, down from 110% five years ago, indicating improved financial stability. Despite these positives, interest payments remain uncovered by EBIT (0x coverage), suggesting room for operational improvements moving forward.

Saudi Advanced Industries (SASE:2120)

Simply Wall St Value Rating: ★★★★★☆

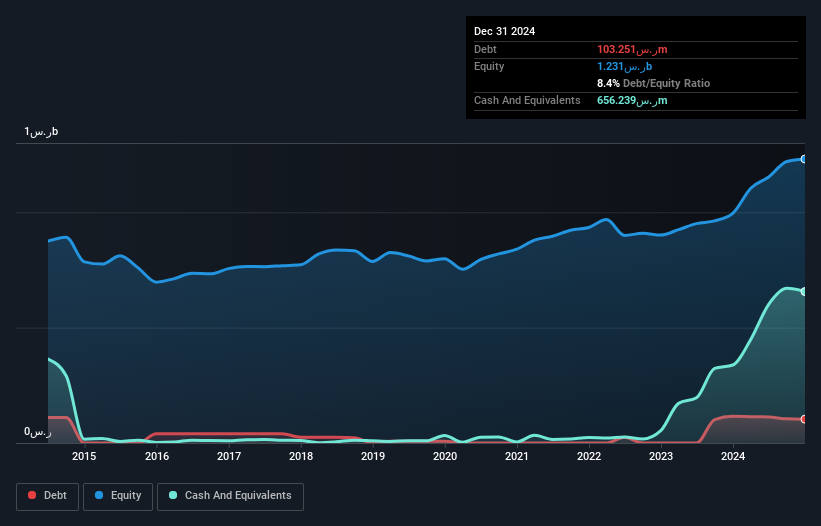

Overview: Saudi Advanced Industries Company engages in investments across diverse industrial projects within Saudi Arabia and has a market capitalization of SAR 1.70 billion.

Operations: Saudi Advanced Industries generates revenue primarily from Financial Services and Investments, contributing SAR 217.28 million, followed by the Glass Industry at SAR 104.43 million. Industrial Services add SAR 20.73 million to its revenue stream.

Saudi Advanced Industries seems to be catching attention with its impressive financial performance. Over the past year, earnings surged by 98%, aligning with industry growth, while net income jumped to SAR 295 million from SAR 148.8 million. The company appears financially robust, boasting a debt-to-equity ratio that increased modestly to 8.4% over five years and is supported by well-covered interest payments at an impressive 44.6 times EBIT coverage. Additionally, a price-to-earnings ratio of just 5.7x suggests it might be undervalued compared to the SA market average of 22.4x, presenting potential value for investors exploring Middle Eastern markets.

- Get an in-depth perspective on Saudi Advanced Industries' performance by reading our health report here.

Evaluate Saudi Advanced Industries' historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Take a closer look at our Middle Eastern Undiscovered Gems With Strong Fundamentals list of 247 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Kayseri Seker Fabrikasi Anonim Sirketi, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kayseri Seker Fabrikasi Anonim Sirketi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:KAYSE

Kayseri Seker Fabrikasi Anonim Sirketi

Manufactures and sells sugar in Turkey and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives