- United Arab Emirates

- /

- Real Estate

- /

- ADX:RAKPROP

RAK Properties PJSC (ADX:RAKPROP) Not Flying Under The Radar

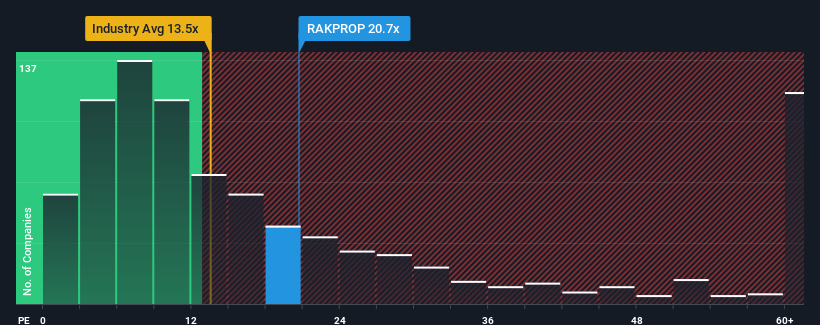

When close to half the companies in the United Arab Emirates have price-to-earnings ratios (or "P/E's") below 15x, you may consider RAK Properties PJSC (ADX:RAKPROP) as a stock to potentially avoid with its 20.7x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for RAK Properties PJSC as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for RAK Properties PJSC

How Is RAK Properties PJSC's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like RAK Properties PJSC's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 249% gain to the company's bottom line. EPS has also lifted 22% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

This is in contrast to the rest of the market, which is expected to grow by 2.2% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why RAK Properties PJSC is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On RAK Properties PJSC's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that RAK Properties PJSC maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with RAK Properties PJSC, and understanding should be part of your investment process.

If you're unsure about the strength of RAK Properties PJSC's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:RAKPROP

RAK Properties PJSC

Engages in the investment, development, and management of real estate properties in the United Arab Emirates.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026