- China

- /

- Professional Services

- /

- SZSE:300492

Discovering Undiscovered Gems on None Exchange in February 2025

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and potential tariff negotiations, major U.S. stock indexes are climbing toward record highs, although small-cap stocks are currently underperforming their larger counterparts. In this environment of economic uncertainty and shifting investor sentiment, identifying promising small-cap stocks on the None Exchange requires a keen eye for companies with strong fundamentals and growth potential that can weather market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Transnational Corporation of Nigeria | 45.51% | 31.42% | 58.48% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 263.90% | 20.29% | 37.81% | ★★★★☆☆ |

| Realia Business | 38.02% | 10.17% | 1.26% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

RAK Properties PJSC (ADX:RAKPROP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: RAK Properties PJSC, along with its subsidiaries, focuses on the investment, development, and management of real estate properties in the United Arab Emirates with a market capitalization of AED4.05 billion.

Operations: RAK Properties PJSC generates revenue primarily from real estate sales (AED1.15 billion), hotel operations (AED199.76 million), and property leasing (AED60.61 million).

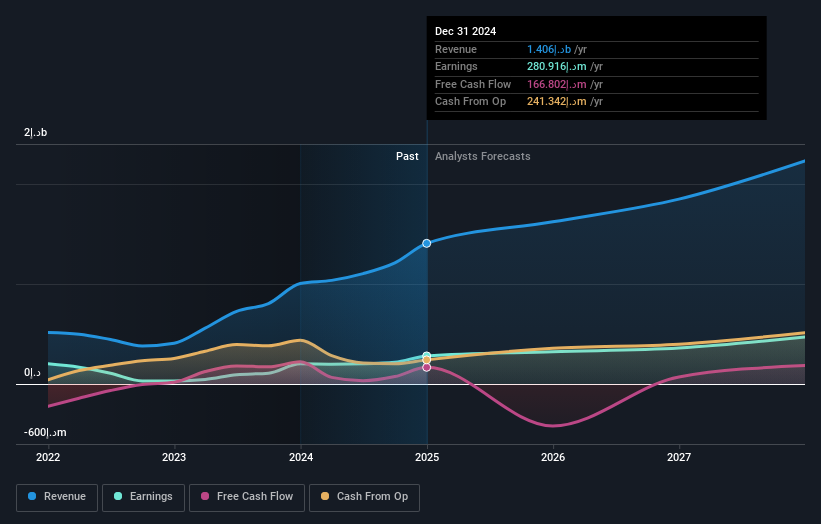

RAK Properties, a notable player in the real estate sector, has shown impressive earnings growth of 39.2% over the past year, outpacing the industry average of 16.2%. The company's financial health appears robust with a satisfactory net debt to equity ratio at 14.5%, and interest payments are well-covered by EBIT at 4.4 times coverage. Recent earnings results reveal sales climbed to AED1.41 billion from AED1 billion last year, while net income increased to AED280.92 million from AED201.82 million previously, indicating strong operational performance despite shareholder dilution concerns over the past year due to substantial issuance of shares.

Fujian Start GroupLtd (SHSE:600734)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fujian Start Group Co. Ltd specializes in providing anti-intrusion detection systems in China and has a market cap of CN¥9.78 billion.

Operations: Fujian Start Group Co. Ltd generates revenue primarily from its anti-intrusion detection systems in China, with a market cap of CN¥9.78 billion.

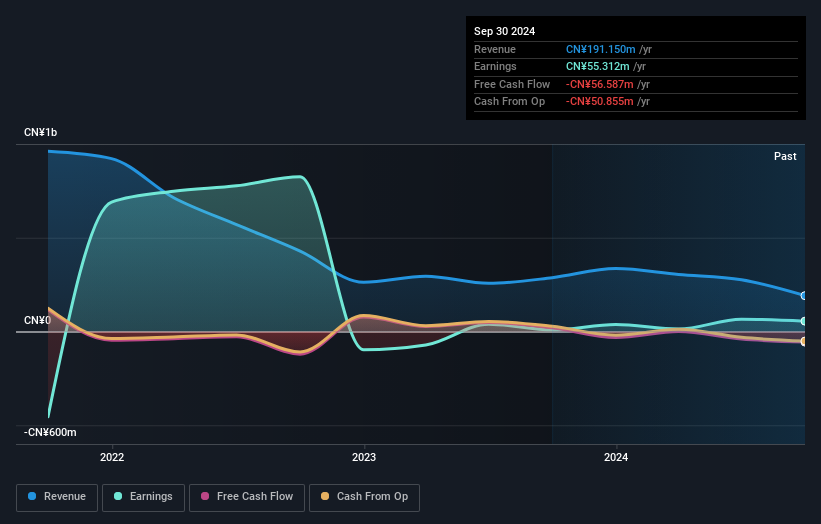

Fujian Start Group, a smaller player in the tech scene, has shown impressive earnings growth of 532.7% over the past year, outpacing its industry peers. This surge is backed by a significant reduction in debt to equity from 74.2% to 35.8% over five years, indicating a stronger balance sheet position now compared to before. The company seems well-positioned financially with more cash than total debt and boasts high-quality non-cash earnings that enhance its financial stability further. Recent shareholder meetings suggest active engagement with stakeholders as they navigate future strategies and opportunities for growth within their sector.

Huatu Cendes (SZSE:300492)

Simply Wall St Value Rating: ★★★★★☆

Overview: Huatu Cendes Co., Ltd. is an architectural design company offering professional design, consulting, and engineering services to various clients in China, with a market cap of CN¥11.07 billion.

Operations: Huatu Cendes generates revenue primarily from providing design, consulting, and engineering services to a diverse client base in China. The company's cost structure includes expenses related to service delivery and operational activities. It has reported a notable net profit margin trend over recent periods.

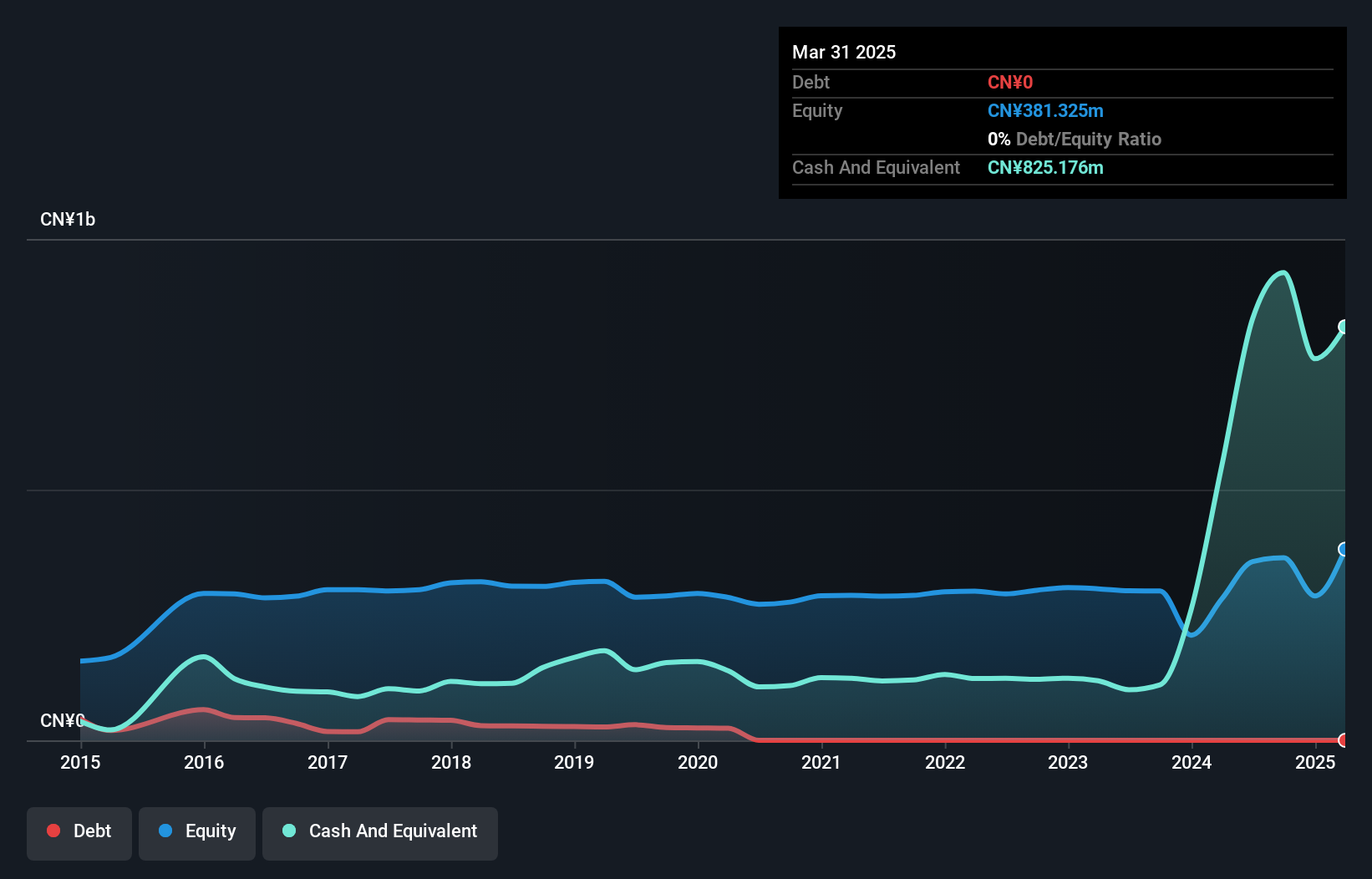

Huatu Cendes, a promising player in the professional services sector, has shown remarkable earnings growth of 2933.6% over the past year, outpacing its industry peers. The company is debt-free now, a significant improvement from five years ago when it had an 8.8% debt-to-equity ratio. With high-quality past earnings and positive free cash flow, Huatu seems well-positioned for future growth. Recent dividends of CNY 2 per 10 shares reflect strong profitability and shareholder returns. Earnings are expected to grow by around 73.66% annually, indicating robust potential in the coming years despite its relatively small market presence.

- Click here to discover the nuances of Huatu Cendes with our detailed analytical health report.

Explore historical data to track Huatu Cendes' performance over time in our Past section.

Taking Advantage

- Click this link to deep-dive into the 4714 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Huatu Cendes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300492

Huatu Cendes

Huatu Cendes Co., Ltd., an architectural design company, provides professional, designing, consulting, and engineering services to state-owned enterprises, private enterprises, multinational corporations and government agencies in China.

High growth potential with solid track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)