- United Arab Emirates

- /

- Consumer Services

- /

- ADX:DRIVE

Emerging Middle Eastern Small Caps Including Emirates Driving Company P.J.S.C With Promising Potential

Reviewed by Simply Wall St

In recent times, Middle Eastern markets have experienced mixed movements, influenced by global economic factors such as U.S. policy shifts and corporate earnings reports. As investors navigate these fluctuations, identifying small-cap stocks with robust fundamentals and growth potential becomes increasingly important for those seeking opportunities in this dynamic region.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Emirates Driving Company P.J.S.C (ADX:DRIVE)

Simply Wall St Value Rating: ★★★★★★

Overview: Emirates Driving Company P.J.S.C., along with its subsidiaries, specializes in managing and developing motor vehicle driving training in the United Arab Emirates, with a market capitalization of AED2.67 billion.

Operations: Emirates Driving Company generates revenue primarily from car and related services, totaling AED512.93 million.

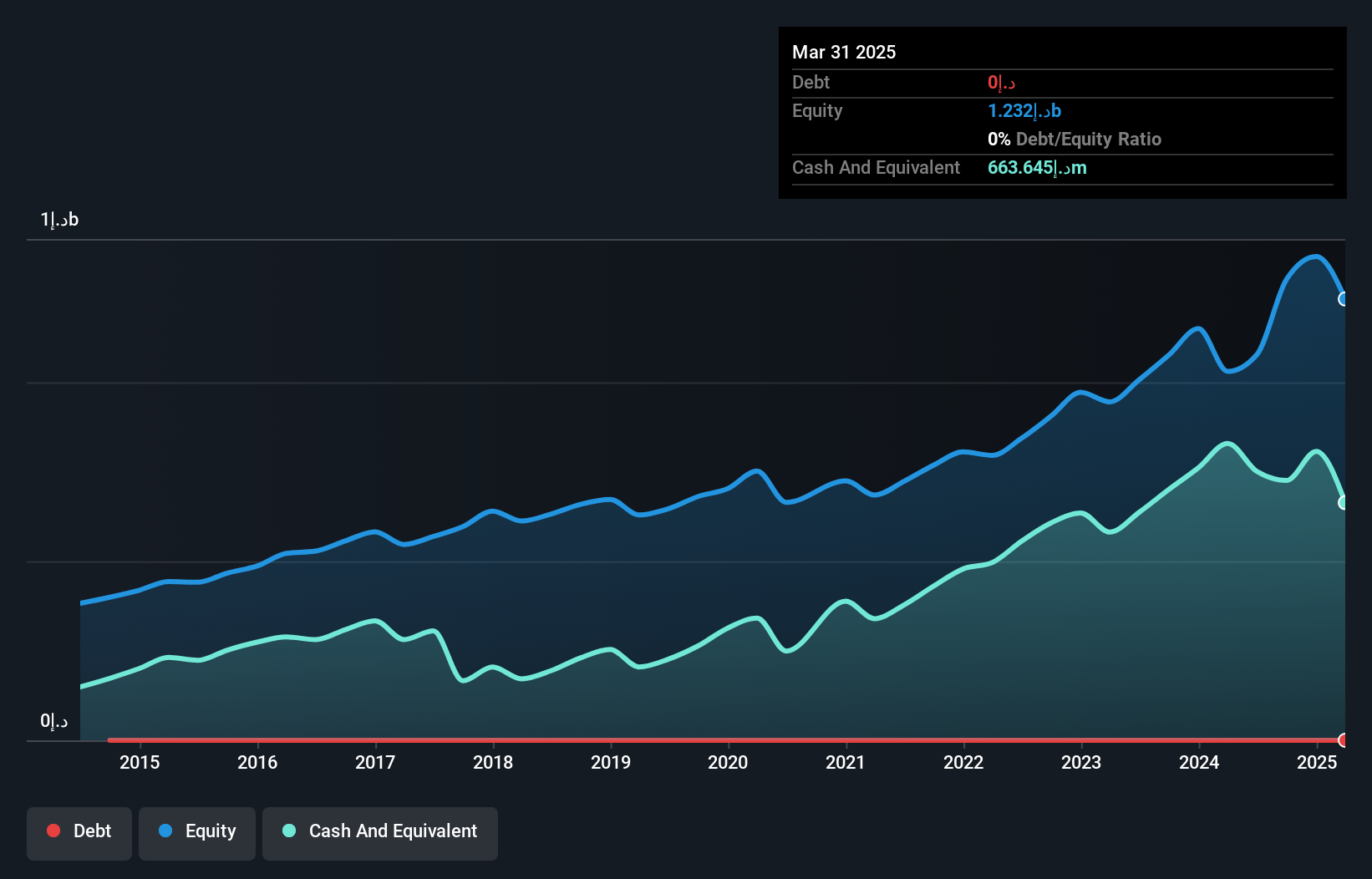

Emirates Driving Company, a nimble player in the Middle East, showcases strong financial health with zero debt over the past five years and high-quality earnings. The company reported impressive sales of AED 512.93 million for 2024, up from AED 355.64 million the previous year, while net income rose to AED 277.21 million from AED 267.15 million. Despite a modest annual earnings growth of 3.8%, which lagged behind its industry benchmark of 8.3%, it remains an attractive investment trading at nearly half its estimated fair value and continues to distribute dividends generously at AED 183 million for fiscal year-end.

Palms Sports PJSC (ADX:PALMS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Palms Sports PJSC offers sports training programs, focusing on Jiu-Jitsu and other sports in the United Arab Emirates, with a market capitalization of AED969 million.

Operations: The company generates revenue primarily from coaching and training services, along with the sale of related materials, amounting to AED1.05 billion.

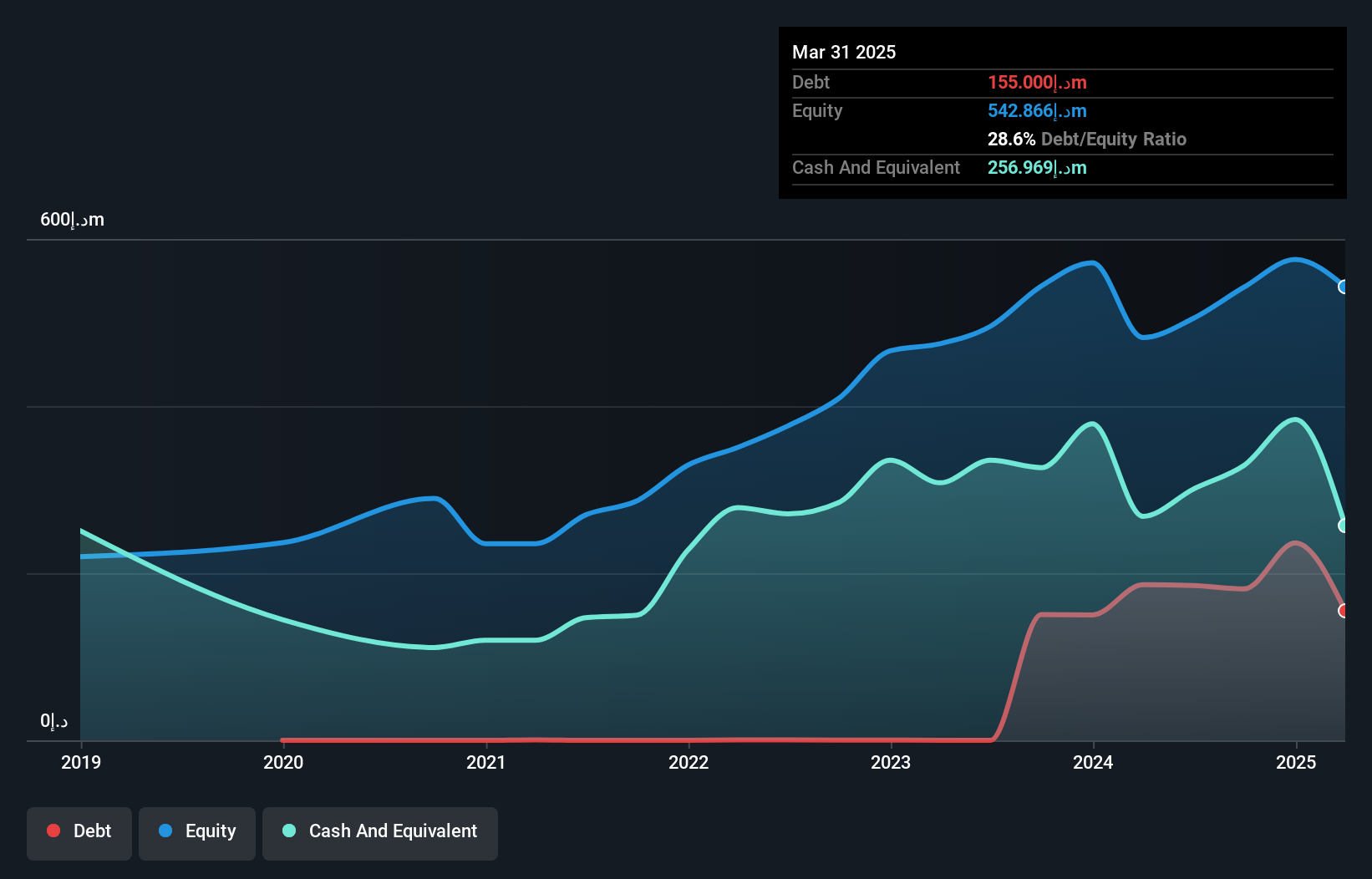

Palms Sports PJSC, a dynamic player in the Middle East's fitness and training sector, showcases robust financial health with high-quality earnings and a solid net profit margin of 10.4%, albeit lower than last year's 18.3%. The company's price-to-earnings ratio stands attractively at 8.8x, undercutting the AE market average of 12.7x, suggesting potential value for investors. Despite a rise in debt-to-equity from 0% to 41.1% over five years, interest payments are well covered by EBIT at 16.3 times coverage. Recent strategic contracts worth AED100 million highlight its growth trajectory and commitment to national partnerships in UAE’s fitness landscape.

- Click here to discover the nuances of Palms Sports PJSC with our detailed analytical health report.

Evaluate Palms Sports PJSC's historical performance by accessing our past performance report.

Nofoth Food Products (SASE:9556)

Simply Wall St Value Rating: ★★★★★★

Overview: Nofoth Food Products Company specializes in the production and sale of bakery products within Saudi Arabia, with a market capitalization of SAR1.19 billion.

Operations: Nofoth Food Products generates revenue through the sale of bakery products in Saudi Arabia. The company's net profit margin is 12.5%.

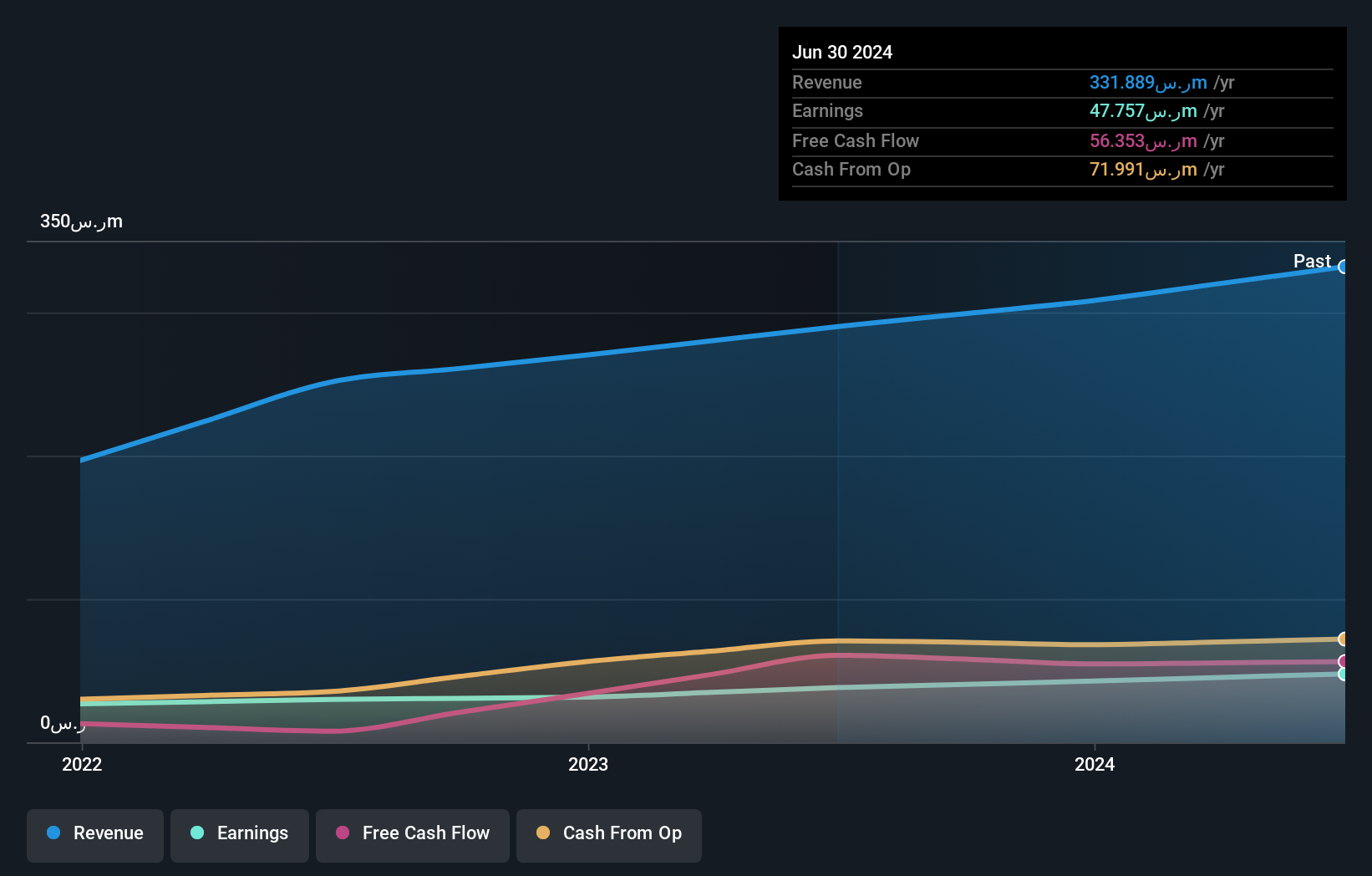

Nofoth Food Products, a nimble player in the Middle East's food sector, has shown impressive earnings growth of 25% over the past year, outpacing the industry average of 14.8%. The company is debt-free and boasts high-quality earnings, which speaks to its operational efficiency. Despite this strong performance, its share price has been highly volatile over recent months. With levered free cash flow reaching US$56.35 million by April 2025 and capital expenditure at US$15.46 million, it seems Nofoth is investing strategically to support future growth while maintaining financial prudence.

Make It Happen

- Embark on your investment journey to our 247 Middle Eastern Undiscovered Gems With Strong Fundamentals selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emirates Driving Company P.J.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:DRIVE

Emirates Driving Company P.J.S.C

Manages and develops motor vehicles driving training in the United Arab Emirates.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives