- United Arab Emirates

- /

- Basic Materials

- /

- ADX:SCIDC

Discover Promising Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets grapple with inflation concerns and political uncertainties, small-cap stocks have notably underperformed their larger counterparts, with the Russell 2000 Index slipping into correction territory. For those interested in investing in smaller or newer companies, penny stocks—despite their somewhat outdated moniker—remain a relevant area for exploration. These stocks can offer a mix of affordability and growth potential when paired with strong financials, making them intriguing candidates for investors seeking under-the-radar opportunities poised for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.805 | £463.19M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £3.61 | £413.58M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.898 | £715.19M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.57 | A$66.82M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.984 | £155.22M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.49 | £66.56M | ★★★★☆☆ |

Click here to see the full list of 5,815 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC)

Simply Wall St Financial Health Rating: ★★★★★★

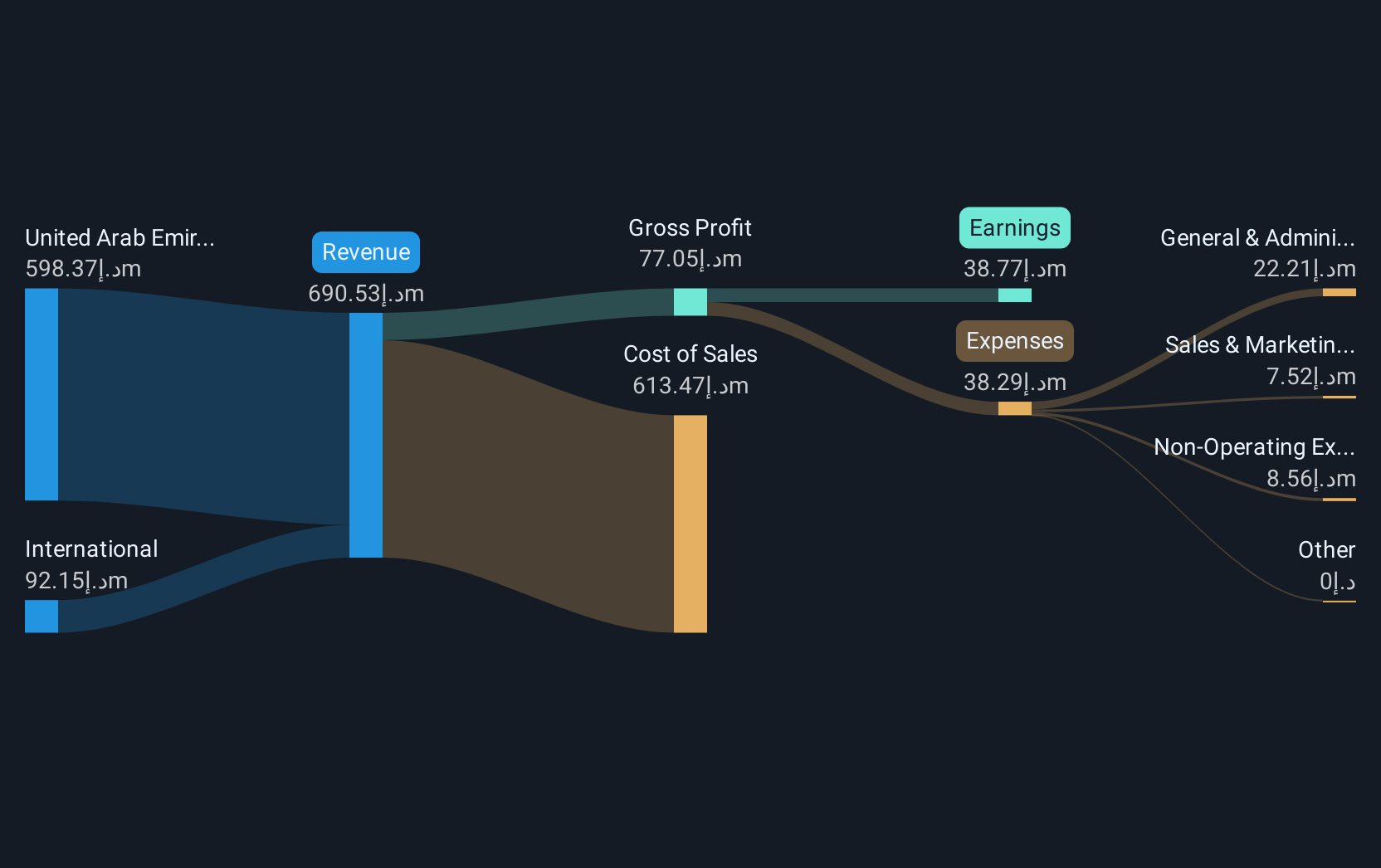

Overview: Sharjah Cement and Industrial Development (PJSC) operates in the production and sale of cement and related products, with a market capitalization of AED393.54 million.

Operations: The company generates revenue of AED676.13 million from its manufacturing operations.

Market Cap: AED393.54M

Sharjah Cement and Industrial Development (PJSC) has shown a positive turnaround, reporting a net income of AED 11.87 million for Q3 2024 compared to a net loss the previous year. The company's financial health is supported by satisfactory debt levels, with net debt to equity at 25.8%, and well-covered interest payments (3.7x EBIT coverage). Despite high-quality earnings and no significant shareholder dilution, its Return on Equity remains low at 2.8%. While profitability has improved, the stock price is highly volatile and trades significantly below fair value estimates, reflecting potential risks in market perception.

- Take a closer look at Sharjah Cement and Industrial Development (PJSC)'s potential here in our financial health report.

- Examine Sharjah Cement and Industrial Development (PJSC)'s past performance report to understand how it has performed in prior years.

QuickBit eu (NGM:QBIT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: QuickBit eu AB (publ) is a fintech company based in Sweden with a market capitalization of SEK447.94 million.

Operations: The company's revenue is generated from its "Solution for e-Merchants" segment, amounting to €159.8 million.

Market Cap: SEK447.94M

QuickBit eu AB (publ) faces challenges as a penny stock with a volatile share price and recent auditor concerns over its ability to continue as a going concern. Despite generating €75.7 million in revenue for Q1 2025, up significantly from the previous year, the company remains unprofitable with increasing losses over five years at 74.3% annually. QuickBit is debt-free and has a cash runway exceeding three years, though short-term liabilities surpass short-term assets by €2.3 million. The management team and board are relatively inexperienced, potentially impacting strategic direction amidst these financial hurdles.

- Dive into the specifics of QuickBit eu here with our thorough balance sheet health report.

- Gain insights into QuickBit eu's historical outcomes by reviewing our past performance report.

China Brilliant Global (SEHK:8026)

Simply Wall St Financial Health Rating: ★★★★★☆

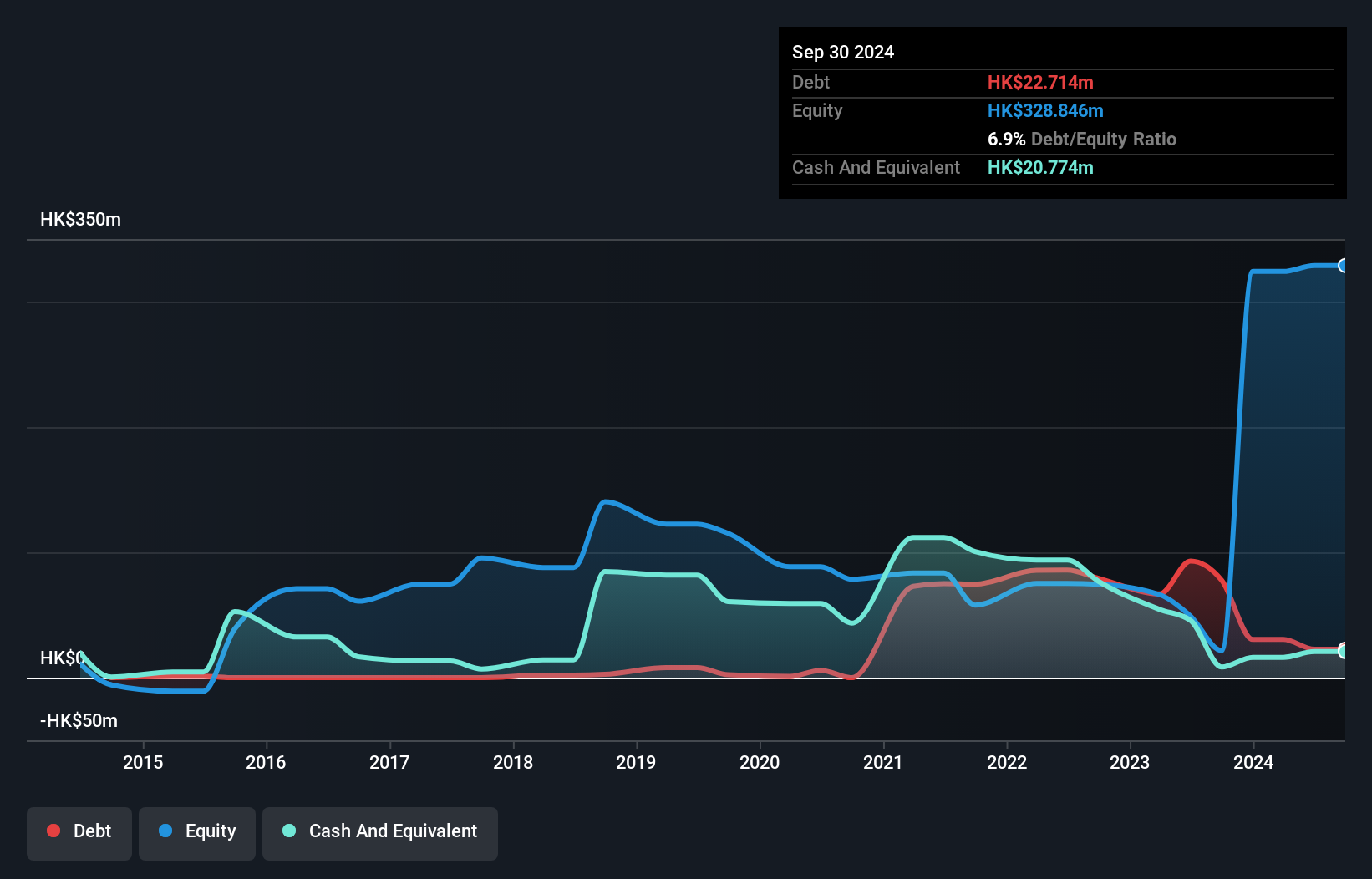

Overview: China Brilliant Global Limited is an investment holding company involved in the research, design, wholesale, and retail of gold and jewelry in Hong Kong and China, with a market capitalization of HK$568.32 million.

Operations: The company's revenue is primarily derived from its Gold and Jewellery Business at HK$78.77 million, followed by the Property Management Services Business at HK$14.07 million and the Lending Business at HK$2.15 million.

Market Cap: HK$568.32M

China Brilliant Global Limited has shown a financial turnaround, reporting a net income of HK$4.27 million for the half-year ended September 2024, compared to a significant loss in the previous year. This improvement is largely due to the disposal of its fintech business and profit contributions from property management services. Despite being unprofitable overall, it maintains positive free cash flow with over three years of cash runway and no long-term liabilities. The company trades significantly below its estimated fair value while experiencing high share price volatility and an increased debt-to-equity ratio over five years.

- Click here to discover the nuances of China Brilliant Global with our detailed analytical financial health report.

- Understand China Brilliant Global's track record by examining our performance history report.

Next Steps

- Explore the 5,815 names from our Penny Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:SCIDC

Sharjah Cement and Industrial Development (PJSC)

Sharjah Cement and Industrial Development Co.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives