- United Arab Emirates

- /

- Basic Materials

- /

- ADX:GCEM

Further Upside For Gulf Cement Company P.S.C. (ADX:GCEM) Shares Could Introduce Price Risks After 31% Bounce

Gulf Cement Company P.S.C. (ADX:GCEM) shares have had a really impressive month, gaining 31% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 2.0% isn't as impressive.

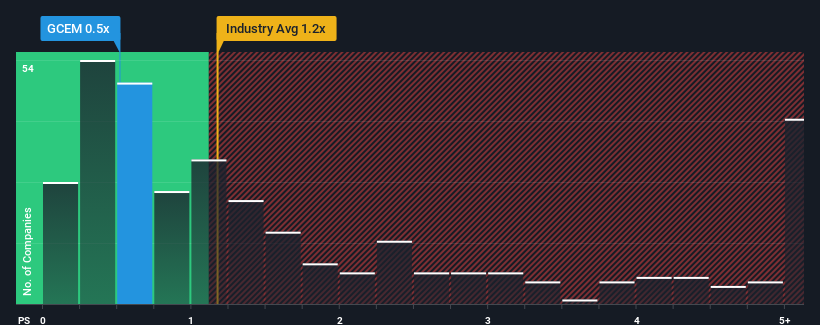

Even after such a large jump in price, it would still be understandable if you think Gulf Cement Company P.S.C is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.5x, considering almost half the companies in the United Arab Emirates' Basic Materials industry have P/S ratios above 1.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Gulf Cement Company P.S.C

How Gulf Cement Company P.S.C Has Been Performing

Revenue has risen at a steady rate over the last year for Gulf Cement Company P.S.C, which is generally not a bad outcome. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. Those who are bullish on Gulf Cement Company P.S.C will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Gulf Cement Company P.S.C's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

Gulf Cement Company P.S.C's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.7% last year. Revenue has also lifted 10% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 0.8% shows it's noticeably more attractive.

In light of this, it's peculiar that Gulf Cement Company P.S.C's P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Gulf Cement Company P.S.C's P/S?

The latest share price surge wasn't enough to lift Gulf Cement Company P.S.C's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We're very surprised to see Gulf Cement Company P.S.C currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Before you settle on your opinion, we've discovered 4 warning signs for Gulf Cement Company P.S.C (3 are significant!) that you should be aware of.

If these risks are making you reconsider your opinion on Gulf Cement Company P.S.C, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:GCEM

Gulf Cement Company P.S.C

Produces and markets various types of cement in the United Arab Emirates and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives