Global markets have shown resilience, with U.S. indexes approaching record highs and smaller-cap stocks outperforming their larger counterparts amid a backdrop of geopolitical tensions and economic uncertainties. In such a climate, the appeal of penny stocks—often representing smaller or newer companies—remains significant due to their potential for growth at lower price points. Despite being an older term, penny stocks can offer unique opportunities when backed by strong financials and solid fundamentals, making them an intriguing option for investors seeking under-the-radar prospects with room to grow.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.49 | MYR2.44B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$552.27M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.215 | £834.53M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.33 | £169.38M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.18 | £415.73M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

| United U-LI Corporation Berhad (KLSE:ULICORP) | MYR1.52 | MYR331.06M | ★★★★★★ |

Click here to see the full list of 5,775 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Apex Investment PSC (ADX:APEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: APEX Investment PSC is involved in the manufacturing, distribution, and sale of clinkers and cement products both in the United Arab Emirates and internationally, with a market capitalization of AED15.63 billion.

Operations: The company's revenue is primarily derived from its Catering segment at AED 577.61 million, followed by Manufacturing at AED 206.31 million, Facility Management Services at AED 107.51 million, and Contracting at AED 62.01 million.

Market Cap: AED15.63B

Apex Investment PSC, with a market cap of AED15.63 billion, primarily generates revenue from its Catering segment. Despite being debt-free and having substantial short-term assets exceeding liabilities, the company faces challenges with volatile share prices and low return on equity at 0.3%. Recent earnings reports show a significant decline in net income for Q3 2024 to AED 28.13 million from AED 186.34 million the previous year, although nine-month sales improved to AED 622.71 million from AED 525.5 million year-over-year. The company's board is relatively new, suggesting potential strategic shifts ahead.

- Click here to discover the nuances of Apex Investment PSC with our detailed analytical financial health report.

- Gain insights into Apex Investment PSC's past trends and performance with our report on the company's historical track record.

Jiangsu Jiangnan High Polymer FiberLtd (SHSE:600527)

Simply Wall St Financial Health Rating: ★★★★★☆

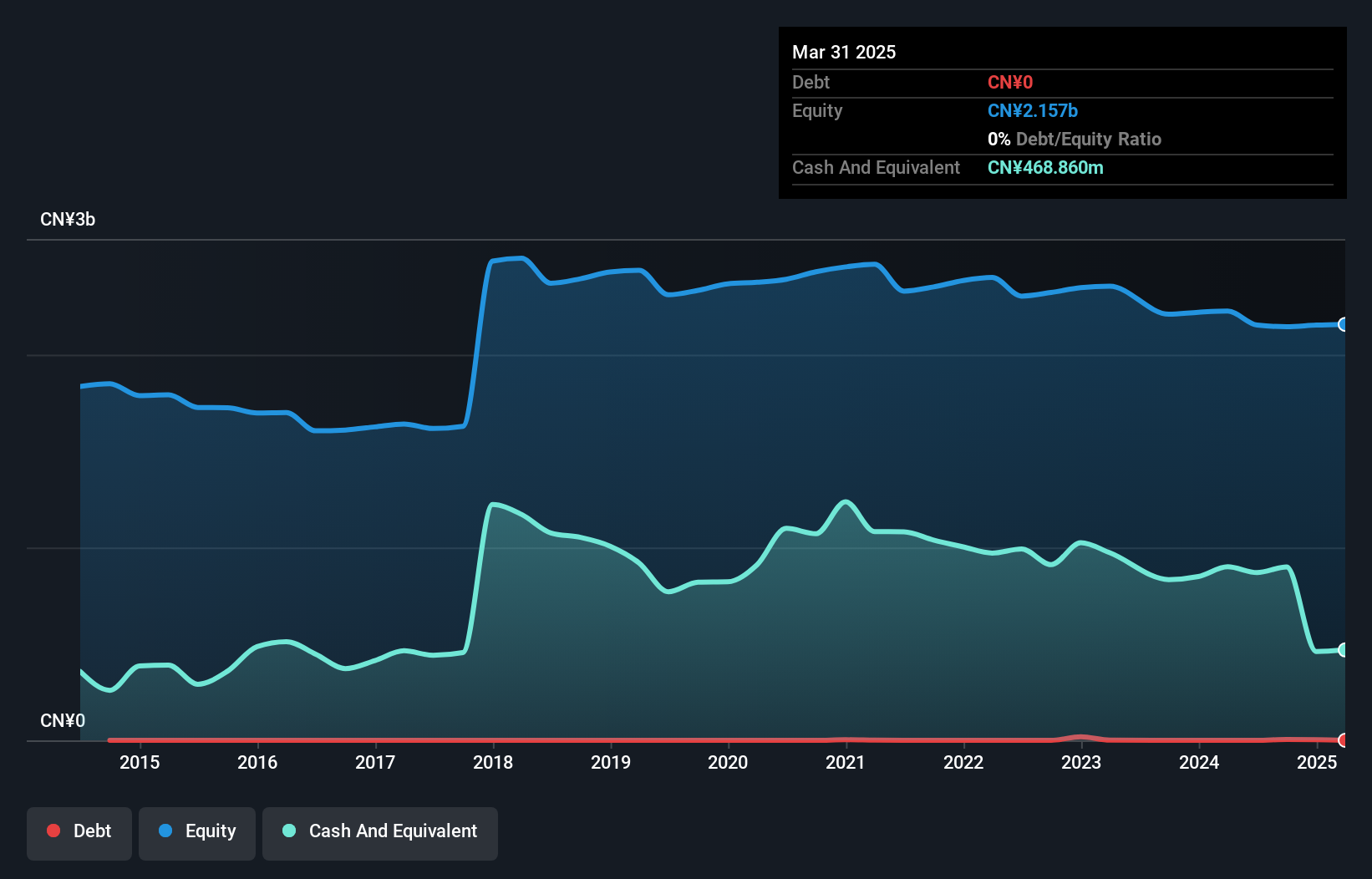

Overview: Jiangsu Jiangnan High Polymer Fiber Co., Ltd specializes in the production and sale of composite short-fibers and polyester tops both in China and internationally, with a market cap of CN¥3.64 billion.

Operations: The company does not report any specific revenue segments.

Market Cap: CN¥3.64B

Jiangsu Jiangnan High Polymer Fiber Co., Ltd, with a market cap of CN¥3.64 billion, faces challenges such as declining earnings, which have dropped by 24.2% annually over the past five years. Despite having more cash than debt and sufficient short-term assets to cover liabilities, its return on equity is low at 1.9%. Recent earnings results for the nine months ending September 2024 show a decline in revenue to CN¥411.11 million from CN¥531.85 million year-over-year and net income falling to CN¥30.1 million from CN¥35.75 million, reflecting ongoing financial pressures amidst stable weekly volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Jiangsu Jiangnan High Polymer FiberLtd.

- Review our historical performance report to gain insights into Jiangsu Jiangnan High Polymer FiberLtd's track record.

Hainan RuiZe New Building MaterialLtd (SZSE:002596)

Simply Wall St Financial Health Rating: ★★★★☆☆

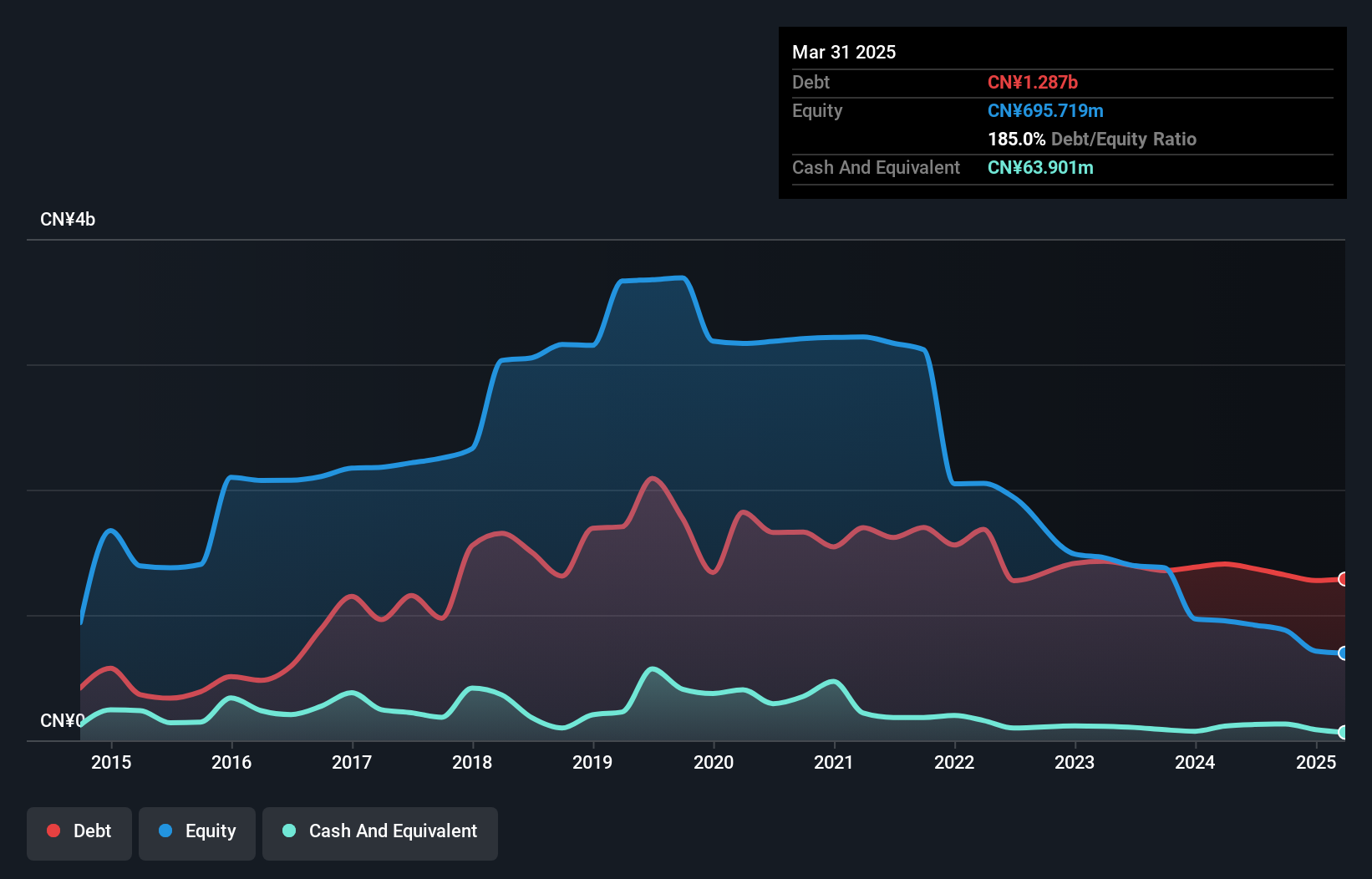

Overview: Hainan RuiZe New Building Material Co., Ltd specializes in the production and sale of commercial concrete and cement in China, with a market capitalization of CN¥3.45 billion.

Operations: The company's revenue is primarily derived from its operations in China, amounting to CN¥1.52 billion.

Market Cap: CN¥3.45B

Hainan RuiZe New Building Material Co., Ltd, with a market cap of CN¥3.45 billion, presents a mixed financial picture. Despite its unprofitability and increased net debt to equity ratio from 48% to 150.3% over five years, the company maintains a solid cash runway exceeding three years due to positive free cash flow growth. Recent earnings show a decrease in revenue from CN¥1.22 billion to CN¥1.04 billion for the nine months ending September 2024, alongside reduced net losses from CN¥104 million to CN¥87 million year-over-year, suggesting some improvement in managing financial challenges amidst high share price volatility.

- Click to explore a detailed breakdown of our findings in Hainan RuiZe New Building MaterialLtd's financial health report.

- Explore historical data to track Hainan RuiZe New Building MaterialLtd's performance over time in our past results report.

Where To Now?

- Get an in-depth perspective on all 5,775 Penny Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600527

Jiangsu Jiangnan High Polymer FiberLtd

Engages in the production and sale of polyester tops and composite staple fibers in China and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives