- Hong Kong

- /

- Energy Services

- /

- SEHK:3337

3 Penny Stocks With Market Caps Over US$200M To Consider

Reviewed by Simply Wall St

As global markets rally with U.S. stocks reaching record highs, driven by optimism around trade policies and AI investments, investors are increasingly exploring diverse opportunities. Penny stocks, often seen as relics of the past, remain relevant due to their potential for growth and affordability when backed by strong financials. In this article, we explore several penny stocks that stand out for their robust financial health and potential value in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.59B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £178.85M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.11B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.905 | £470.9M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR423.03M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.09 | £776.24M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

Click here to see the full list of 5,721 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Apex Investment PSC (ADX:APEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Apex Investment PSC manufactures, distributes, and sells clinkers and cement products in the United Arab Emirates and internationally, with a market cap of AED17.20 billion.

Operations: The company's revenue is primarily generated from catering services (AED577.61 million), manufacturing (AED206.31 million), facility management services (AED107.51 million), and contracting (AED62.01 million).

Market Cap: AED17.2B

Apex Investment PSC, with a market cap of AED17.20 billion, operates without debt and has short-term assets (AED1.7 billion) that cover both short-term (AED202.3 million) and long-term liabilities (AED12.4 million). Despite significant past earnings growth, recent performance has been hindered by negative earnings growth and a large one-off loss of AED133.2 million, impacting financial results as of September 2024. The company's return on equity is low at 0.3%, and profit margins have decreased from 3% to 0.6%. The board's average tenure is relatively new at 2.8 years, indicating potential governance challenges ahead.

- Jump into the full analysis health report here for a deeper understanding of Apex Investment PSC.

- Understand Apex Investment PSC's track record by examining our performance history report.

Anton Oilfield Services Group (SEHK:3337)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anton Oilfield Services Group is an investment holding company that offers oilfield engineering and technical services to oil companies in China, Iraq, and internationally, with a market cap of HK$2.01 billion.

Operations: The company's revenue is primarily derived from Oilfield Technical Services (CN¥2.22 billion), followed by Oilfield Management Services (CN¥1.77 billion), Inspection Services (CN¥441.14 million), and Drilling Rig Services (CN¥292.99 million).

Market Cap: HK$2.01B

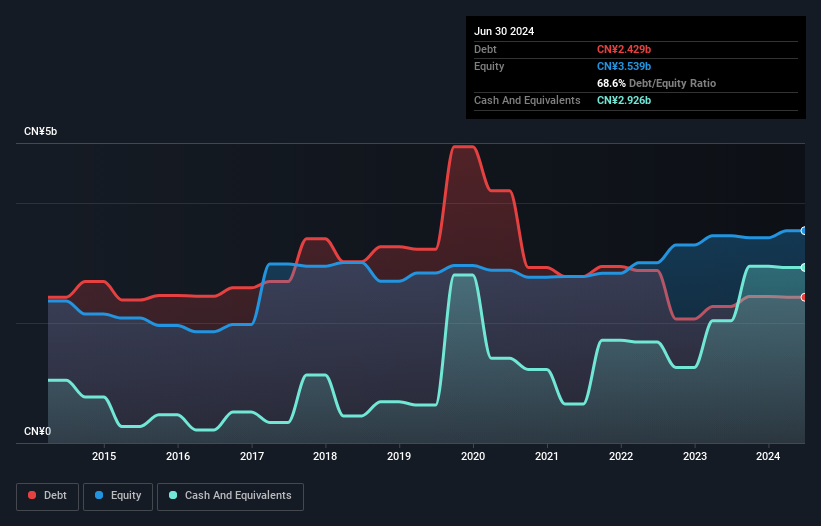

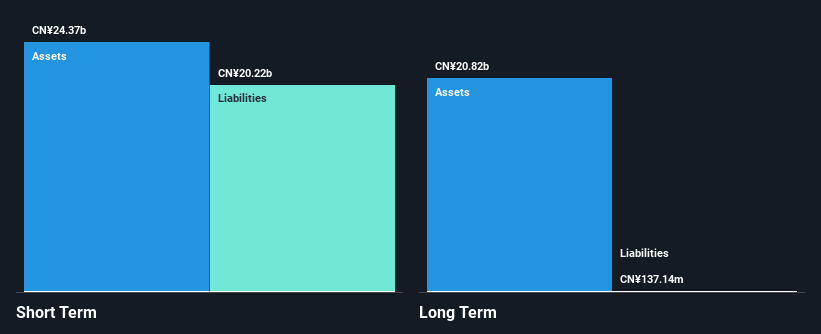

Anton Oilfield Services Group, with a market cap of HK$2.01 billion, is trading at a significant discount to its estimated fair value and has demonstrated steady profit growth over the past five years. Despite recent negative earnings growth, its financial stability is underscored by short-term assets exceeding liabilities and debt being well covered by cash flow. The company recently addressed outstanding debt obligations through a substantial payment transfer. However, challenges remain with declining profit margins and low return on equity at 6.5%. Governance appears stable with an experienced board averaging 8.8 years in tenure, bolstered by recent strategic appointments.

- Dive into the specifics of Anton Oilfield Services Group here with our thorough balance sheet health report.

- Assess Anton Oilfield Services Group's future earnings estimates with our detailed growth reports.

Sinopec Shanghai Petrochemical (SEHK:338)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sinopec Shanghai Petrochemical Company Limited, along with its subsidiaries, engages in the manufacturing and sale of petroleum and chemical products in the People’s Republic of China, with a market capitalization of approximately HK$26.47 billion.

Operations: Sinopec Shanghai Petrochemical Company Limited has not reported any specific revenue segments.

Market Cap: HK$26.47B

Sinopec Shanghai Petrochemical, with a market cap of approximately HK$26.47 billion, is navigating financial challenges as it remains unprofitable with increasing losses over the past five years. Despite this, its short-term assets significantly surpass both short and long-term liabilities, indicating solid liquidity management. The company forecasts a potential turnaround in profitability for 2024, estimating net profits between RMB 253 million to RMB 379 million. Recent strategic moves include a Technology R&D Framework Agreement with Sinopec Corp., aiming to enhance technological capabilities through mutual collaboration and development services. Additionally, debt levels are well covered by operating cash flow at a very large rate of 804.9%.

- Navigate through the intricacies of Sinopec Shanghai Petrochemical with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Sinopec Shanghai Petrochemical's future.

Taking Advantage

- Get an in-depth perspective on all 5,721 Penny Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3337

Anton Oilfield Services Group

An investment holding company, operates as an integrated oilfield technology services company in the People’s Republic of China, Iraq, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives