- United Arab Emirates

- /

- Insurance

- /

- DFM:SALAMA

Top Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

Global markets have recently experienced a significant rally, with U.S. stocks reaching record highs following expectations of favorable economic policies under the new administration. For investors interested in smaller or newer companies, penny stocks—despite the term's outdated connotation—remain an intriguing area for potential value. By focusing on those with solid financial foundations and growth potential, investors may uncover opportunities within this segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.41B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.97M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB1.84 | THB1.49B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.6025 | A$70.63M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR288.79M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.20 | £840.18M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.76 | £386.39M | ★★★★☆☆ |

Click here to see the full list of 5,802 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Ajman Bank PJSC (DFM:AJMANBANK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ajman Bank PJSC offers a range of banking products and services in the United Arab Emirates, with a market capitalization of AED4.68 billion.

Operations: The company generates its revenue through Treasury (AED63.72 million), Consumer Banking (AED292.65 million), and Wholesale Banking (-AED30.47 million) segments in the United Arab Emirates.

Market Cap: AED4.68B

Ajman Bank PJSC, with a market capitalization of AED 4.68 billion, presents a mixed picture for investors interested in penny stocks. The bank's revenue streams are primarily from Consumer Banking (AED 292.65 million) and Treasury (AED 63.72 million), while Wholesale Banking showed negative returns (-AED 30.47 million). Despite recent improvements in net income—reporting AED 74 million for Q3 2024 compared to a loss last year—the bank remains unprofitable overall, with increasing losses over the past five years and high levels of bad loans at 11.2%. However, its funding is primarily low-risk through customer deposits, offering some stability amidst volatility concerns.

- Get an in-depth perspective on Ajman Bank PJSC's performance by reading our balance sheet health report here.

- Gain insights into Ajman Bank PJSC's historical outcomes by reviewing our past performance report.

Islamic Arab Insurance (Salama) PJSC (DFM:SALAMA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Islamic Arab Insurance (Salama) PJSC, along with its subsidiaries, offers a variety of general, family, health, and auto takaful solutions across Africa and Asia with a market capitalization of AED365.41 million.

Operations: No revenue segments are reported for Islamic Arab Insurance (Salama) PJSC.

Market Cap: AED365.41M

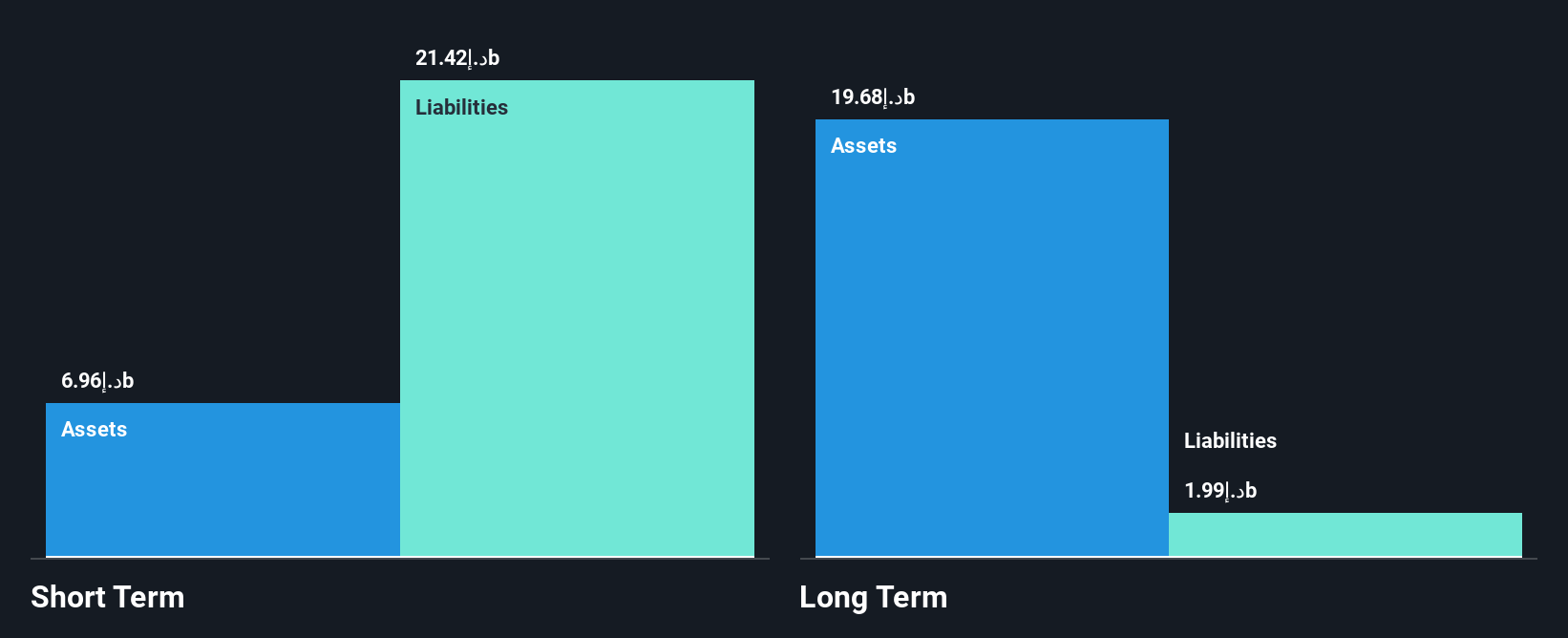

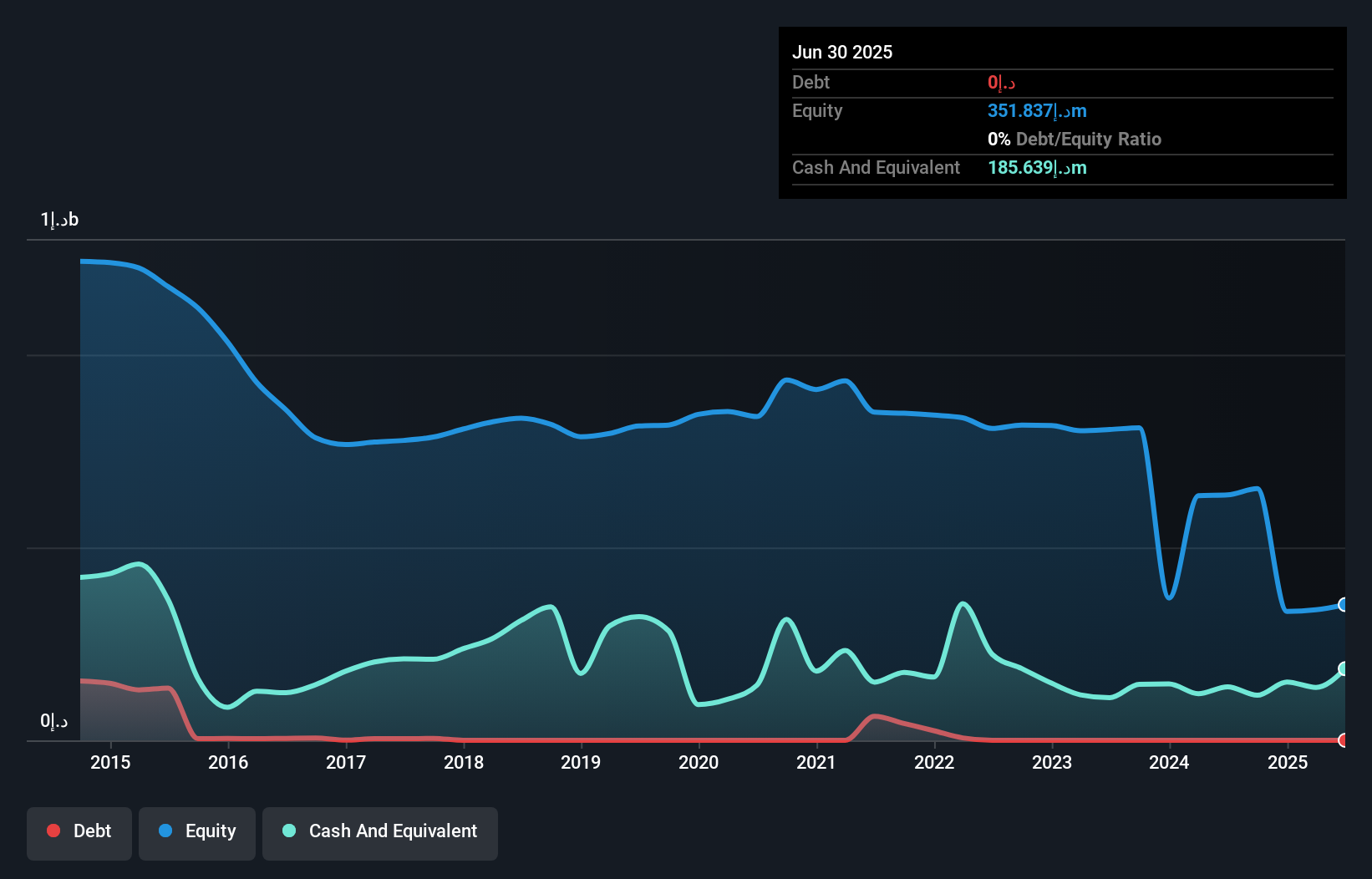

Islamic Arab Insurance (Salama) PJSC, with a market cap of AED 365.41 million, offers potential for penny stock investors despite its unprofitable status. The company reported significant earnings improvement in Q3 2024, with net income rising to AED 8.08 million from AED 1.26 million the previous year. While Salama is debt-free and boasts a strong cash runway exceeding three years, it faces challenges as short-term assets do not cover long-term liabilities of AED 2.9 billion. Additionally, the company's return on equity remains negative at -19.53%, reflecting ongoing profitability issues despite recent gains in net income.

- Jump into the full analysis health report here for a deeper understanding of Islamic Arab Insurance (Salama) PJSC.

- Evaluate Islamic Arab Insurance (Salama) PJSC's historical performance by accessing our past performance report.

Liaoning SG Automotive Group (SHSE:600303)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Liaoning SG Automotive Group Co., Ltd. manufactures and sells automobiles, axles, and other auto parts in China, with a market cap of CN¥2.22 billion.

Operations: The company does not report specific revenue segments.

Market Cap: CN¥2.22B

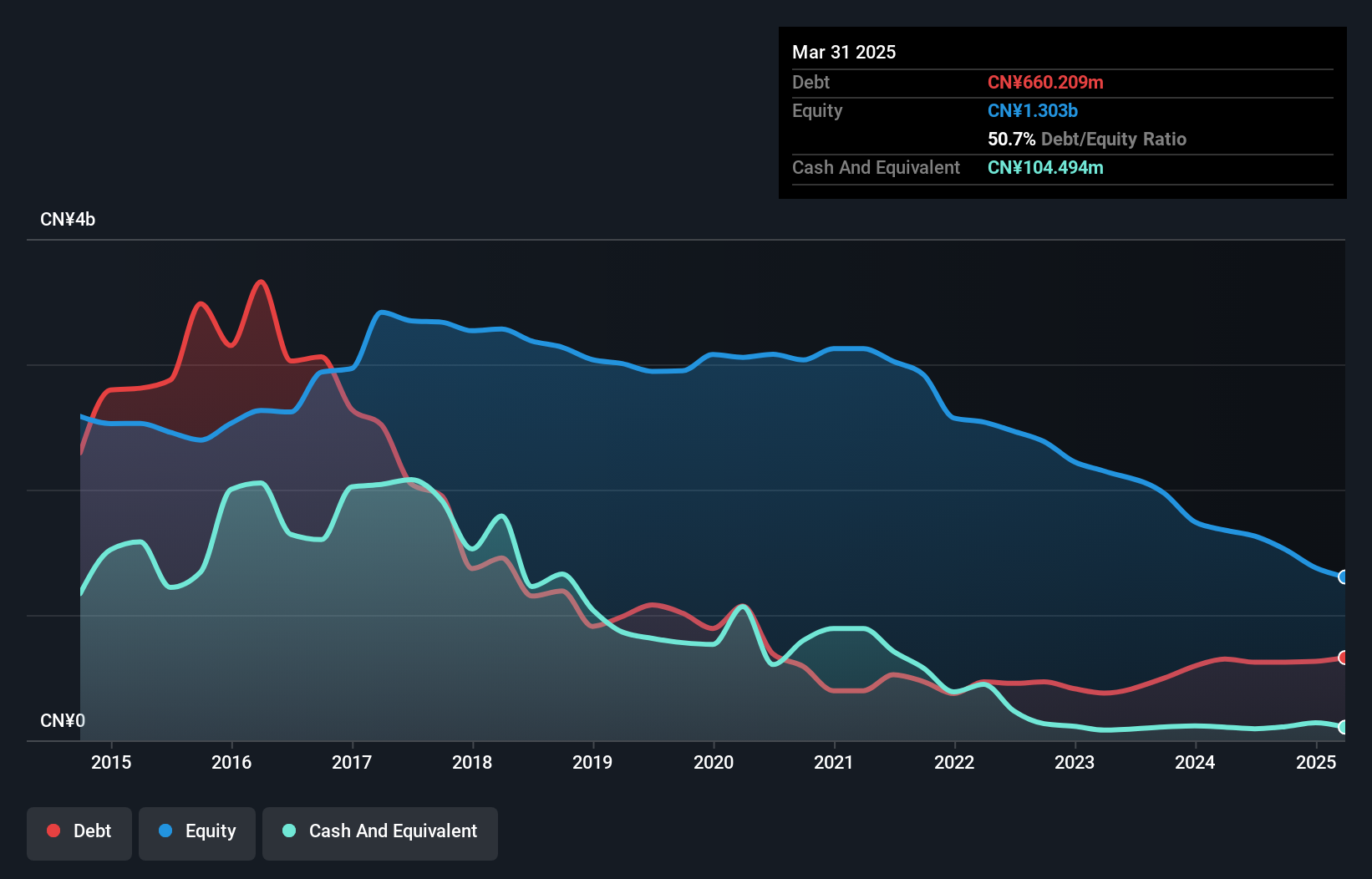

Liaoning SG Automotive Group, with a market cap of CN¥2.22 billion, continues to navigate financial challenges typical for penny stocks. Despite reporting sales of CN¥944.4 million for the first nine months of 2024, it remains unprofitable with a net loss of CN¥223.66 million. The company's negative return on equity at -29.84% and increasing debt-to-equity ratio highlight ongoing struggles in achieving profitability and managing debt levels effectively. Recent capital raised through a private placement aims to bolster its cash runway but requires regulatory approvals before implementation, reflecting efforts to stabilize its financial position amidst operational hurdles.

- Dive into the specifics of Liaoning SG Automotive Group here with our thorough balance sheet health report.

- Learn about Liaoning SG Automotive Group's historical performance here.

Taking Advantage

- Investigate our full lineup of 5,802 Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:SALAMA

Islamic Arab Insurance (Salama) PJSC

Provides a range of general, family, health, and auto takaful solutions in Africa and Asia.

Excellent balance sheet and slightly overvalued.