- United Arab Emirates

- /

- Insurance

- /

- ADX:EIC

Undiscovered Gems In The Middle East To Explore This September 2025

Reviewed by Simply Wall St

As the Middle Eastern markets navigate the challenges posed by declining oil prices, with most Gulf indices experiencing a downturn, investors are keenly observing how these economic shifts might impact small-cap stocks in the region. Amidst this backdrop, identifying promising stocks requires careful consideration of their resilience and potential for growth despite broader market pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 23.85% | 5.17% | 7.38% | ★★★★★★ |

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 29.00% | 42.23% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Qassim Cement | 0.30% | 0.78% | -14.65% | ★★★★★☆ |

| Y.D. More Investments | 50.84% | 28.30% | 35.02% | ★★★★★☆ |

| Segmen Kardesler Gida Üretim ve Ambalaj Sanayi Anonim Sirketi | 1.89% | 3.11% | 71.69% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Emirates Insurance Company P.J.S.C (ADX:EIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Emirates Insurance Company P.J.S.C. operates in the general insurance and reinsurance sectors across the United Arab Emirates, the United States, and Europe, with a market capitalization of AED1.10 billion.

Operations: Emirates Insurance generates revenue primarily from underwriting, contributing AED2.36 billion, and investments, adding AED88.37 million.

Emirates Insurance Company, a debt-free entity, has demonstrated consistent earnings growth of 2.2% annually over the past five years. Its recent financial results highlight a significant improvement with net income reaching AED 35.31 million for Q2 2025, up from AED 11.6 million in the previous year, and basic earnings per share increasing to AED 0.24 from AED 0.08. Despite not outpacing the broader insurance industry last year, its price-to-earnings ratio of 8.6x remains attractive compared to the AE market average of 13.2x, suggesting potential value for investors looking at this sector.

Emirates Reem Investments Company P.J.S.C (DFM:ERC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emirates Reem Investments Company P.J.S.C operates in the bottling, distribution, and trading of mineral water, carbonated drinks, soft drinks, juices, and evaporated milk across the United Arab Emirates, Middle East, and Africa with a market capitalization of AED985.20 million.

Operations: Emirates Reem Investments Company P.J.S.C generates revenue primarily through its operations segment, amounting to AED208.64 million. The company's financial performance reflects a focus on bottling and distribution activities across various beverage categories in key regions.

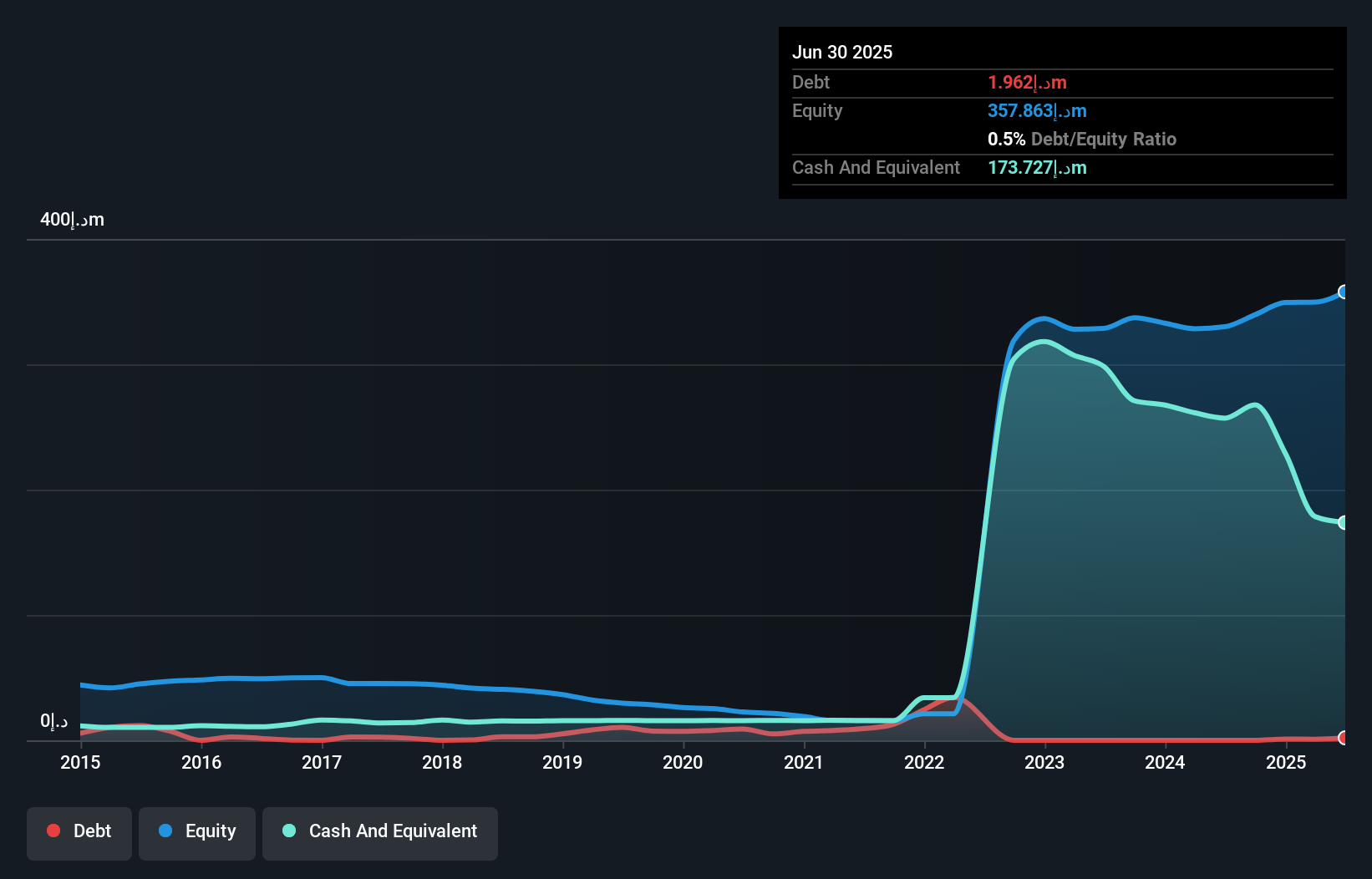

Emirates Reem Investments Company P.J.S.C has demonstrated significant growth, with earnings surging by 481% over the past year, outpacing the Beverage industry's 4.2% rise. The company reported a net income of AED 8.07 million for Q2 2025, a substantial improvement from AED 1.71 million in the same period last year. This impressive performance is coupled with a reduction in its debt-to-equity ratio from 40% to just 0.5% over five years, indicating strong financial management. Despite not being free cash flow positive currently, its high level of non-cash earnings suggests robust underlying profitability and potential for future growth.

Tamkeen Human Resources (SASE:1835)

Simply Wall St Value Rating: ★★★★★★

Overview: Tamkeen Human Resources Company provides labor recruitment and manpower services in Saudi Arabia, with a market capitalization of SAR1.47 billion.

Operations: The company's revenue streams are primarily derived from corporate services, generating SAR714.57 million, and individual services, contributing SAR200.39 million.

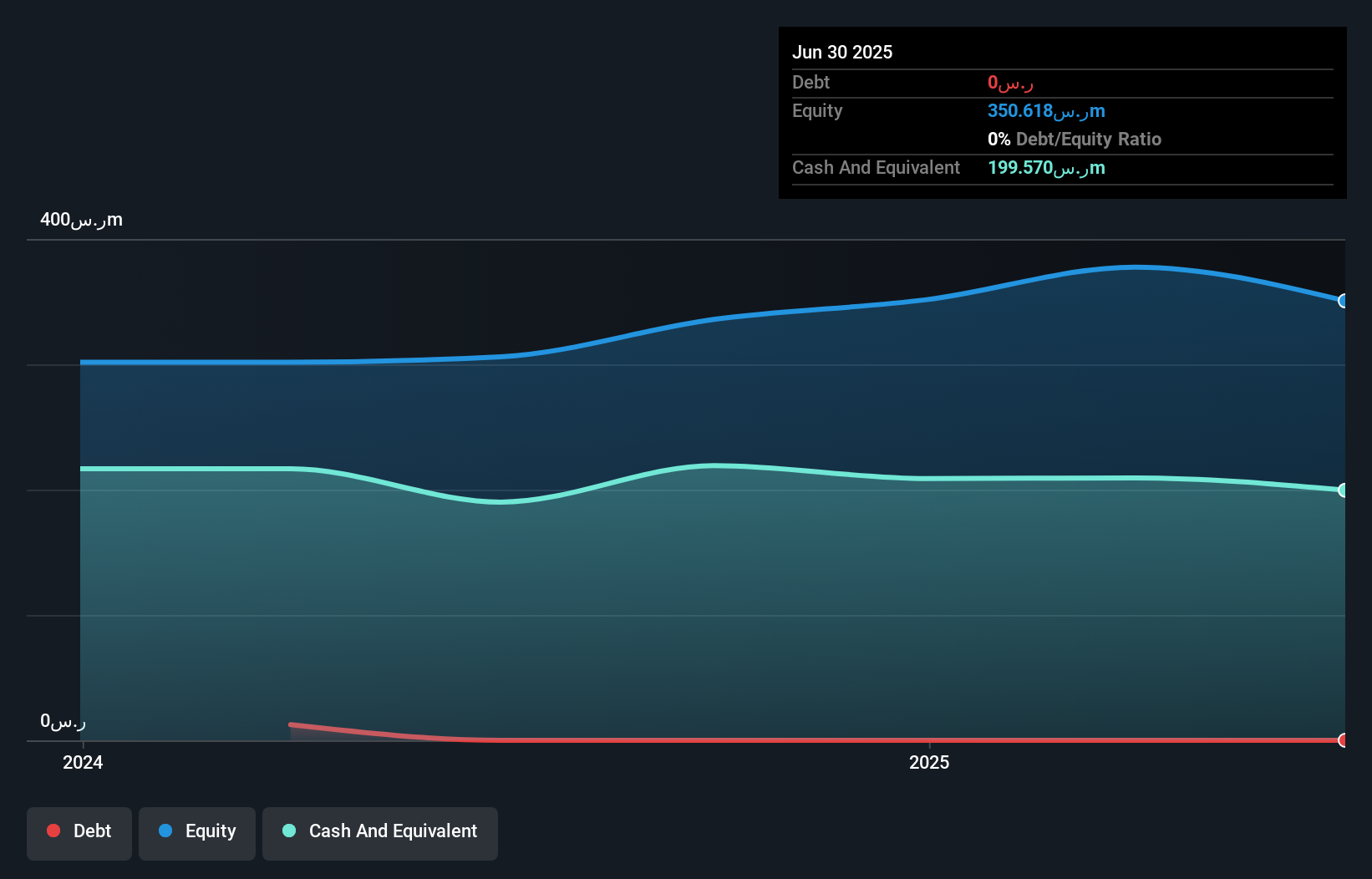

Tamkeen Human Resources, a nimble player in the Middle East market, has shown impressive growth with earnings surging 65.7% over the past year, outpacing its industry peers. The company reported sales of SAR 265.19 million and net income of SAR 26.7 million for Q2 2025, reflecting strong financial health without any debt concerns. Trading at a value estimated to be 21% below its fair value, Tamkeen appears attractive compared to industry standards. Its inclusion in major indices like S&P Pan Arab Composite highlights its growing prominence and potential for continued expansion within the region's dynamic landscape.

- Click here and access our complete health analysis report to understand the dynamics of Tamkeen Human Resources.

Understand Tamkeen Human Resources' track record by examining our Past report.

Summing It All Up

- Explore the 201 names from our Middle Eastern Undiscovered Gems With Strong Fundamentals screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emirates Insurance Company P.J.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:EIC

Emirates Insurance Company P.J.S.C

Engages in writing general insurance and reinsurance in the United Arab Emirates, the United States, and Europe.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives