In the current Middle Eastern market landscape, Gulf equities have experienced muted performance due to disappointing corporate earnings and a cautious stance from the U.S. Federal Reserve on interest rates. Despite these challenges, dividend stocks remain an attractive option for investors seeking steady income, as they can provide a buffer against market volatility and offer potential returns through regular payouts.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi Telecom (SASE:7010) | 9.99% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.17% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.38% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.45% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 3.74% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.56% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 4.90% | ★★★★★☆ |

| Banque Saudi Fransi (SASE:1050) | 6.41% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.98% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.56% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our Top Middle Eastern Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Al Wathba National Insurance Company PJSC (ADX:AWNIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al Wathba National Insurance Company PJSC operates in the general insurance and reinsurance sectors both within the United Arab Emirates and internationally, with a market capitalization of AED774.18 million.

Operations: Al Wathba National Insurance Company PJSC generates revenue from its Motor insurance segment, which accounts for AED206.19 million, and its Investments segment, contributing AED97.50 million.

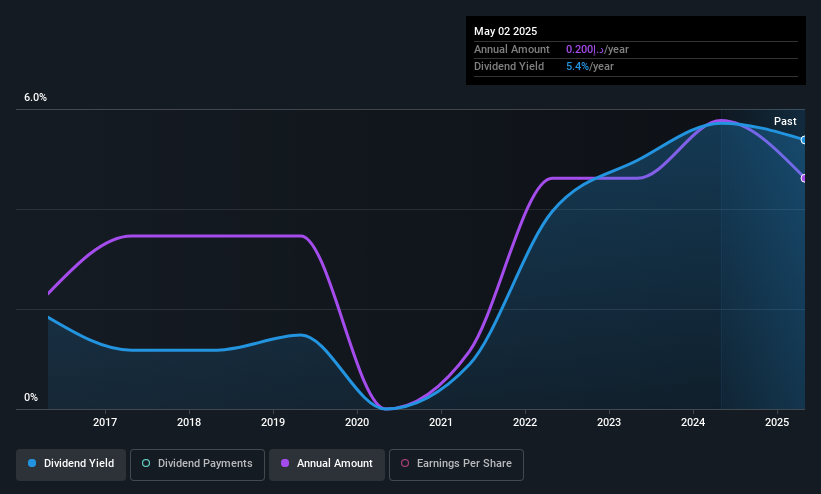

Dividend Yield: 5.3%

Al Wathba National Insurance Company PJSC has shown an increase in dividend payments over the past decade, but these have been unreliable and volatile. Despite a high payout ratio of 84.7%, dividends are covered by earnings and cash flows. The company's recent net loss of AED 16.05 million highlights financial challenges, with profit margins significantly lower than last year. Additionally, AWNIC's dividend yield of 5.35% is below the top tier in the AE market.

- Click here to discover the nuances of Al Wathba National Insurance Company PJSC with our detailed analytical dividend report.

- Our valuation report here indicates Al Wathba National Insurance Company PJSC may be overvalued.

Al-Babtain Power and Telecommunications (SASE:2320)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al-Babtain Power and Telecommunications Company, along with its subsidiaries, manufactures lighting poles and power transmission towers and accessories in the United Arab Emirates, Saudi Arabia, and Egypt, with a market cap of SAR3.56 billion.

Operations: Al-Babtain Power and Telecommunications Company generates revenue from four main segments: Towers and Metal Structures Sector (SAR1.18 billion), Solar Energy Sector (SAR592.76 million), Columns and Lighting (SAR571.13 million), and Design, Supply, and Installation (SAR404.90 million).

Dividend Yield: 3.5%

Al-Babtain Power and Telecommunications has a sustainable dividend payout with a low payout ratio of 35.4%, supported by earnings and cash flows. The company reported Q1 net income of SAR 88.2 million, up from SAR 82.6 million the previous year, despite lower sales of SAR 631.23 million. However, its dividends have been unreliable over the past decade due to volatility exceeding annual drops of 20%. The stock trades at a favorable P/E ratio of 13.3x compared to the SA market average, yet its dividend yield is below top-tier payers in the region.

- Dive into the specifics of Al-Babtain Power and Telecommunications here with our thorough dividend report.

- Our valuation report here indicates Al-Babtain Power and Telecommunications may be undervalued.

Rimoni Industries (TASE:RIMO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rimoni Industries Ltd. designs, engineers, and manufactures molds and precise injection molding assemblies for various industries including medical, automotive, agricultural, high-tech, and consumer sectors in Israel with a market cap of ₪478.60 million.

Operations: Rimoni Industries Ltd. generates revenue from its segments in patterns and plastic casting, amounting to ₪14.26 million and ₪169.63 million respectively.

Dividend Yield: 8.8%

Rimoni Industries offers a high dividend yield of 8.78%, ranking it among the top 25% in the IL market, though its payouts have been unstable and not fully covered by earnings, with a payout ratio of 102.8%. Despite an increase in dividends over the past decade, their reliability remains questionable due to volatility. Recent Q1 results showed slight earnings growth with net income at ILS 10.92 million against lower sales of ILS 46.57 million year-on-year.

- Delve into the full analysis dividend report here for a deeper understanding of Rimoni Industries.

- Insights from our recent valuation report point to the potential undervaluation of Rimoni Industries shares in the market.

Seize The Opportunity

- Click this link to deep-dive into the 75 companies within our Top Middle Eastern Dividend Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:RIMO

Rimoni Industries

Engages in the design, engineering, and manufacture of molds, and precise injection molding and assemblies for the medical, automotive, agricultural, high-tech, and consumer industries in Israel.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives