- United Arab Emirates

- /

- Insurance

- /

- ADX:AWNIC

Pinning Down Al Wathba National Insurance Company PJSC's (ADX:AWNIC) P/E Is Difficult Right Now

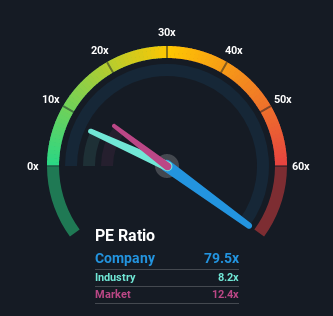

With a price-to-earnings (or "P/E") ratio of 79.5x Al Wathba National Insurance Company PJSC (ADX:AWNIC) may be sending very bearish signals at the moment, given that almost half of all companies in the United Arab Emirates have P/E ratios under 12x and even P/E's lower than 7x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been quite advantageous for Al Wathba National Insurance Company PJSC as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Al Wathba National Insurance Company PJSC

How Is Al Wathba National Insurance Company PJSC's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Al Wathba National Insurance Company PJSC's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 204%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 80% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's an unpleasant look.

In light of this, it's alarming that Al Wathba National Insurance Company PJSC's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Al Wathba National Insurance Company PJSC revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 4 warning signs for Al Wathba National Insurance Company PJSC (2 are a bit unpleasant!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Al Wathba National Insurance Company PJSC, explore our interactive list of high quality stocks to get an idea of what else is out there.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ADX:AWNIC

Al Wathba National Insurance Company PJSC

Engages in general insurance and reinsurance business in the United Arab Emirates and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives