- Taiwan

- /

- Semiconductors

- /

- TPEX:6640

3 Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rising inflation and fluctuating interest rates, major U.S. stock indexes have edged closer to record highs, with growth stocks outpacing their value counterparts. Despite this upward momentum, small-cap stocks have lagged behind broader indices like the S&P 500, creating an environment ripe for identifying lesser-known opportunities that may offer promising potential. In such a climate, discerning investors often seek companies with strong fundamentals and innovative strategies that can thrive amid economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.73% | 7.10% | 12.89% | ★★★★★★ |

| Ruentex Interior Design | NA | 21.07% | 27.94% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Ampire | NA | 1.50% | 11.39% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Taiyo KagakuLtd | 0.73% | 4.83% | -2.64% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Dana Gas PJSC (ADX:DANA)

Simply Wall St Value Rating: ★★★★★★

Overview: Dana Gas PJSC operates in the exploration, production, and sale of natural gas and petroleum products across the United Arab Emirates, Iraq, and Egypt with a market capitalization of AED5.39 billion.

Operations: Dana Gas PJSC generates revenue from its integrated oil and gas operations, with a reported segment revenue of $300 million. The company's cost structure primarily involves expenses related to exploration, production, and distribution activities.

Dana Gas, a notable player in the energy sector, trades at nearly half its estimated fair value, suggesting potential undervaluation. Over the past five years, it has impressively reduced its debt-to-equity ratio from 17.1% to 5.8%, reflecting improved financial health. Despite a slight earnings dip of 0.7% last year compared to the industry average of -5.6%, Dana Gas still boasts high-quality past earnings and positive free cash flow (US$157 million as of September 2024). With more cash than total debt and projected revenue growth of over 10% annually, it presents intriguing prospects for investors seeking value in energy stocks.

- Click to explore a detailed breakdown of our findings in Dana Gas PJSC's health report.

Examine Dana Gas PJSC's past performance report to understand how it has performed in the past.

Wuhan Ligong Guangke (SZSE:300557)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuhan Ligong Guangke Co., Ltd. specializes in optical fiber sensor products and Internet of Things solutions for security and fire protection in China, with a market cap of CN¥2.99 billion.

Operations: The company's primary revenue stream is from the Optical Fiber Sensor and Smart Instrument Manufacturing Industry, generating CN¥614.43 million. The net profit margin reflects a significant aspect of its financial performance.

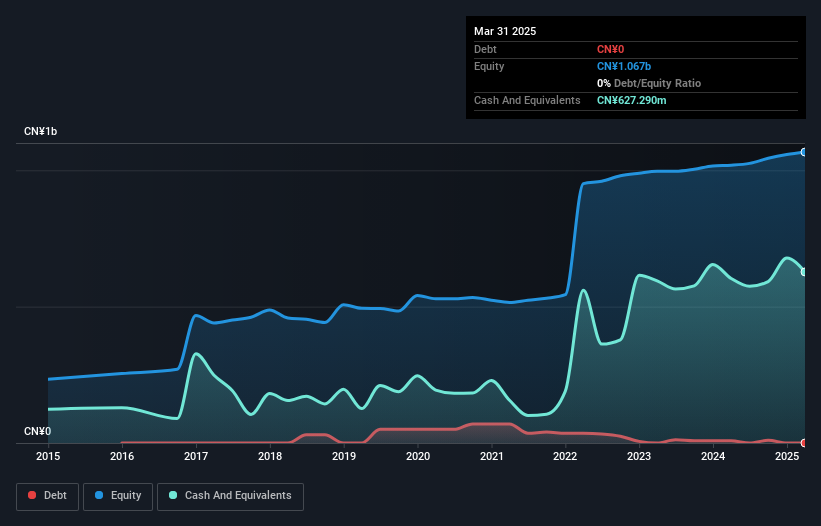

Wuhan Ligong Guangke, a small player in the electronics sector, has been making waves with its robust earnings growth of 55% over the past year, outpacing the industry average of 1.9%. The company enjoys a healthy financial position, boasting more cash than its total debt and reducing its debt-to-equity ratio from 10.3 to 1 over five years. With free cash flow remaining positive and high-quality earnings reported, Wuhan Ligong seems well-prepared for future challenges. Recent shareholder discussions on stock repurchase plans highlight active management strategies aimed at enhancing shareholder value.

Gallant Micro. Machining (TPEX:6640)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gallant Micro. Machining Co., LTD. specializes in producing and selling machinery, equipment, precision molds, and various components across Taiwan, China, and international markets with a market cap of NT$14.20 billion.

Operations: Gallant Micro. Machining Co., LTD. generates revenue primarily from its operations, with Gallant Micro. Machining Co., Ltd. contributing NT$1.75 billion and KMC Corporation adding NT$584.94 million to its sales figures.

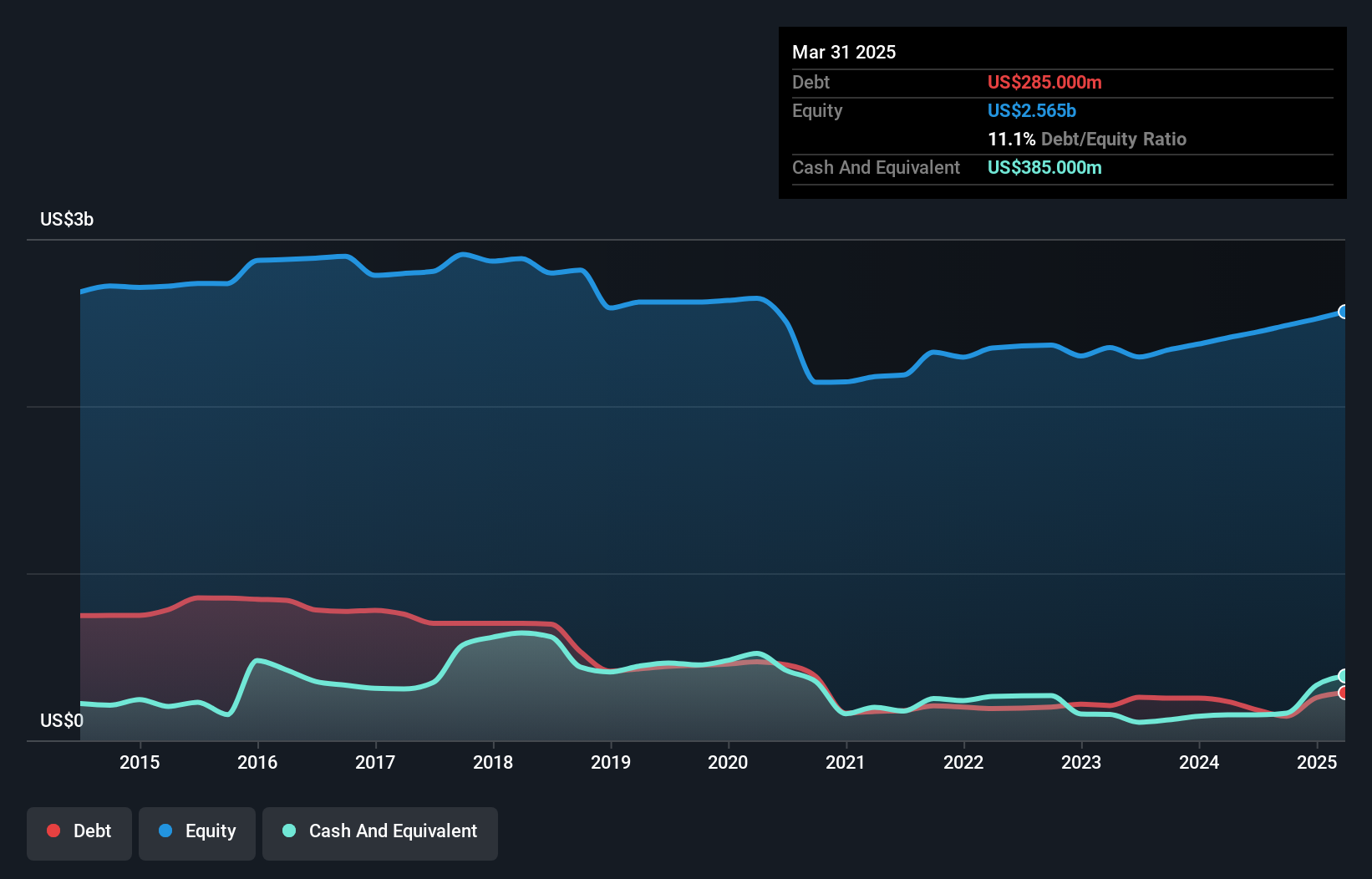

Gallant Micro. Machining is making waves with its impressive earnings growth of 496.7% over the past year, far surpassing the semiconductor industry's average of 5.9%. Despite a rise in its debt to equity ratio from 34% to 40.4% over five years, the company maintains a satisfactory net debt to equity ratio at just 0.5%, indicating prudent financial management. Free cash flow remains positive, reflecting robust operational efficiency and strategic capital expenditure decisions amounting to US$32 million recently, which likely supports future growth initiatives in this dynamic sector while handling interest payments comfortably without concern for coverage issues or liquidity constraints.

Summing It All Up

- Access the full spectrum of 4722 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6640

Gallant Micro. Machining

Engages in the production and sale of machinery and equipment, precision molds, and other parts and components in Taiwan, China, and internationally.

Solid track record with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)