August 2025's Middle Eastern Penny Stocks: Discovering Hidden Opportunities

Reviewed by Simply Wall St

As the Middle Eastern markets navigate mixed corporate earnings and global trade tensions, investors are closely watching for opportunities amid fluctuating indices. Despite recent downturns in major Gulf shares, the region's economic landscape continues to offer potential for strategic investments. Penny stocks, often overlooked due to their vintage connotation, can present intriguing prospects by combining affordability with growth potential; this article explores three such stocks that stand out for their financial resilience and promise in today's market climate.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.403 | ₪14.89M | ✅ 0 ⚠️ 5 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.83 | SAR1.53B | ✅ 2 ⚠️ 1 View Analysis > |

| Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP) | TRY4.39 | TRY1.21B | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.50 | AED3.02B | ✅ 4 ⚠️ 3 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY3.08 | TRY3.32B | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.45 | AED398.48M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.90 | AED12.33B | ✅ 2 ⚠️ 2 View Analysis > |

| Union Properties (DFM:UPP) | AED0.839 | AED3.6B | ✅ 1 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.798 | AED485.39M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.94 | ₪218.57M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 78 stocks from our Middle Eastern Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Amanat Holdings PJSC (DFM:AMANAT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amanat Holdings PJSC invests in education and healthcare companies and enterprises in the UAE and internationally, with a market cap of AED2.91 billion.

Operations: The company generates revenue from two main segments: AED460.94 million from education and AED362.38 million from healthcare.

Market Cap: AED2.91B

Amanat Holdings PJSC, with a market cap of AED2.91 billion, invests in education and healthcare sectors, generating significant revenues from both. The company has strong financial health, with short-term assets exceeding liabilities and more cash than total debt. Although Return on Equity is low at 6%, earnings have grown substantially by 166.2% over the past year, surpassing industry averages. However, its dividend yield of 3.93% is not well covered by free cash flows. Recent quarterly results show sales growth but a slight decline in net income compared to the previous year’s quarter.

- Jump into the full analysis health report here for a deeper understanding of Amanat Holdings PJSC.

- Assess Amanat Holdings PJSC's previous results with our detailed historical performance reports.

BioLight Life Sciences (TASE:BOLT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BioLight Life Sciences Ltd. is an ophthalmic company focused on discovering, developing, and commercializing products for eye conditions, with a market cap of ₪22.98 million.

Operations: BioLight Life Sciences Ltd. has not reported any specific revenue segments.

Market Cap: ₪22.98M

BioLight Life Sciences Ltd., with a market cap of ₪22.98 million, operates in the ophthalmic sector but remains pre-revenue, generating less than US$1 million annually. Despite being debt-free and having short-term assets exceeding liabilities, the company faces financial challenges with a cash runway of less than a year and increasing losses over five years at 19.1% annually. The experienced management team has not diluted shareholder equity recently, yet the stock experiences high volatility compared to most Israeli stocks. Recent financial results show a net loss for Q1 2025, highlighting ongoing profitability issues.

- Click here and access our complete financial health analysis report to understand the dynamics of BioLight Life Sciences.

- Understand BioLight Life Sciences' track record by examining our performance history report.

InterCure (TASE:INCR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: InterCure Ltd. operates in the research, cultivation, production, marketing, and distribution of pharmaceutical-grade cannabis products for medical use both in Israel and internationally, with a market cap of ₪235.29 million.

Operations: The company generated revenue of ₪238.85 million from its cannabis segment.

Market Cap: ₪235.29M

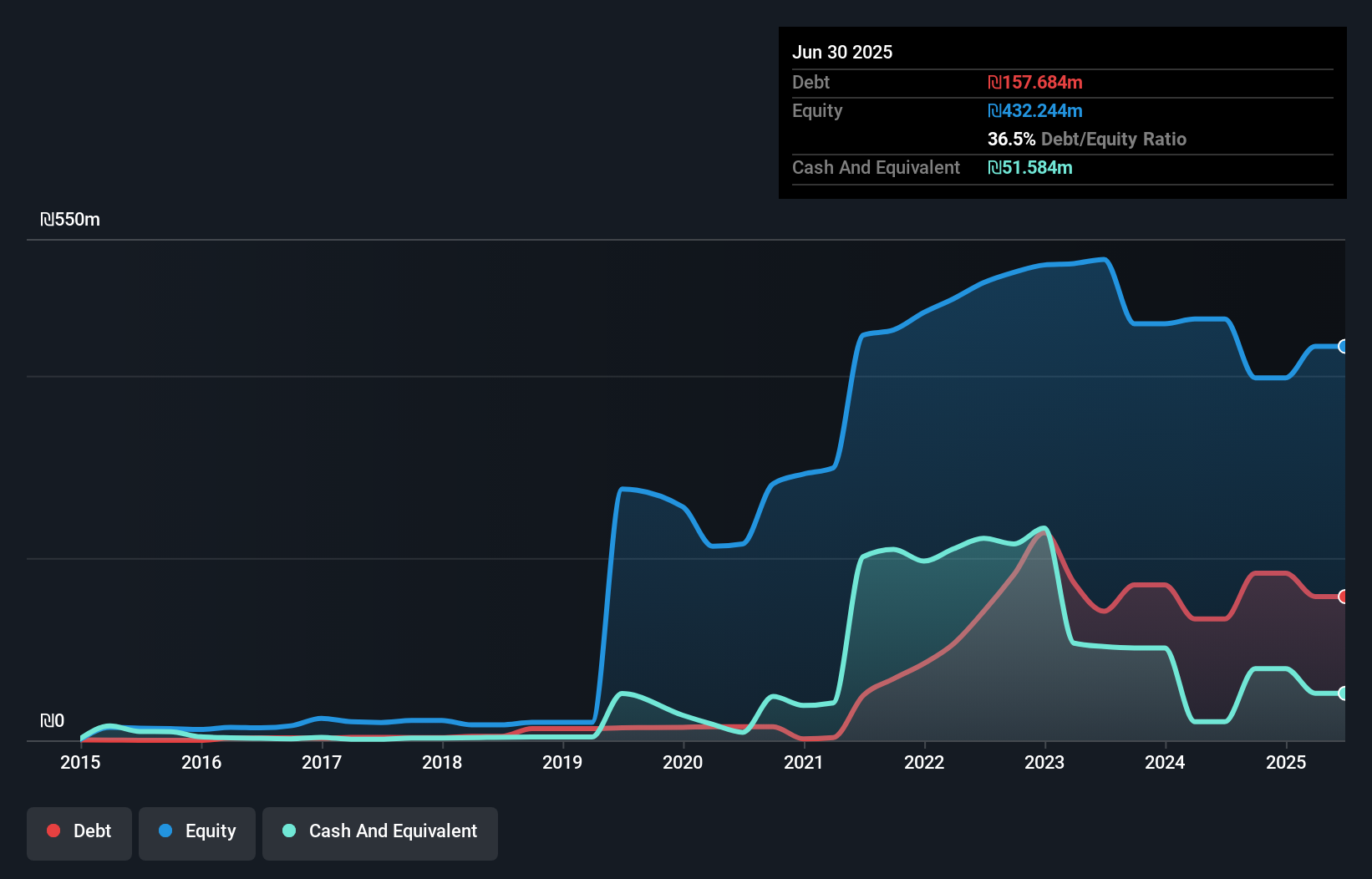

InterCure Ltd., with a market cap of ₪235.29 million, operates in the cannabis sector and generated revenue of ₪238.85 million. Despite its revenue generation, the company remains unprofitable with earnings declining by 5.7% annually over five years, and a negative Return on Equity of -18.3%. However, InterCure's financial position is bolstered by short-term assets exceeding both short and long-term liabilities and a satisfactory net debt to equity ratio of 26.3%. The board's average tenure is considered experienced at 6.9 years, while shareholders have not faced significant dilution recently despite increased debt levels over five years.

- Get an in-depth perspective on InterCure's performance by reading our balance sheet health report here.

- Gain insights into InterCure's historical outcomes by reviewing our past performance report.

Summing It All Up

- Gain an insight into the universe of 78 Middle Eastern Penny Stocks by clicking here.

- Want To Explore Some Alternatives? Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:INCR

InterCure

Engages in the research, cultivation, production, marketing, and distribution of pharmaceutical-grade cannabis and cannabis-based products for medical use in Israel and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives