- United Arab Emirates

- /

- Consumer Services

- /

- DFM:TAALEEM

Taaleem Holdings PJSC And 2 Other Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

In recent weeks, global markets have been navigating a landscape marked by geopolitical tensions and consumer spending concerns, with major U.S. indices experiencing volatility amid tariff discussions and economic data pointing to potential slowdowns. As investors seek stability in uncertain times, small-cap stocks—often overlooked but with unique growth potential—can offer opportunities for diversification and resilience in a portfolio. Amidst these conditions, identifying companies with strong fundamentals and innovative business models can be key to enhancing your investment strategy.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 10.92% | 8.23% | 18.26% | ★★★★★★ |

| Intelligent Wave | NA | 7.78% | 15.50% | ★★★★★★ |

| Kyoritsu Electric | 7.58% | 3.45% | 12.53% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yashima Denki | 2.71% | -1.00% | 18.12% | ★★★★★★ |

| Toyo Kanetsu K.K | 33.97% | 3.33% | 18.20% | ★★★★★☆ |

| Nikko | 44.54% | 5.86% | -5.45% | ★★★★★☆ |

| Loadstar Capital K.K | 244.76% | 17.29% | 21.16% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Taaleem Holdings PJSC (DFM:TAALEEM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Taaleem Holdings PJSC is a company that provides and invests in education services in the United Arab Emirates, with a market capitalization of approximately AED3.99 billion.

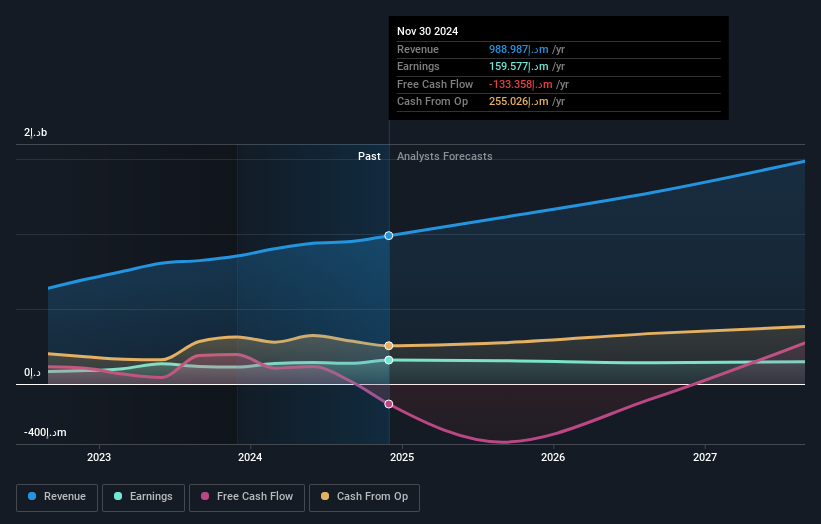

Operations: Taaleem Holdings generates revenue primarily from its school operations, amounting to AED987.13 million. The company's cost structure and net profit margin are not detailed in the provided data.

Taaleem Holdings, a smaller player in the education sector, has shown robust earnings growth of 41.1% over the past year, outpacing the industry average of 11.3%. Despite an increase in its debt to equity ratio from 14.9% to 37.1% over five years, it holds more cash than total debt, indicating financial stability. Recent earnings reported net income of AED 68.2 million for Q1 FY2025 compared to AED 46.63 million last year, with sales rising to AED 306.68 million from AED 266.91 million previously, reflecting strong operational performance and potential for continued growth in revenue and profitability.

- Unlock comprehensive insights into our analysis of Taaleem Holdings PJSC stock in this health report.

Evaluate Taaleem Holdings PJSC's historical performance by accessing our past performance report.

Pasifik Eurasia Lojistik Dis Ticaret (IBSE:PASEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pasifik Eurasia Lojistik Dis Ticaret A.S. operates in the logistics and transportation sector with a focus on railroads, and has a market capitalization of TRY23.28 billion.

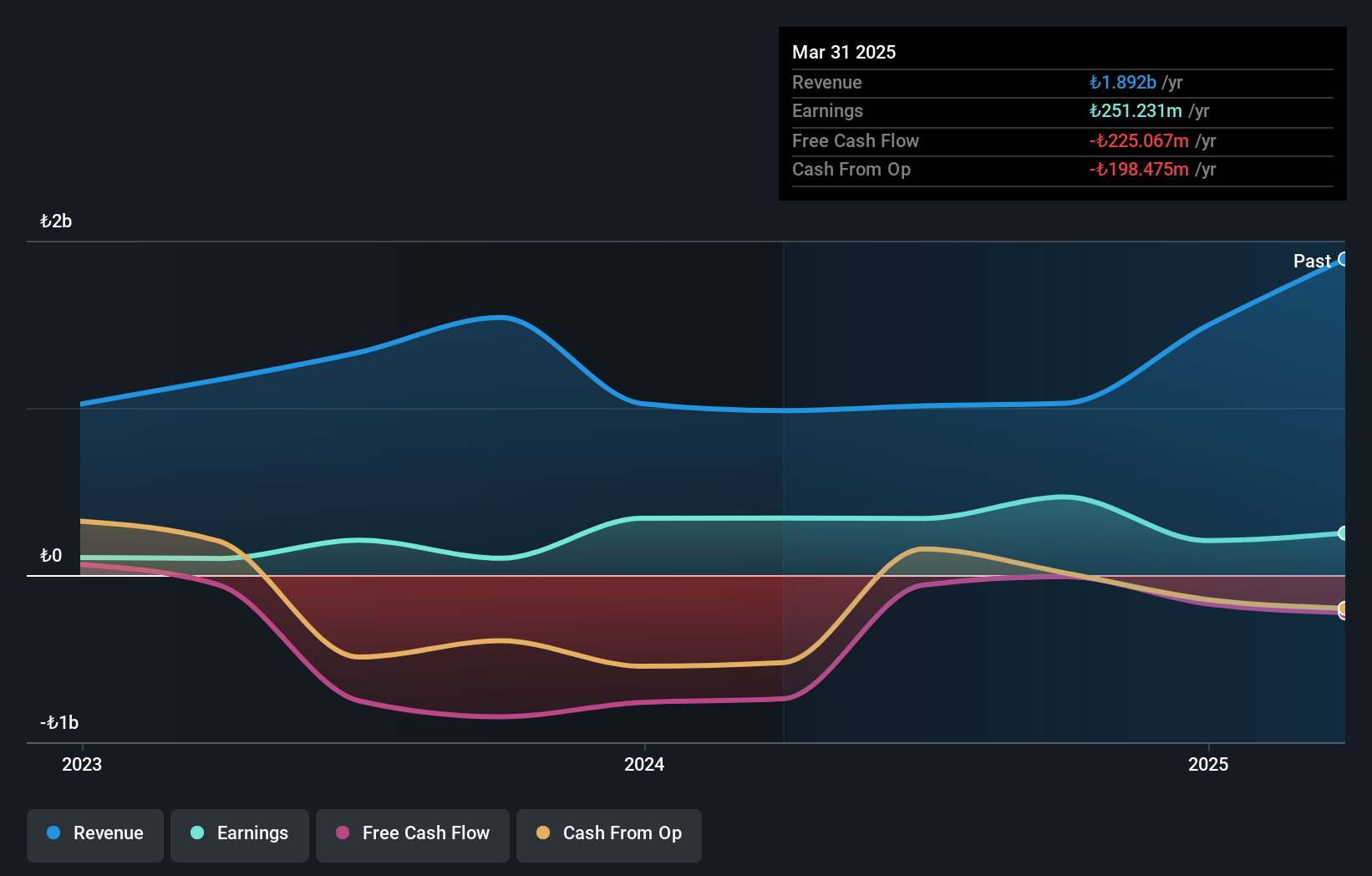

Operations: Pasifik Eurasia generates revenue primarily through its rail transportation services, amounting to TRY665.02 million.

Pasifik Eurasia Lojistik Dis Ticaret stands out with a robust financial profile, boasting more cash than total debt, which speaks to its solid footing. The company has experienced a remarkable earnings surge of 259% over the past year, far outpacing the Transportation industry's growth of 37%. Despite some fluctuations in levered free cash flow, with notable improvements reaching US$251.17 million by September 2024, Pasifik Eurasia's ability to cover interest payments is not a concern. This strong performance suggests potential for continued success within its sector while maintaining high-quality earnings.

First Tractor (SEHK:38)

Simply Wall St Value Rating: ★★★★★★

Overview: First Tractor Company Limited is involved in the research, development, manufacture, and sale of agricultural and power machinery globally, with a market capitalization of HK$14.59 billion.

Operations: First Tractor generates revenue primarily from the sale of agricultural and power machinery. The company's financial performance is influenced by its ability to manage production costs and optimize its net profit margin, which reflects its operational efficiency.

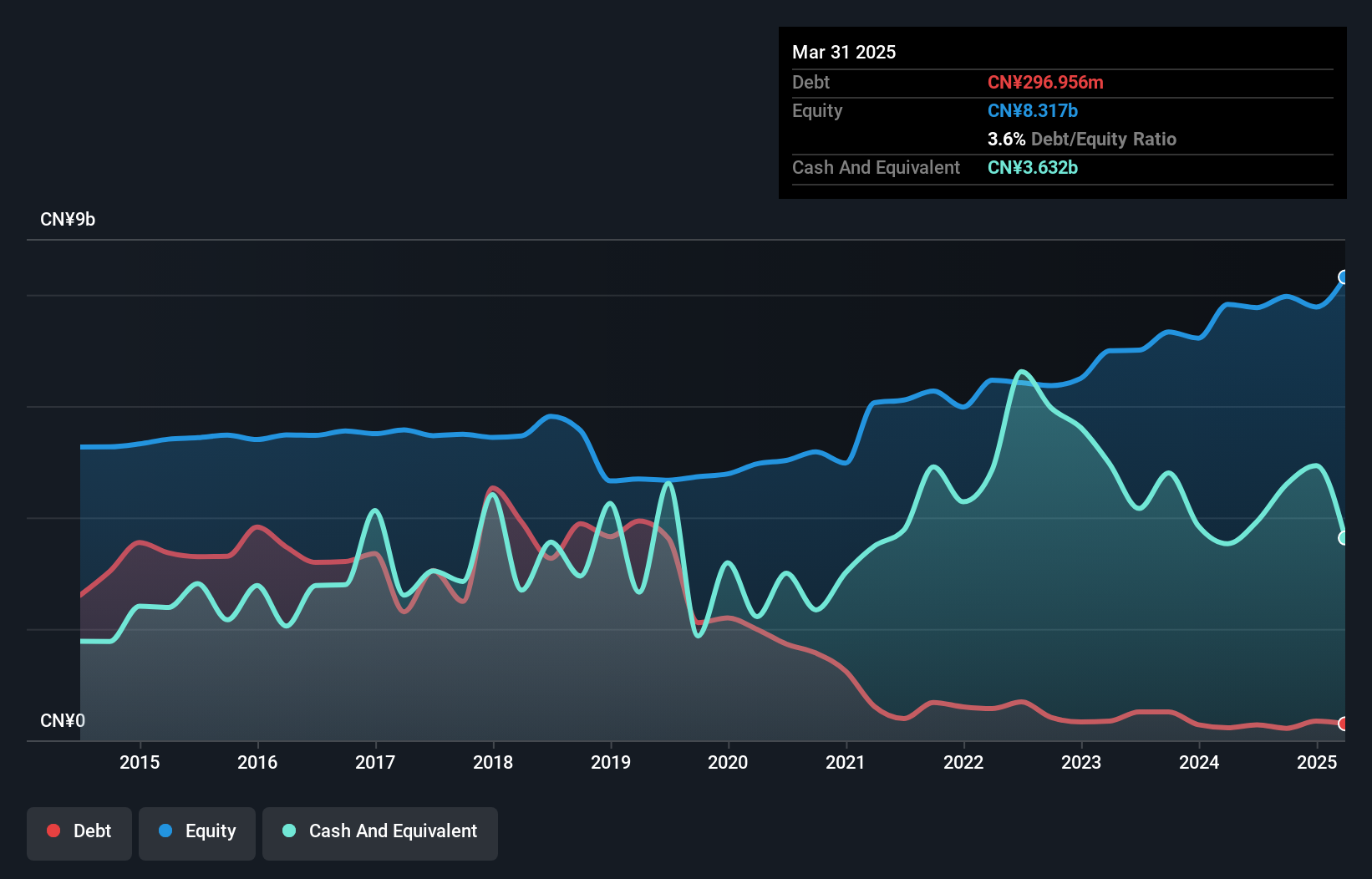

First Tractor has been making strides with a significant reduction in its debt to equity ratio from 44.6% to 2.7% over the past five years, showcasing improved financial health. The company is trading at a notable discount of 63.7% below its estimated fair value, suggesting potential undervaluation. Despite earnings growth of 4.4% last year lagging behind the machinery industry's 8.5%, First Tractor's earnings have grown by an impressive average of 39.4% annually over the past five years, reflecting robust performance in recent history and hinting at promising future prospects within its industry context.

- Take a closer look at First Tractor's potential here in our health report.

Assess First Tractor's past performance with our detailed historical performance reports.

Make It Happen

- Gain an insight into the universe of 4750 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taaleem Holdings PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:TAALEEM

Taaleem Holdings PJSC

Provides and invests in education services in the United Arab Emirates.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives