- Israel

- /

- Healthcare Services

- /

- TASE:NVLG

Middle Eastern Penny Stocks With Market Caps Under US$1B

Reviewed by Simply Wall St

The Middle East stock markets have recently shown mixed performance, influenced by corporate earnings announcements and the anticipation of U.S.-China trade talks. In such a fluctuating environment, investors often look for opportunities in less conventional areas like penny stocks. Although the term 'penny stocks' might seem outdated, these smaller or newer companies can offer significant potential when they possess strong financials.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.98 | SAR1.59B | ✅ 2 ⚠️ 1 View Analysis > |

| Keir International (SASE:9542) | SAR3.92 | SAR474M | ✅ 2 ⚠️ 3 View Analysis > |

| Dna Group (T.R.) (TASE:DNA) | ₪1.009 | ₪124.27M | ✅ 2 ⚠️ 4 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.518 | ₪176.34M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.924 | ₪2.87B | ✅ 1 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.082 | ₪154.78M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.695 | AED422.74M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.42 | AED395.01M | ✅ 2 ⚠️ 4 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED0.995 | AED2.08B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.36 | AED10.03B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 95 stocks from our Middle Eastern Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Taaleem Holdings PJSC (DFM:TAALEEM)

Simply Wall St Financial Health Rating: ★★★★☆☆

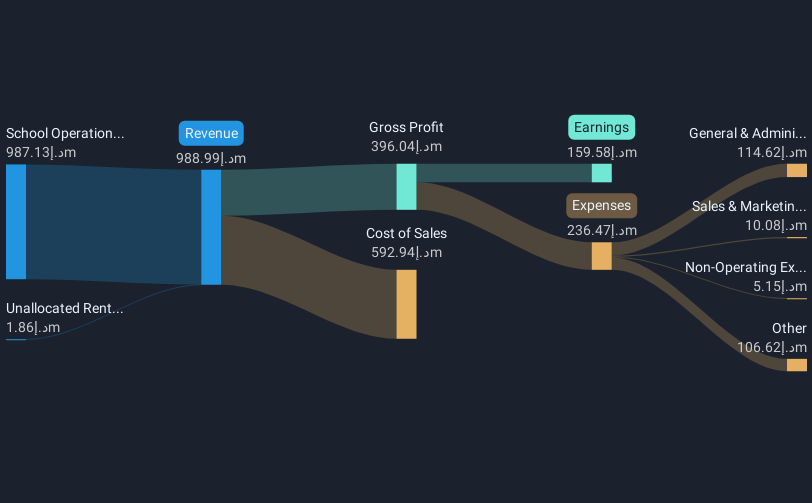

Overview: Taaleem Holdings PJSC operates in the United Arab Emirates, focusing on providing and investing in education services, with a market cap of AED3.65 billion.

Operations: The company generates revenue primarily from school operations, amounting to AED1.05 billion.

Market Cap: AED3.65B

Taaleem Holdings PJSC, with a market cap of AED3.65 billion, demonstrates potential within the penny stock segment in the Middle East due to its stable financial performance and strategic focus on education services. The company's recent earnings report shows a revenue increase to AED343.74 million for the second quarter of 2025, reflecting growth from AED282.54 million in the previous year. Despite a slight decline in net profit margin from 15.3% to 15.2%, Taaleem maintains robust debt management with operating cash flow covering 59.3% of its debt and interest coverage at 49.6 times EBIT, indicating financial resilience and prudent fiscal strategy.

- Jump into the full analysis health report here for a deeper understanding of Taaleem Holdings PJSC.

- Learn about Taaleem Holdings PJSC's future growth trajectory here.

Airtouch Solar (TASE:ARTS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Airtouch Solar Ltd offers autonomous water-free robotic cleaning solutions for solar panels and has a market cap of ₪32.20 million.

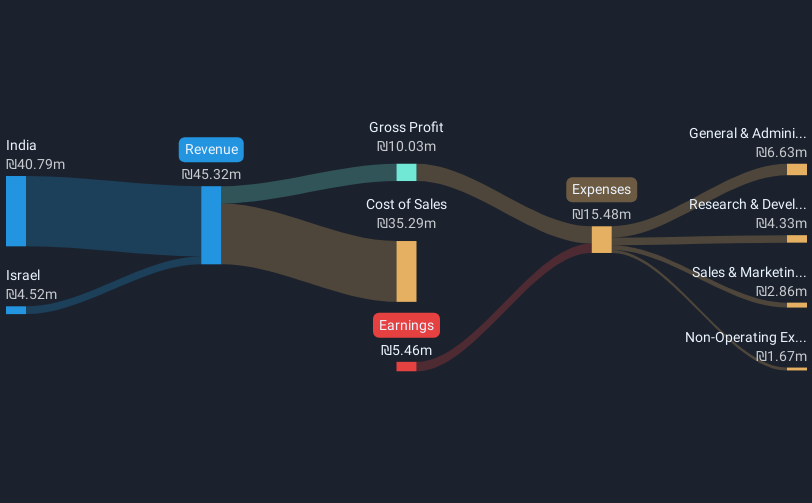

Operations: The company generates revenue from its Industrial Automation & Controls segment, totaling ₪45.32 million.

Market Cap: ₪32.2M

Airtouch Solar Ltd, with a market cap of ₪32.20 million, has shown significant revenue growth, reaching ₪45.32 million from the previous year's ₪16.26 million. Despite this increase, the company remains unprofitable with a net loss of ₪5.46 million for 2024. The company's short-term assets of ₪42.5M comfortably cover both its short and long-term liabilities, while its cash reserves exceed total debt levels, providing financial stability amid high share price volatility over recent months. The management team and board are experienced but face challenges in reversing negative earnings trends and improving return on equity currently at -23.04%.

- Get an in-depth perspective on Airtouch Solar's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Airtouch Solar's track record.

Novolog (Pharm-Up 1966) (TASE:NVLG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Novolog (Pharm-Up 1966) Ltd operates in the healthcare services sector in Israel with a market cap of ₪794.87 million.

Operations: The company generates revenue from its Logistics Division with ₪1.79 billion, the Health Services Division contributing ₪206.73 million, and the Digital Division adding ₪26.31 million.

Market Cap: ₪794.87M

Novolog (Pharm-Up 1966) Ltd, with a market cap of ₪794.87 million, has transitioned to profitability, reporting net income of ₪39.54 million for 2024 compared to a loss the previous year. The company's revenue rose to ₪2.02 billion from its Logistics and Health Services divisions primarily. Despite becoming profitable, Novolog's earnings have declined by an average of 22.8% annually over five years and its return on equity remains low at 10.7%. The company is debt-free but faces challenges as short-term assets slightly undercut short-term liabilities by ₪100 million, while the board lacks extensive experience with an average tenure of 2.5 years.

- Navigate through the intricacies of Novolog (Pharm-Up 1966) with our comprehensive balance sheet health report here.

- Explore historical data to track Novolog (Pharm-Up 1966)'s performance over time in our past results report.

Where To Now?

- Access the full spectrum of 95 Middle Eastern Penny Stocks by clicking on this link.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Novolog (Pharm-Up 1966), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Novolog (Pharm-Up 1966) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NVLG

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives