- United Arab Emirates

- /

- Consumer Services

- /

- DFM:TAALEEM

Middle Eastern Opportunities: Taaleem Holdings PJSC Among 3 Promising Penny Stocks

Reviewed by Simply Wall St

Most Gulf markets have recently closed higher, demonstrating resilience despite global trade tensions and tariff announcements. In this context, penny stocks—though an older term—remain relevant as they often represent smaller or newer companies with potential for growth at lower price points. When these stocks are supported by strong financials, they can offer significant opportunities; this article highlights three such promising options in the Middle Eastern market.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.39 | ₪14.75M | ✅ 0 ⚠️ 5 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR4.19 | SAR1.68B | ✅ 2 ⚠️ 1 View Analysis > |

| Amanat Holdings PJSC (DFM:AMANAT) | AED1.09 | AED2.71B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.541 | ₪319.37M | ✅ 3 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.19 | AED2.36B | ✅ 3 ⚠️ 2 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.89 | TRY2.03B | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.19 | AED368.44M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.71 | AED11.48B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.822 | AED499.98M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.616 | ₪194.48M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 77 stocks from our Middle Eastern Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Taaleem Holdings PJSC (DFM:TAALEEM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Taaleem Holdings PJSC operates in the education sector by providing and investing in educational services within the United Arab Emirates, with a market capitalization of AED4.20 billion.

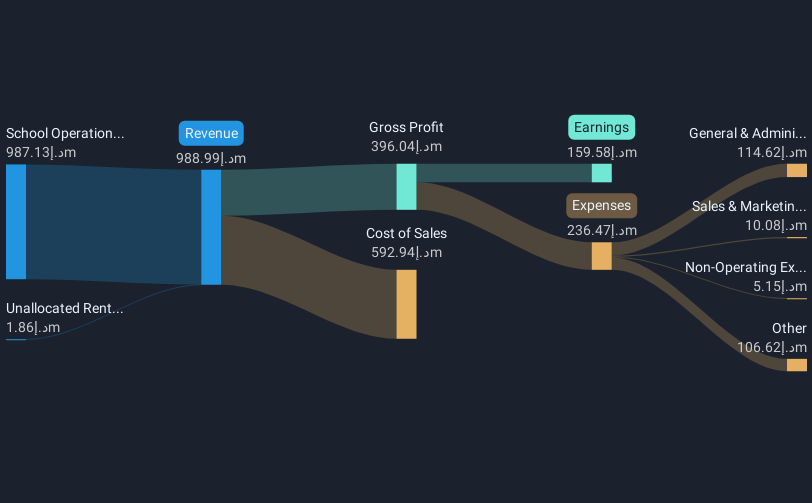

Operations: The company generates revenue primarily from its school operations, amounting to AED1.10 billion.

Market Cap: AED4.2B

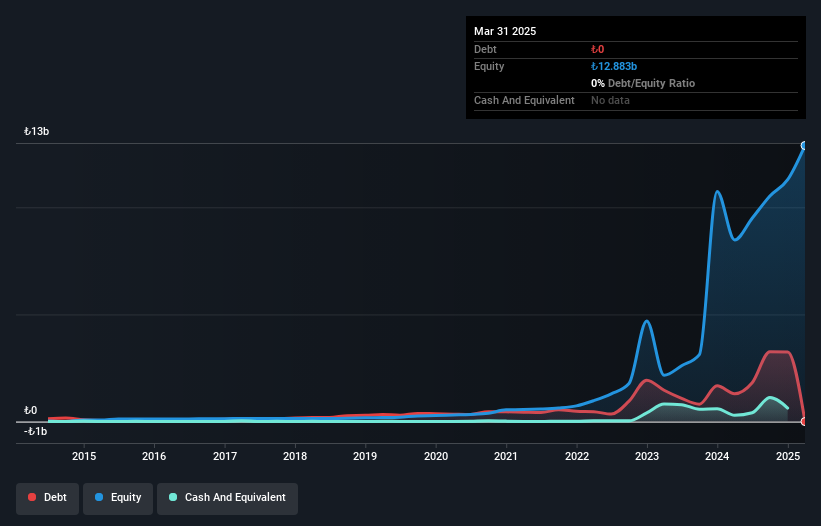

Taaleem Holdings PJSC, with a market cap of AED4.20 billion, operates in the education sector and has demonstrated consistent revenue growth, reaching AED11.66 million in its recent quarter. Despite this growth, earnings have slightly declined year-over-year to AED82.03 million for the quarter ending May 2025. The company's short-term assets exceed its liabilities, but long-term liabilities remain uncovered by short-term assets. Taaleem's debt is effectively managed with strong interest coverage and operating cash flow support; however, its return on equity is low at 8.4%. The management team is experienced and stable with an average tenure of 8.5 years.

- Jump into the full analysis health report here for a deeper understanding of Taaleem Holdings PJSC.

- Explore Taaleem Holdings PJSC's analyst forecasts in our growth report.

Tukas Gida Sanayi ve Ticaret (IBSE:TUKAS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tukas Gida Sanayi ve Ticaret A.S. manufactures and sells food products both domestically in Turkey and internationally, with a market cap of TRY12.29 billion.

Operations: The company's revenue is primarily derived from its food processing segment, which generated TRY6.60 billion.

Market Cap: TRY12.29B

Tukas Gida Sanayi ve Ticaret A.S., with a market cap of TRY12.29 billion, has shown resilience in its financial performance despite challenges. The company's first-quarter sales were TRY2 billion, slightly down from the previous year, but it turned a net income of TRY488.15 million from a loss previously. Its seasoned board and stable weekly volatility contribute to investor confidence, while its price-to-earnings ratio of 8.9x suggests potential value compared to the broader Turkish market. However, negative operating cash flow raises concerns about debt coverage, although short-term assets comfortably cover both short and long-term liabilities.

- Take a closer look at Tukas Gida Sanayi ve Ticaret's potential here in our financial health report.

- Review our historical performance report to gain insights into Tukas Gida Sanayi ve Ticaret's track record.

Alinma Retail REIT Fund (SASE:4345)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alinma Retail REIT Fund is a real estate investment trust focused on retail properties, with a market cap of SAR547.52 million.

Operations: The fund generates revenue primarily through its real estate rental segment, which amounts to SAR187.74 million.

Market Cap: SAR547.52M

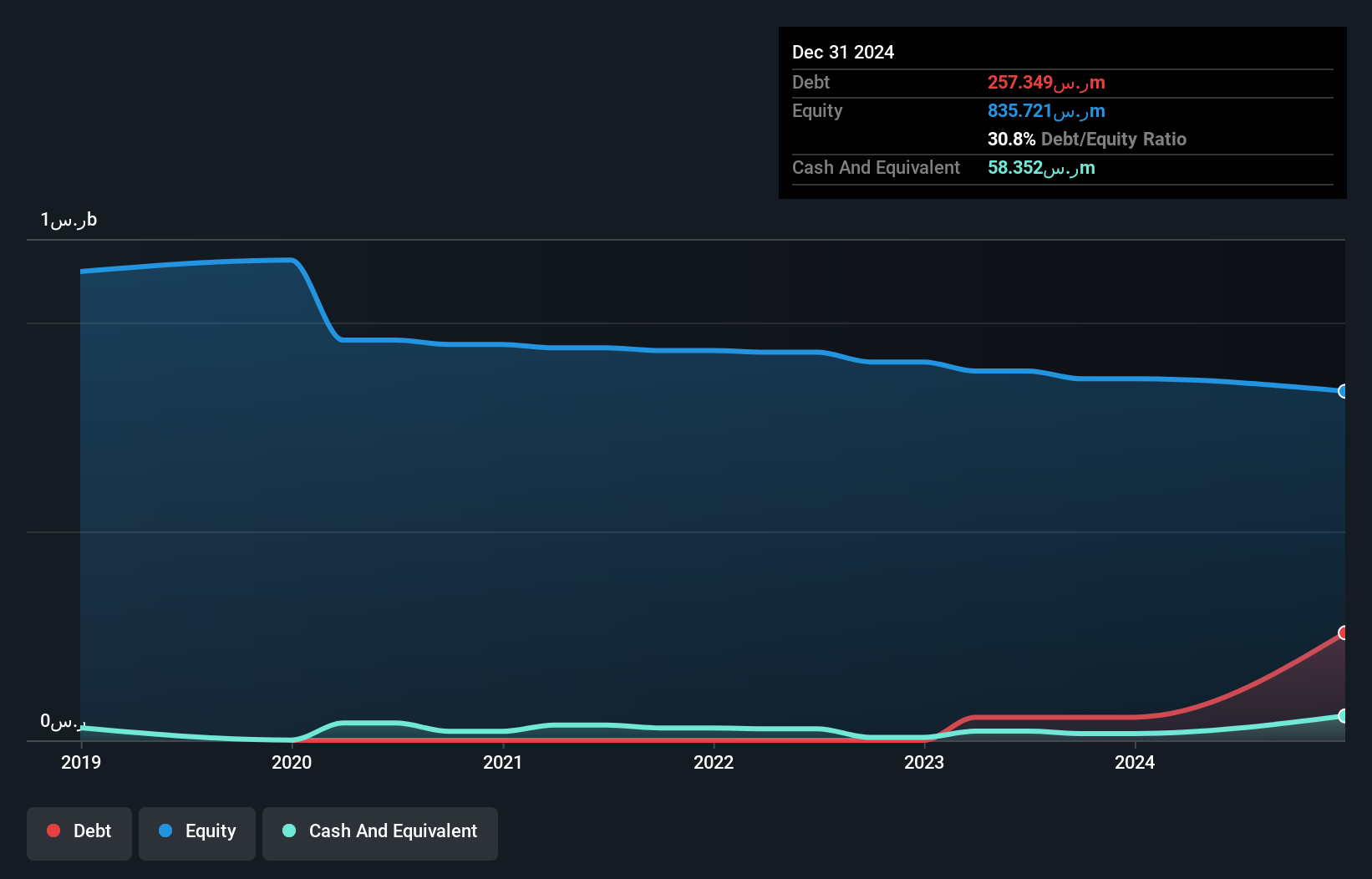

Alinma Retail REIT Fund, with a market cap of SAR547.52 million, has recently announced a dividend distribution of SAR21.24 million for the first half of 2025, reflecting its profitability achieved in the past year. Despite this positive development, challenges remain as short-term assets do not cover long-term liabilities and a large one-off loss of SAR86.1 million impacted recent financial results. The fund's debt to equity ratio has increased to 30.8% over five years but remains satisfactorily covered by operating cash flow at 31.3%. Its Return on Equity is low at 1%, indicating room for improvement in financial efficiency and returns.

- Click here to discover the nuances of Alinma Retail REIT Fund with our detailed analytical financial health report.

- Explore historical data to track Alinma Retail REIT Fund's performance over time in our past results report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 77 Middle Eastern Penny Stocks here.

- Looking For Alternative Opportunities? Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taaleem Holdings PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:TAALEEM

Taaleem Holdings PJSC

Provides and invests in education services in the United Arab Emirates.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives