- Saudi Arabia

- /

- Basic Materials

- /

- SASE:3040

Exploring Taaleem Holdings PJSC and 2 Other Undiscovered Gems in Middle East Stocks

Reviewed by Simply Wall St

As Gulf markets experience a retreat, influenced by anticipated U.S. economic data and fluctuating oil prices, investors are navigating the complexities of regional monetary policies tied to the U.S. dollar. In this environment, identifying promising stocks involves assessing resilience to external economic pressures and potential for growth within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Taaleem Holdings PJSC (DFM:TAALEEM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Taaleem Holdings PJSC is engaged in providing and investing in education services within the United Arab Emirates, with a market capitalization of AED4.68 billion.

Operations: The primary revenue stream for Taaleem Holdings comes from school operations, generating AED1.10 billion. The company's net profit margin demonstrates a notable trend, reflecting its financial efficiency in managing costs relative to its revenue generation.

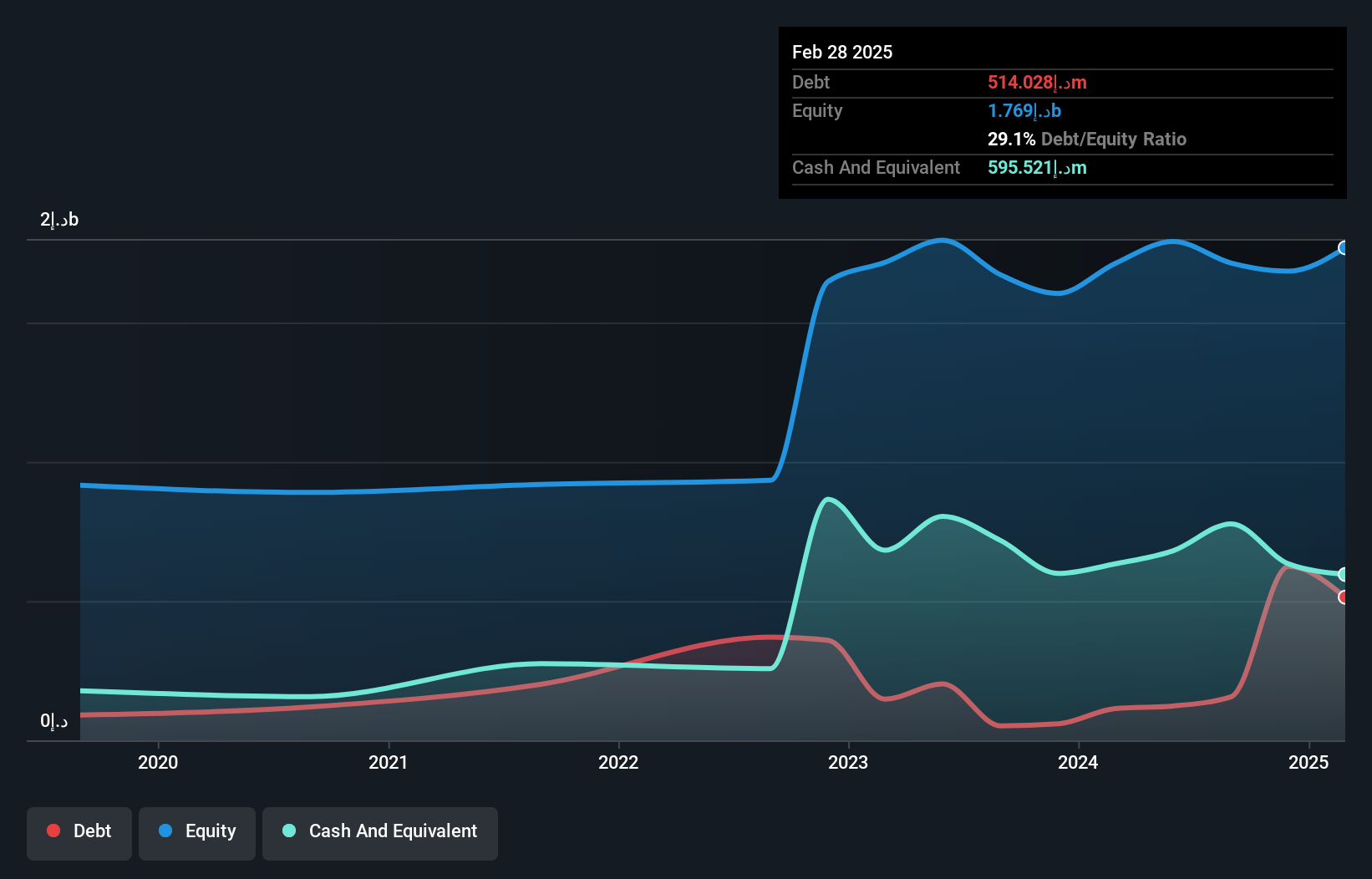

Taaleem Holdings PJSC, a notable player in the UAE's education sector, is strategically expanding into premium segments to boost growth. With plans to add around 10,000 seats through acquisitions and new schools by 2026, revenue is projected to grow annually by 21.1%. Despite an increase in debt-to-equity ratio from 25.2% to 30.3% over five years, Taaleem maintains more cash than total debt and covers interest payments well with EBIT at a coverage of 15x. Recent earnings showed net income at AED 82 million for Q3 compared to AED 86 million last year, indicating slight pressure on margins amidst growth initiatives.

Qassim Cement (SASE:3040)

Simply Wall St Value Rating: ★★★★★☆

Overview: Qassim Cement Company is involved in the manufacture and sale of cement within Saudi Arabia, with a market capitalization of SAR4.74 billion.

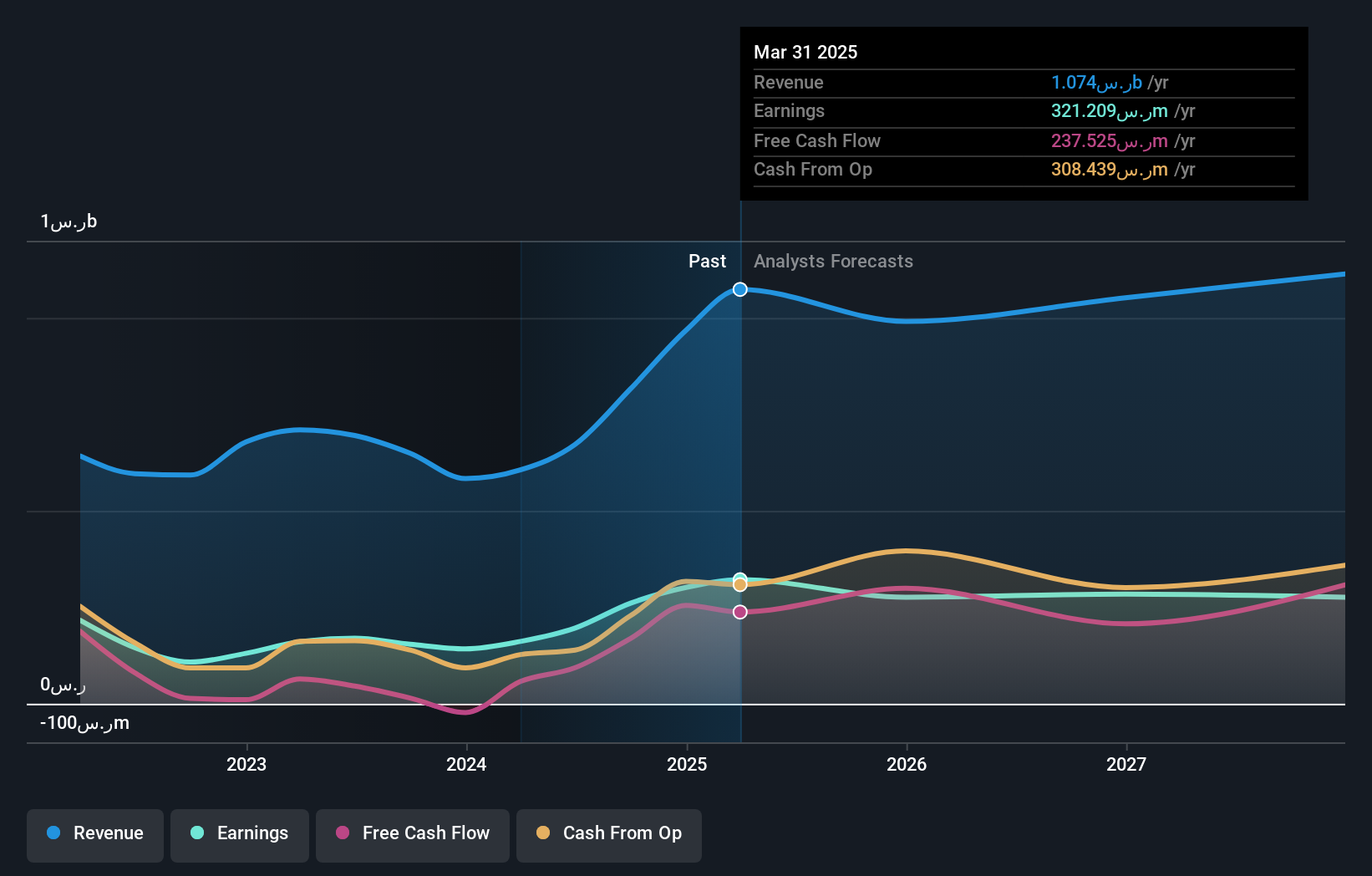

Operations: Qassim Cement generates revenue primarily from the manufacturing and selling of cement, amounting to SAR1.16 billion.

Qassim Cement, a notable player in the Middle Eastern cement industry, showcased significant sales growth to SAR 293.47 million for Q2 2025 from SAR 203.3 million the previous year, though net income dipped to SAR 61.06 million from SAR 72.89 million. The company is advancing its sustainability efforts with a USD 12 million contract with Sinoma International for converting production lines to natural gas, aligning with Saudi Arabia's Vision 2030 goals. Despite a slight earnings per share decrease to SAR 0.56, dividends remain strong at SAR 0.80 per share, reflecting confidence in ongoing operations and future prospects.

- Unlock comprehensive insights into our analysis of Qassim Cement stock in this health report.

Understand Qassim Cement's track record by examining our Past report.

Automatic Bank Services (TASE:SHVA)

Simply Wall St Value Rating: ★★★★★★

Overview: Automatic Bank Services Limited operates payment systems for international debit cards in Israel and has a market cap of ₪848 million.

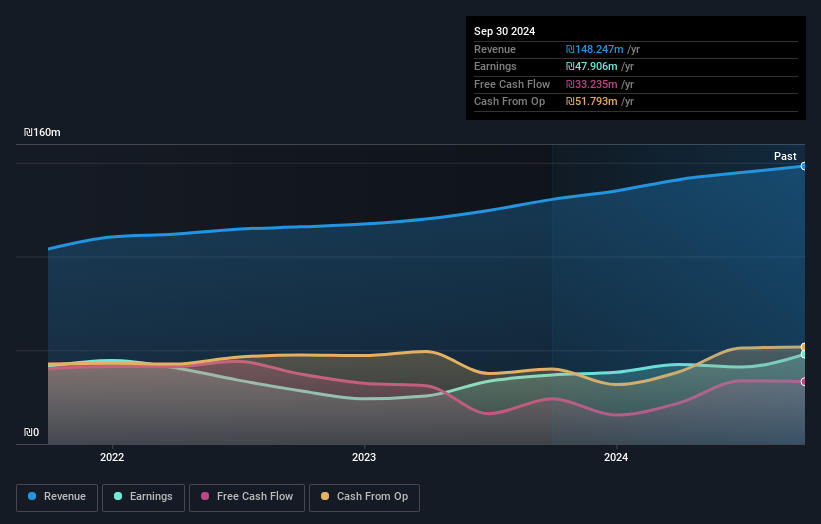

Operations: The company generates revenue primarily from operating payment systems for international debit cards in Israel. It has a market cap of ₪848 million.

Automatic Bank Services, a promising player in the Middle East financial landscape, showcases notable financial stability with no debt over the past five years. The company reported a net income of ILS 13.44 million for Q2 2025, up from ILS 10.93 million in the previous year, reflecting robust earnings growth of 25.7% that outpaced the industry average of 23.3%. With revenue reaching ILS 38.35 million this quarter and basic earnings per share rising to ILS 0.34 from ILS 0.27 last year, Automatic Bank Services appears well-positioned within its sector despite its smaller scale compared to larger competitors.

- Get an in-depth perspective on Automatic Bank Services' performance by reading our health report here.

Evaluate Automatic Bank Services' historical performance by accessing our past performance report.

Summing It All Up

- Access the full spectrum of 208 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qassim Cement might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:3040

Qassim Cement

Engages in the manufacture and selling of cement in the Kingdom of Saudi Arabia.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives