- Singapore

- /

- Specialty Stores

- /

- SGX:AGS

Emerging Opportunities: 3 Penny Stocks With Market Caps Over US$200M

Reviewed by Simply Wall St

As global markets continue to reach record highs, with indices like the Dow Jones and S&P 500 setting new intraday records, investors are increasingly seeking opportunities that offer both affordability and growth potential. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. These smaller or relatively new companies can provide a mix of value and growth when paired with strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.39B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$145.87M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.14B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.98 | HK$44.38B | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.255 | £849.6M | ★★★★★★ |

| V.S. Industry Berhad (KLSE:VS) | MYR1.07 | MYR4.1B | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.57 | £68.08M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.345 | £432.14M | ★★★★☆☆ |

Click here to see the full list of 5,703 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Taaleem Holdings PJSC (DFM:TAALEEM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Taaleem Holdings PJSC operates in the education sector by providing and investing in educational services in the United Arab Emirates, with a market capitalization of AED3.93 billion.

Operations: The company generates revenue primarily from school operations, amounting to AED947.58 million.

Market Cap: AED3.93B

Taaleem Holdings PJSC, with a market cap of AED3.93 billion, shows promising financial stability and growth in the education sector. The company reported sales of AED946.88 million for the year ending August 2024, reflecting a strong revenue increase from AED820.14 million previously. Earnings have grown at an annual rate of 15.4% over five years, with recent growth accelerating to 17.6%. Taaleem's short-term assets exceed both its long-term and short-term liabilities, indicating solid liquidity management. Despite low return on equity at 8.1%, the company's debt is well-covered by operating cash flow and profits continue to grow faster than industry averages.

- Take a closer look at Taaleem Holdings PJSC's potential here in our financial health report.

- Review our growth performance report to gain insights into Taaleem Holdings PJSC's future.

Axelum Resources (PSE:AXLM)

Simply Wall St Financial Health Rating: ★★★★★★

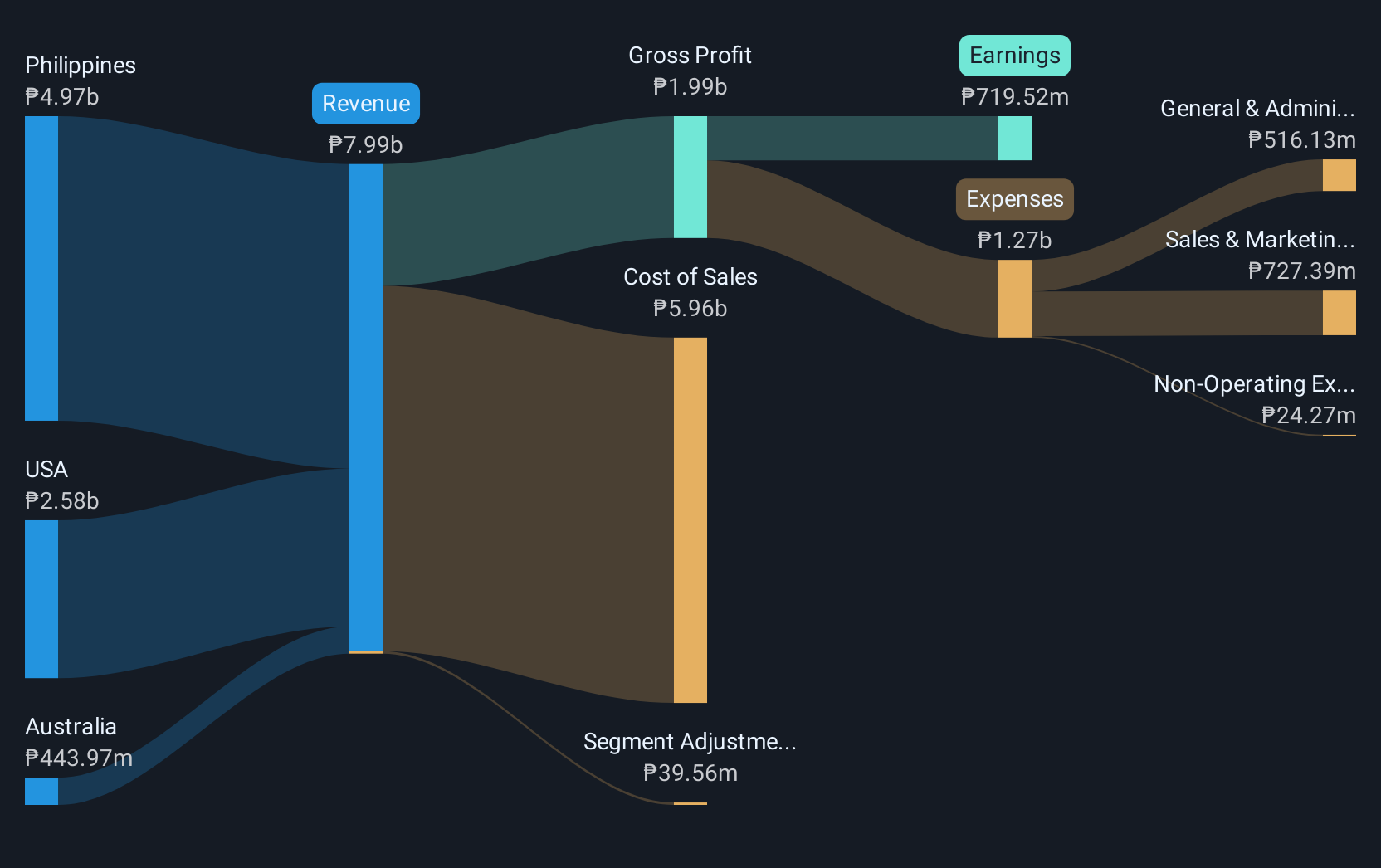

Overview: Axelum Resources Corp. is a company that manufactures and distributes coconut products in the Philippines, the United States, and Australia, with a market cap of ₱7.75 billion.

Operations: The company generates revenue of ₱6.52 billion from the sale of coconut-based products.

Market Cap: ₱7.75B

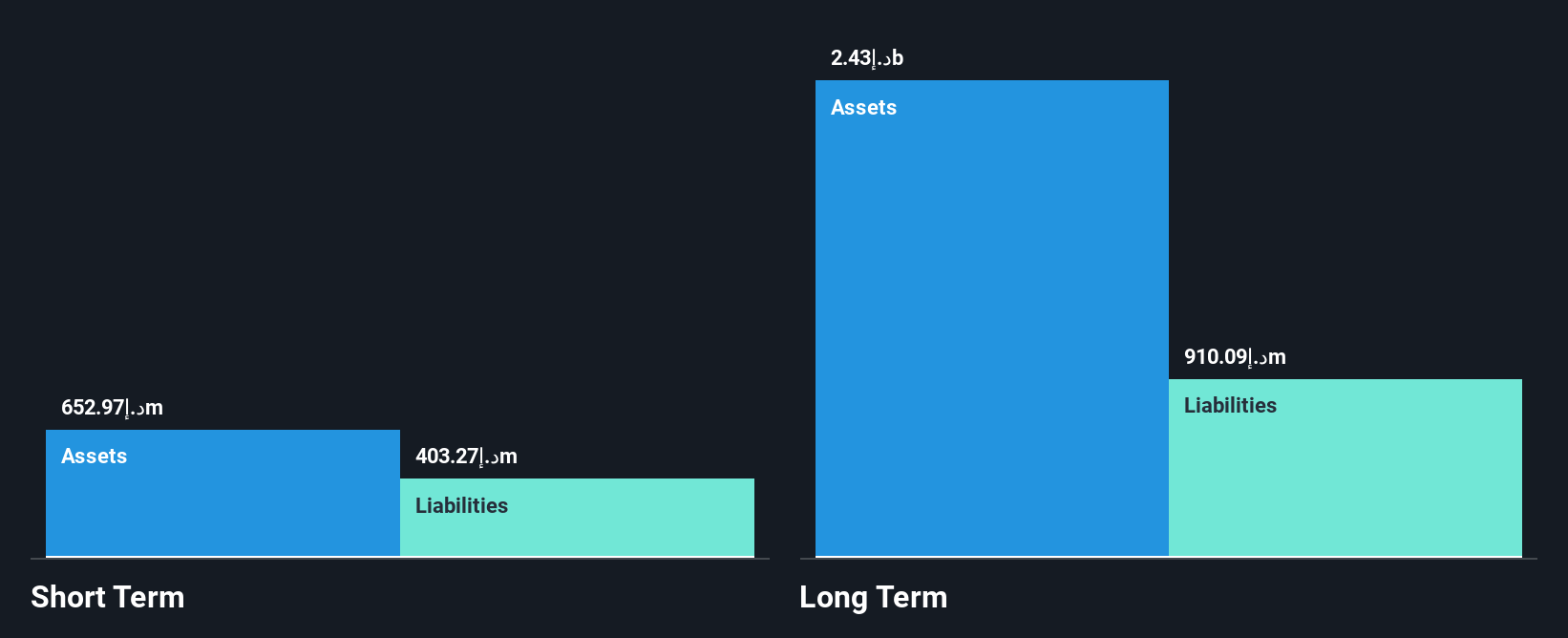

Axelum Resources Corp., with a market cap of ₱7.75 billion, has shown improvement in financial stability despite past profitability challenges. Recent earnings reports indicate a turnaround, with third-quarter sales increasing to ₱1.90 billion and net income reaching ₱130.39 million from a loss last year. The company's debt-to-equity ratio has significantly decreased over five years, and short-term assets comfortably cover both short- and long-term liabilities, showcasing strong liquidity management. Although historically unprofitable with volatile share prices, its experienced management team and strategic buyback program aim to enhance shareholder value amidst stable cash flow coverage of debt obligations.

- Unlock comprehensive insights into our analysis of Axelum Resources stock in this financial health report.

- Assess Axelum Resources' previous results with our detailed historical performance reports.

Hour Glass (SGX:AGS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: The Hour Glass Limited is an investment holding company involved in the retailing and distribution of watches, jewelry, and other luxury products across several countries including Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam with a market cap of SGD978.57 million.

Operations: The company's revenue from its operations in retailing and distributing watches, jewelry, and luxury products amounted to SGD1.11 billion.

Market Cap: SGD978.57M

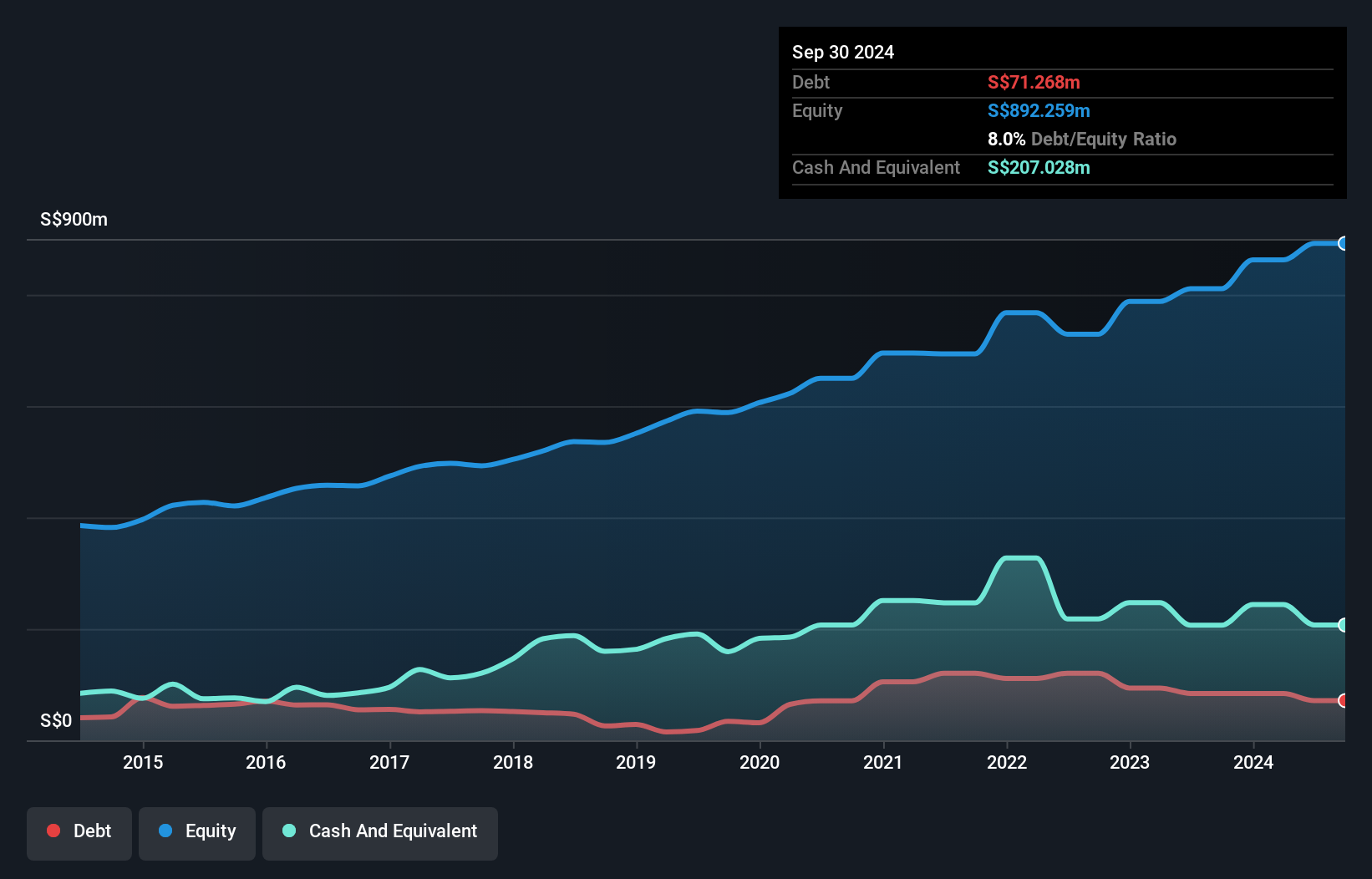

Hour Glass Limited, with a market cap of SGD978.57 million, has demonstrated financial resilience despite recent earnings declines. The company reported half-year sales of SGD540.31 million and net income of SGD61.42 million, down from the previous year. Its operating cash flow comfortably covers debt obligations, and short-term assets exceed liabilities, indicating strong liquidity management. Although the return on equity is low at 15.8%, Hour Glass maintains an attractive price-to-earnings ratio below the market average and has not diluted shareholders recently. Despite a stable dividend history, recent affirmations show commitment to shareholder returns amidst fluctuating profit margins.

- Get an in-depth perspective on Hour Glass' performance by reading our balance sheet health report here.

- Learn about Hour Glass' historical performance here.

Seize The Opportunity

- Access the full spectrum of 5,703 Penny Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hour Glass might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:AGS

Hour Glass

An investment holding company, engages in the retailing and distribution of watches, jewellry, and other luxury products in Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives