- United Arab Emirates

- /

- Consumer Services

- /

- DFM:TAALEEM

3 Promising Penny Stocks With Market Caps Over US$700M

Reviewed by Simply Wall St

Global markets have experienced varied movements recently, with the S&P 500 Index advancing and small-cap indices like the Russell 2000 outperforming, while energy stocks saw a pullback. In this context of mixed market dynamics, investors often look for opportunities beyond traditional large-cap stocks. Penny stocks, though an older term, still hold relevance as they can offer unique growth potential when backed by strong financials. In this article, we will explore several penny stocks that stand out for their financial strength and potential to capture investor interest in today's diverse market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR337.78M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.595 | MYR2.96B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.975 | £189.41M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.76 | MYR131.64M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.28 | CN¥2.1B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.925 | MYR307.05M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.54 | MYR2.57B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.05 | £402.8M | ★★★★☆☆ |

Click here to see the full list of 5,786 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Taaleem Holdings PJSC (DFM:TAALEEM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Taaleem Holdings PJSC operates in the education services sector in the United Arab Emirates and has a market capitalization of AED4.02 billion.

Operations: The company generates revenue primarily from school operations, amounting to AED947.58 million.

Market Cap: AED4.02B

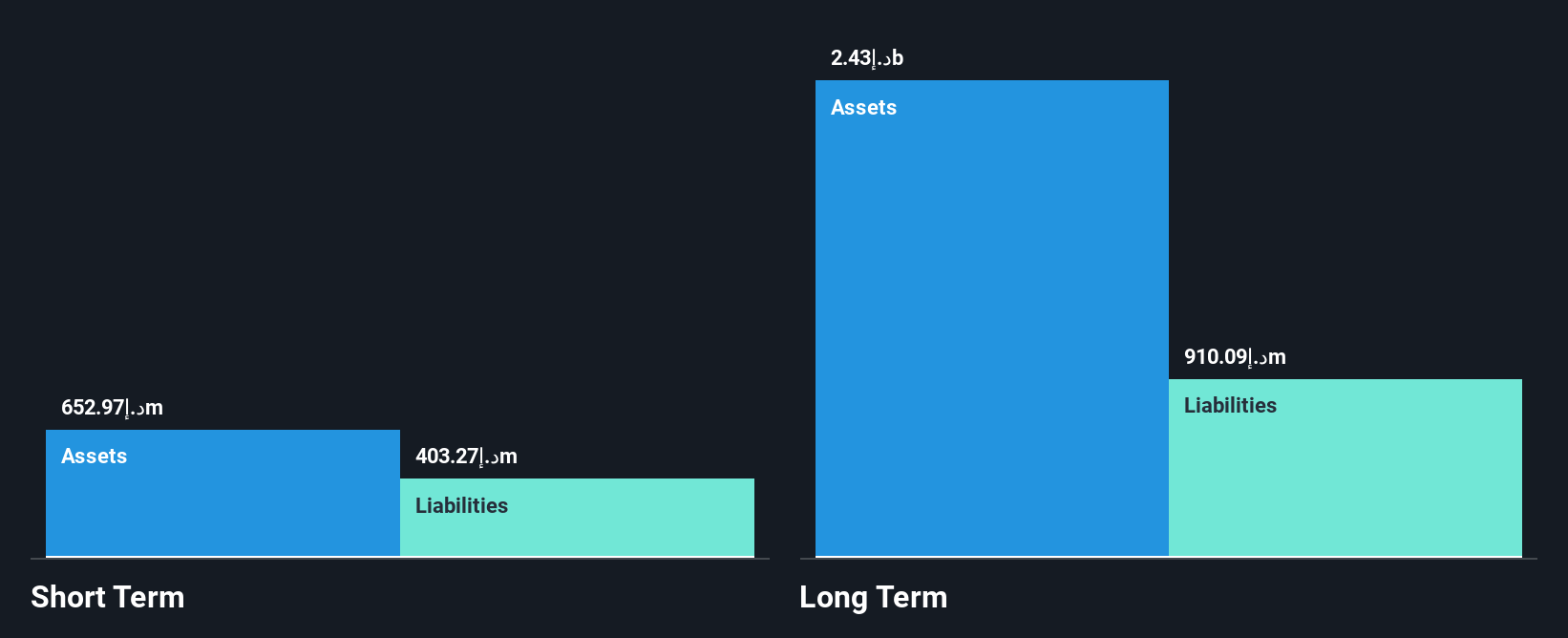

Taaleem Holdings PJSC, with a market cap of AED4.02 billion, has shown strong financial performance within the education sector in the UAE. Recent earnings indicate revenue of AED946.88 million and net income of AED138 million for the year ended August 2024, reflecting growth from the previous year. The company benefits from seasoned management and board teams, stable weekly volatility, and high-quality earnings. Its short-term assets comfortably cover both short- and long-term liabilities while maintaining more cash than total debt. Earnings growth outpaces industry averages, though Return on Equity remains low at 8.1%.

- Unlock comprehensive insights into our analysis of Taaleem Holdings PJSC stock in this financial health report.

- Examine Taaleem Holdings PJSC's earnings growth report to understand how analysts expect it to perform.

Uniphar (ISE:UPR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Uniphar plc is a diversified healthcare services company operating in the Republic of Ireland, the United Kingdom, The Netherlands, and internationally with a market cap of €696.19 million.

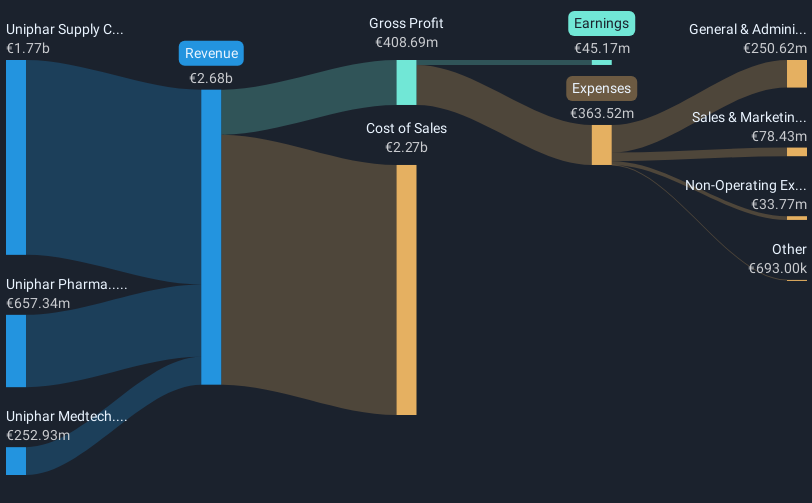

Operations: The company's revenue is generated from three primary segments: Pharma (€657.34 million), Medtech (€252.93 million), and Supply Chain & Retail (€1.77 billion).

Market Cap: €696.19M

Uniphar plc, with a market cap of €696.19 million, operates across Pharma, Medtech, and Supply Chain & Retail segments. The company reported half-year sales of €1.37 billion and net income of €15.37 million for 2024. Despite earnings growth lagging behind the industry at 1.4%, Uniphar's debt management has improved significantly over five years with a reduced debt-to-equity ratio now at 68.5%. However, the net debt to equity remains high at 41.1%. Short-term liabilities exceed short-term assets, but interest payments are well-covered by EBIT (3.4x). Analysts anticipate further stock price appreciation potential.

- Get an in-depth perspective on Uniphar's performance by reading our balance sheet health report here.

- Gain insights into Uniphar's outlook and expected performance with our report on the company's earnings estimates.

Pci Technology GroupLtd (SHSE:600728)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pci Technology Group Co., Ltd. specializes in providing artificial intelligence technology and products in China, with a market capitalization of CN¥9.95 billion.

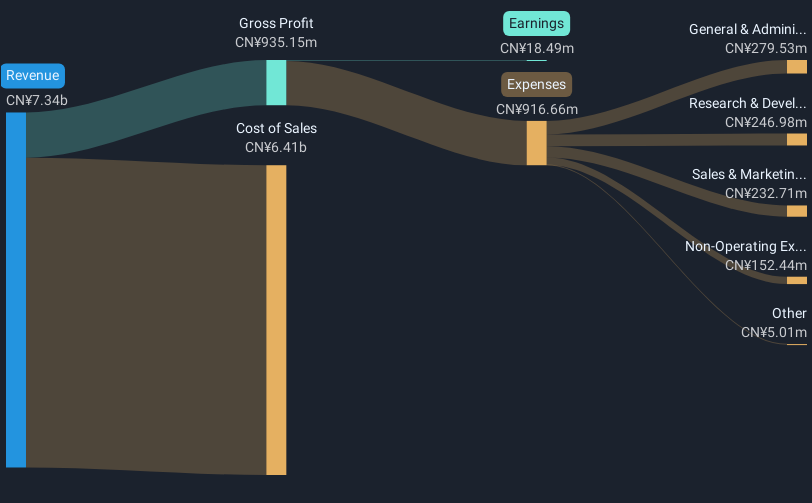

Operations: The company generates revenue primarily from its Software and IT Services segment, amounting to CN¥6.69 billion.

Market Cap: CN¥9.95B

Pci Technology Group Co., Ltd. has shown a stable weekly volatility of 6% over the past year, supported by an experienced management team with an average tenure of 4.7 years. Despite reporting sales of CN¥2.98 billion for H1 2024, the company faced a net loss of CN¥191.97 million, reflecting its current unprofitability and negative return on equity at -2.17%. However, operating cash flow covers debt well at a very high rate, and short-term assets significantly exceed both short-term and long-term liabilities. The company completed a share buyback program worth CN¥76.08 million recently.

- Click here and access our complete financial health analysis report to understand the dynamics of Pci Technology GroupLtd.

- Understand Pci Technology GroupLtd's earnings outlook by examining our growth report.

Next Steps

- Unlock more gems! Our Penny Stocks screener has unearthed 5,783 more companies for you to explore.Click here to unveil our expertly curated list of 5,786 Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taaleem Holdings PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:TAALEEM

Taaleem Holdings PJSC

Provides and invests in education services in the United Arab Emirates.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives