Here's Why We Think Dubai Refreshment (P.J.S.C.) (DFM:DRC) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Dubai Refreshment (P.J.S.C.) (DFM:DRC). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Dubai Refreshment (P.J.S.C.) with the means to add long-term value to shareholders.

See our latest analysis for Dubai Refreshment (P.J.S.C.)

Dubai Refreshment (P.J.S.C.)'s Improving Profits

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. Which is why EPS growth is looked upon so favourably. Commendations have to be given in seeing that Dubai Refreshment (P.J.S.C.) grew its EPS from د.إ1.13 to د.إ3.76, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company.

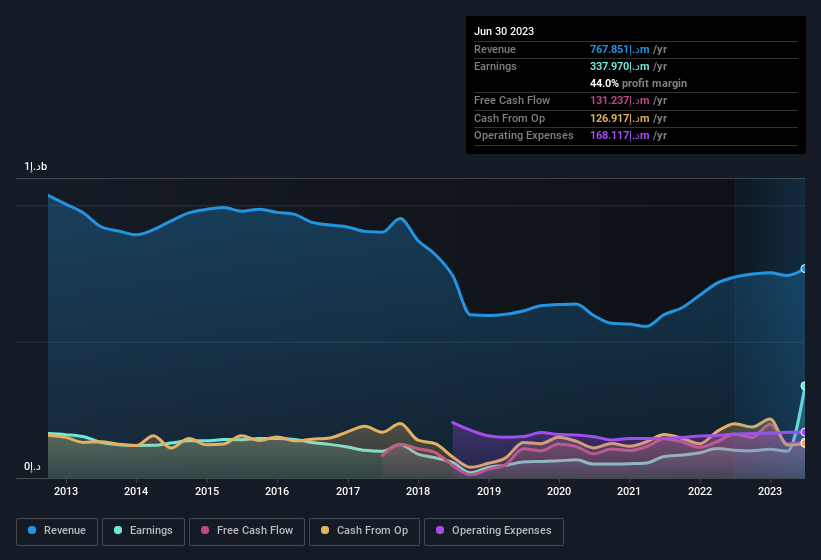

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Dubai Refreshment (P.J.S.C.) maintained stable EBIT margins over the last year, all while growing revenue 4.2% to د.إ768m. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Dubai Refreshment (P.J.S.C.)'s balance sheet strength, before getting too excited.

Are Dubai Refreshment (P.J.S.C.) Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Dubai Refreshment (P.J.S.C.) insiders have a significant amount of capital invested in the stock. Given insiders own a significant chunk of shares, currently valued at د.إ355m, they have plenty of motivation to push the business to succeed. That holding amounts to 20% of the stock on issue, thus making insiders influential owners of the business and aligned with the interests of shareholders.

Should You Add Dubai Refreshment (P.J.S.C.) To Your Watchlist?

Dubai Refreshment (P.J.S.C.)'s earnings per share growth have been climbing higher at an appreciable rate. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. Based on the sum of its parts, we definitely think its worth watching Dubai Refreshment (P.J.S.C.) very closely. What about risks? Every company has them, and we've spotted 3 warning signs for Dubai Refreshment (P.J.S.C.) (of which 2 are significant!) you should know about.

Although Dubai Refreshment (P.J.S.C.) certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DFM:DRC

Dubai Refreshment (P.J.S.C.)

Engages in bottling and selling Pepsi Cola International products in the United Arab Emirates and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026