- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6121

3 Reliable Dividend Stocks Offering Yields Up To 5.7%

Reviewed by Simply Wall St

In the midst of a volatile global market, characterized by fluctuating earnings reports and economic uncertainties, investors are increasingly looking for stability in their portfolios. Dividend stocks can offer a reliable income stream, making them an attractive option during times when growth stocks may be underperforming.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.69% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.50% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.77% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.49% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.38% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.23% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.53% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.94% | ★★★★★★ |

Click here to see the full list of 1950 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Dubai Refreshment (P.J.S.C.) (DFM:DRC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dubai Refreshment (P.J.S.C.) is involved in the bottling and selling of Pepsi Cola International products across Dubai, Sharjah, and the other Northern Emirates of the UAE, with a market cap of AED2.16 billion.

Operations: The company's revenue primarily comes from the wholesale of groceries, amounting to AED807.98 million.

Dividend Yield: 3.3%

Dubai Refreshment's dividend payments are covered by both earnings and cash flows, with payout ratios of 53.2% and 71.3%, respectively, suggesting sustainability. However, the dividends have been volatile over the past decade despite some growth in payments. The current yield of 3.33% is below top-tier levels in the AE market. Profit margins have decreased significantly from last year, which may impact future dividend reliability despite a favorable price-to-earnings ratio of 16x compared to industry averages.

- Click to explore a detailed breakdown of our findings in Dubai Refreshment (P.J.S.C.)'s dividend report.

- Our valuation report unveils the possibility Dubai Refreshment (P.J.S.C.)'s shares may be trading at a premium.

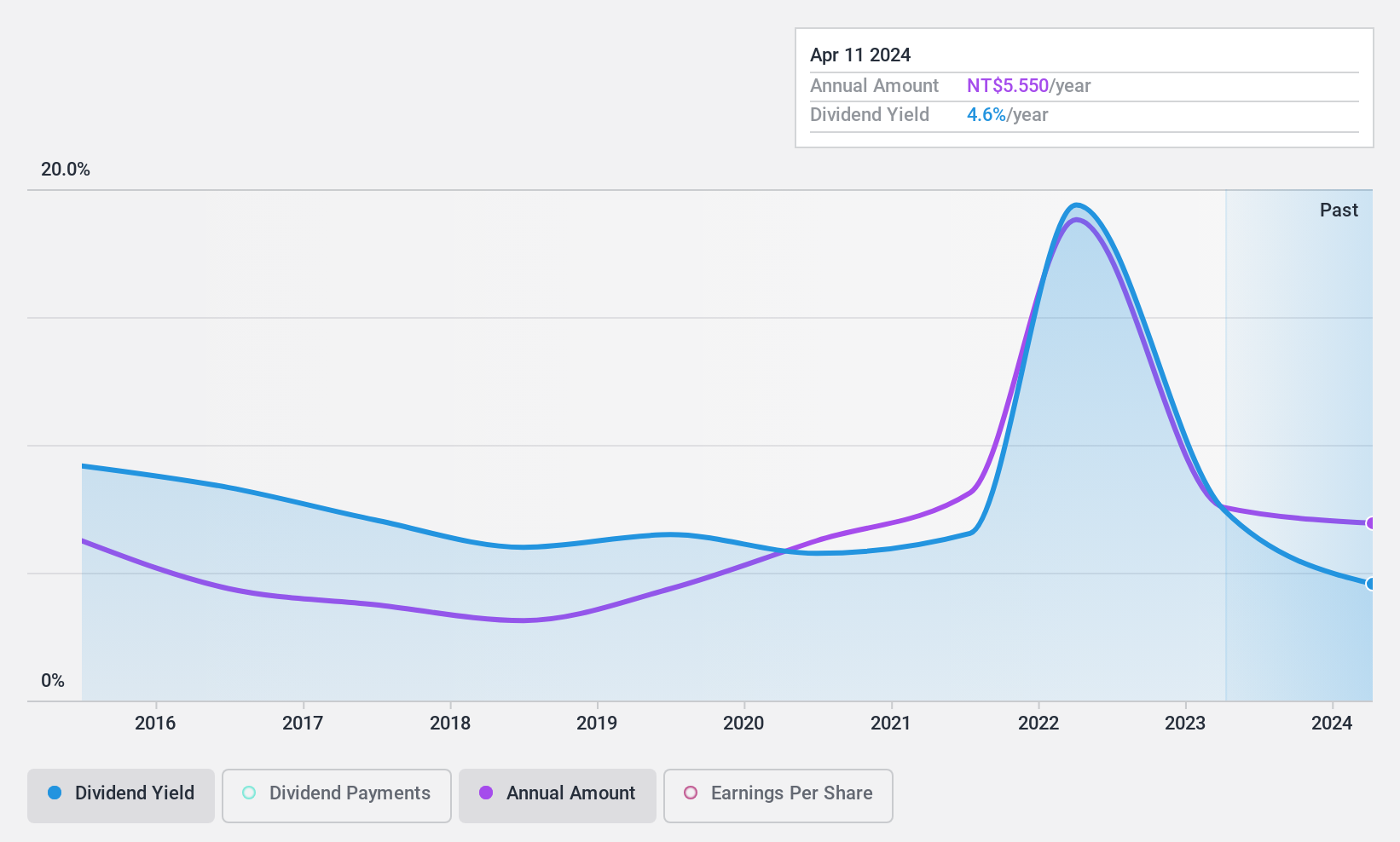

Dynapack International Technology (TPEX:3211)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dynapack International Technology Corporation manufactures and sells lithium-ion battery packs in Taiwan, the United States, and internationally, with a market cap of NT$18.39 billion.

Operations: Dynapack International Technology Corporation's revenue from the production and sales of hammer battery packs is NT$16.13 billion.

Dividend Yield: 4.6%

Dynapack International Technology's dividend yield of 4.59% is among the top 25% in Taiwan, yet its history of volatile payments over the past decade raises concerns about stability. Despite this, dividends are well covered by earnings and cash flows with payout ratios of 42.2% and 48.6%, respectively, indicating sustainability. The company's price-to-earnings ratio of 9.3x suggests it may be undervalued compared to the broader market average of 21.5x.

- Get an in-depth perspective on Dynapack International Technology's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Dynapack International Technology is trading beyond its estimated value.

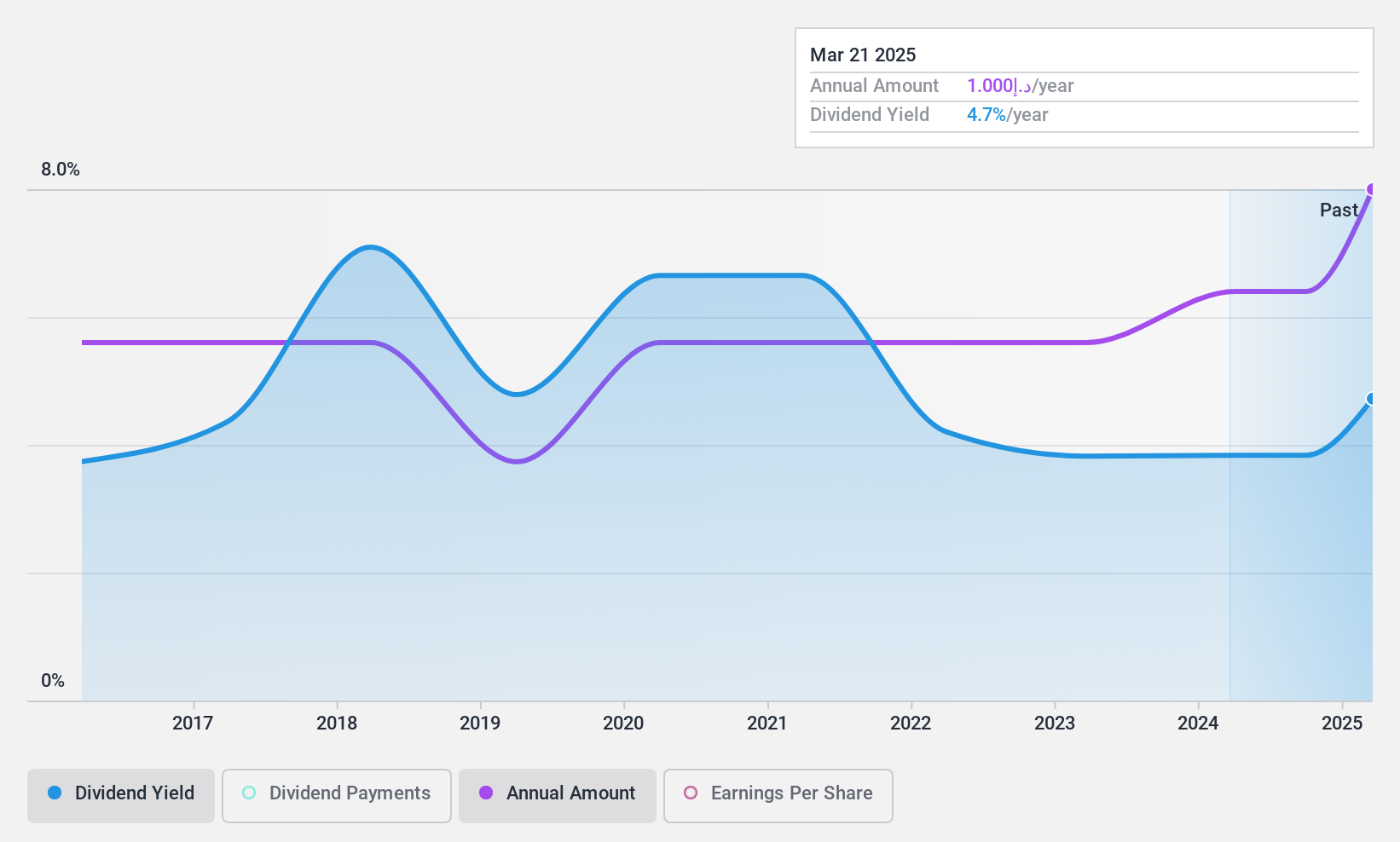

Simplo Technology (TPEX:6121)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Simplo Technology Co., Ltd. produces and sells battery packs worldwide, with a market cap of NT$69.55 billion.

Operations: Simplo Technology Co., Ltd. generates revenue from its Batteries/Battery Systems segment, which amounts to NT$82.29 billion.

Dividend Yield: 5.8%

Simplo Technology's dividend yield of 5.77% ranks in the top 25% in Taiwan, but its history of volatile and unreliable payments over the past decade may concern investors. Although dividends are well covered by earnings with a payout ratio of 39.8%, the high cash payout ratio of 175.5% indicates unsustainable cash flow coverage. Trading at 47% below estimated fair value suggests potential undervaluation, yet recent declines in sales and net income could impact future performance.

- Dive into the specifics of Simplo Technology here with our thorough dividend report.

- The valuation report we've compiled suggests that Simplo Technology's current price could be quite moderate.

Key Takeaways

- Investigate our full lineup of 1950 Top Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6121

Flawless balance sheet, undervalued and pays a dividend.