- United Arab Emirates

- /

- Food and Staples Retail

- /

- ADX:GHITHA

Not Many Are Piling Into Ghitha Holding P.J.S.C (ADX:GHITHA) Stock Yet As It Plummets 26%

Ghitha Holding P.J.S.C (ADX:GHITHA) shares have had a horrible month, losing 26% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 49% share price drop.

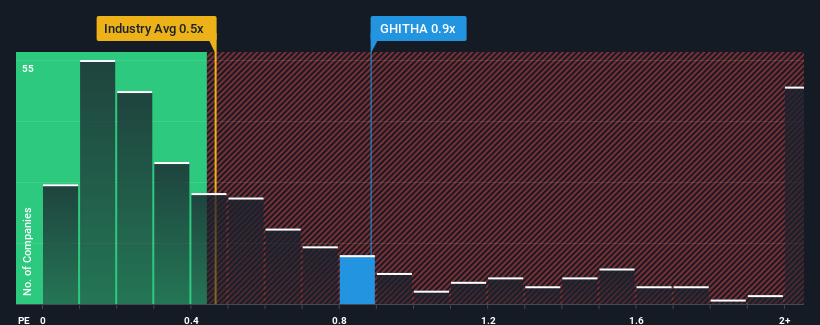

Since its price has dipped substantially, given about half the companies operating in the United Arab Emirates' Consumer Retailing industry have price-to-sales ratios (or "P/S") above 1.8x, you may consider Ghitha Holding P.J.S.C as an attractive investment with its 0.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Ghitha Holding P.J.S.C

How Has Ghitha Holding P.J.S.C Performed Recently?

Ghitha Holding P.J.S.C has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for Ghitha Holding P.J.S.C, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Ghitha Holding P.J.S.C's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Ghitha Holding P.J.S.C's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 8.9% gain to the company's revenues. The latest three year period has seen an incredible overall rise in revenue, even though the last 12 month performance was only fair. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 12% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that Ghitha Holding P.J.S.C's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Ghitha Holding P.J.S.C's P/S?

Ghitha Holding P.J.S.C's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We're very surprised to see Ghitha Holding P.J.S.C currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Before you take the next step, you should know about the 2 warning signs for Ghitha Holding P.J.S.C (1 shouldn't be ignored!) that we have uncovered.

If you're unsure about the strength of Ghitha Holding P.J.S.C's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:GHITHA

Ghitha Holding P.J.S.C

An investment holding company, provides management and investment services in diversified projects and businesses in the United Arab Emirates.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026