- Saudi Arabia

- /

- IT

- /

- SASE:9534

Unveiling Three Undiscovered Gems In Middle East Stocks

Reviewed by Simply Wall St

As most Gulf markets experience gains ahead of earnings reports and significant U.S. economic data releases, investor sentiment in the Middle East is cautiously optimistic, with indices like Dubai's main share index advancing by 1.3%. In this dynamic environment, identifying promising stocks involves looking for companies that demonstrate resilience and potential for growth amid shifting market conditions and economic indicators.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Amanat Holdings PJSC (DFM:AMANAT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Amanat Holdings PJSC operates by investing in companies within the education and healthcare sectors both in the United Arab Emirates and internationally, with a market capitalization of AED2.67 billion.

Operations: Amanat Holdings PJSC generates revenue primarily from its investments in the education sector, contributing AED432.26 million, and in the healthcare sector, adding AED363.84 million.

Amanat Holdings, a nimble player in the Middle East's financial scene, has recently showcased impressive earnings growth of 191.4% over the past year, outpacing its industry peers. Despite a rise in the debt-to-equity ratio from 2.2% to 12% over five years, Amanat holds more cash than total debt, ensuring financial stability. The company reported AED 796 million in sales for 2024 and turned around from a net loss to AED 115 million net income. High-quality earnings and positive free cash flow further solidify its position as an intriguing investment opportunity within this dynamic region.

- Click here to discover the nuances of Amanat Holdings PJSC with our detailed analytical health report.

Explore historical data to track Amanat Holdings PJSC's performance over time in our Past section.

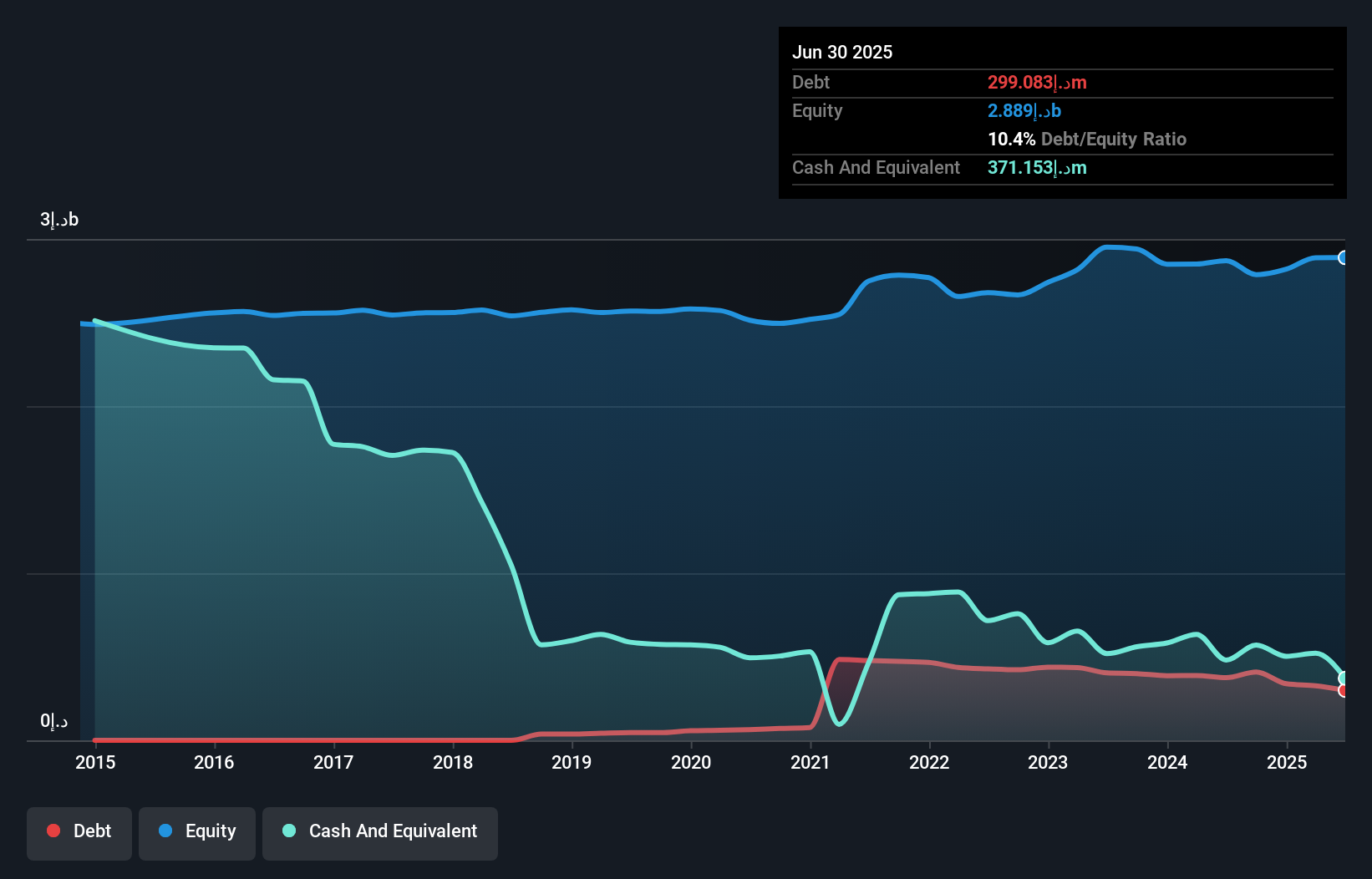

Drake and Scull International P.J.S.C (DFM:DSI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Drake and Scull International P.J.S.C. operates in the construction sector across various countries including the UAE, Saudi Arabia, and others, with a market capitalization of AED946.43 million.

Operations: Drake and Scull International P.J.S.C. generates revenue primarily from its MEP segment, contributing AED1.83 million, and Wastewater Treatment and Water Sludge segment, which adds AED101.84 million. The company's net profit margin is a key indicator of its financial health in the construction industry.

Drake and Scull International has shown a remarkable turnaround, with net income reaching AED 3.75 billion for the year ending December 31, 2024, compared to a net loss of AED 366.87 million the previous year. This shift is partly due to a significant one-off gain of AED 3.8 billion impacting its financial results. The company's price-to-earnings ratio stands at an attractive 0.3x against the AE market's average of 12.8x, suggesting potential undervaluation. With more cash than total debt and positive shareholder equity after five years in the red, DSI seems poised for continued stability in its operations.

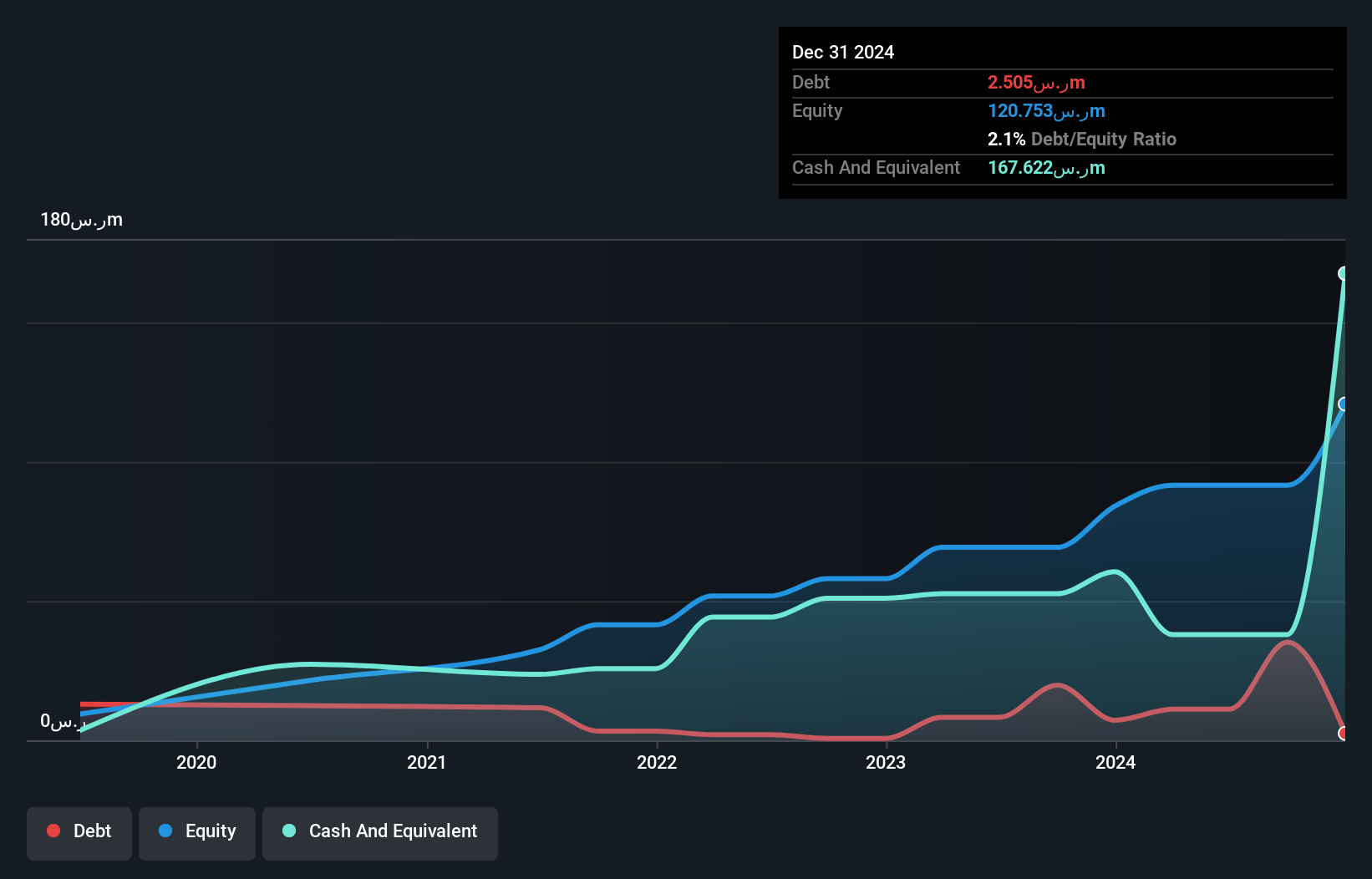

Saudi Azm for Communication and Information Technology (SASE:9534)

Simply Wall St Value Rating: ★★★★★★

Overview: Saudi Azm for Communication and Information Technology Company, with a market cap of SAR1.68 billion, offers business and digital technology solutions in the Kingdom of Saudi Arabia through its subsidiaries.

Operations: The company generates revenue primarily from Enterprise Services (SAR142.76 million), followed by Proprietary Technologies (SAR48.32 million), Advisory (SAR31.56 million), and Platforms for Third Parties (SAR19.79 million).

Saudi Azm for Communication and Information Technology has been making waves with its robust financial performance. Over the past five years, earnings have grown at a solid 21.1% annually, reflecting high-quality earnings. The company reported net income of SAR 7.24 million for the recent quarter, up from SAR 5.49 million a year ago, alongside sales of SAR 63.95 million compared to SAR 49.54 million previously. With a debt-to-equity ratio significantly reduced from 84.1% to just 2.1%, Azm's financial health seems strong and its interest payments are well covered at an impressive EBIT coverage of 17x, indicating sound fiscal management and potential for sustained growth in the IT sector.

- Navigate through the intricacies of Saudi Azm for Communication and Information Technology with our comprehensive health report here.

Learn about Saudi Azm for Communication and Information Technology's historical performance.

Make It Happen

- Click here to access our complete index of 246 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9534

Saudi Azm for Communication and Information Technology

Provides business and digital technology solutions in the Kingdom of Saudi Arabia.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives