- United Arab Emirates

- /

- Industrials

- /

- ADX:HH

Uncovering Promising Penny Stocks For November 2024

Reviewed by Simply Wall St

Global markets have been buoyed by a surge in U.S. stocks, driven by optimism surrounding potential growth and tax reforms following a significant political shift. Amid this backdrop, investors are exploring diverse opportunities, including those found in penny stocks—a term that may seem outdated but still signifies potential value in smaller or newer companies. While these stocks often carry higher risk, they can offer unique opportunities for growth when backed by strong financial fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR343.4M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.36B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.11M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB1.84 | THB1.56B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.6025 | A$72.09M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR288.79M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.23 | £840.18M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$545.92M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.8789 | £385.78M | ★★★★☆☆ |

Click here to see the full list of 5,796 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Hily Holding PJSC (ADX:HH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hily Holding PJSC, along with its subsidiaries, manages securities portfolios in the United Arab Emirates and has a market cap of AED280.80 million.

Operations: The company's revenue is primarily derived from trading (AED34.39 million), investment property (AED36.29 million), and freight forwarding and storage (AED14.25 million).

Market Cap: AED280.8M

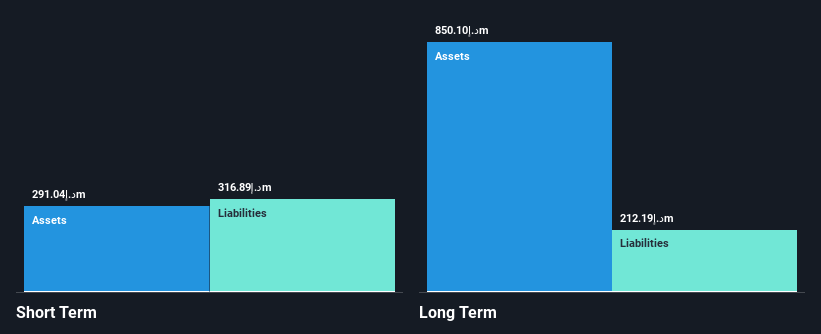

Hily Holding PJSC, with a market cap of AED280.80 million, has shown mixed financial performance. The company's revenue streams include trading (AED34.39 million), investment property (AED36.29 million), and freight forwarding (AED14.25 million). Despite a satisfactory net debt to equity ratio of 17.8%, earnings growth has been negative (-83.3%) over the past year, and profit margins have decreased from 48.9% to 16.7%. Recent earnings reports indicate sales for Q3 2024 at AED17.41 million, down from AED23.57 million in the previous year, though nine-month net income rose to AED14.8 million from AED10.01 million last year.

- Navigate through the intricacies of Hily Holding PJSC with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Hily Holding PJSC's track record.

Buriram Sugar (SET:BRR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Buriram Sugar Public Company Limited, along with its subsidiaries, is involved in the production and distribution of sugar and molasses both in Thailand and internationally, with a market cap of THB3.54 billion.

Operations: The company's revenue is primarily derived from the production and distribution of sugar and molasses (THB5.68 billion), followed by the distribution of agricultural products (THB1.05 billion) and the production and distribution of electricity and steam (THB834 million).

Market Cap: THB3.54B

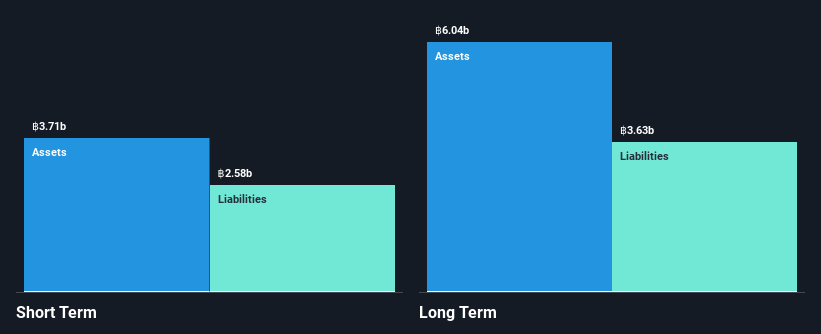

Buriram Sugar Public Company Limited, with a market cap of THB3.54 billion, has demonstrated significant earnings growth of 120.2% over the past year, surpassing both its five-year average and the food industry benchmark. Its Price-To-Earnings ratio (4.1x) suggests it is undervalued compared to the Thai market average (14.6x). Despite this growth, concerns remain about its financial structure; debt is not well covered by operating cash flow (0.6%), though short-term assets exceed liabilities and interest payments are well covered by EBIT (9.1x). Recent board changes include appointing Air Chief Marshal Saritpong Wattanavrangkul as an Independent Director and Audit Committee member in October 2024.

- Click here to discover the nuances of Buriram Sugar with our detailed analytical financial health report.

- Gain insights into Buriram Sugar's historical outcomes by reviewing our past performance report.

Nera Telecommunications (SGX:N01)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nera Telecommunications Ltd is involved in designing, engineering, distributing, selling, servicing, installing, and maintaining telecommunication systems and products across transmission networks, satellite communications, and information technology networks with a market cap of SGD36.91 million.

Operations: The company's revenue is derived from two primary segments: Network Infrastructure (NI) at SGD84.76 million and Wireless Infrastructure Network (WIN) at SGD23.89 million.

Market Cap: SGD36.91M

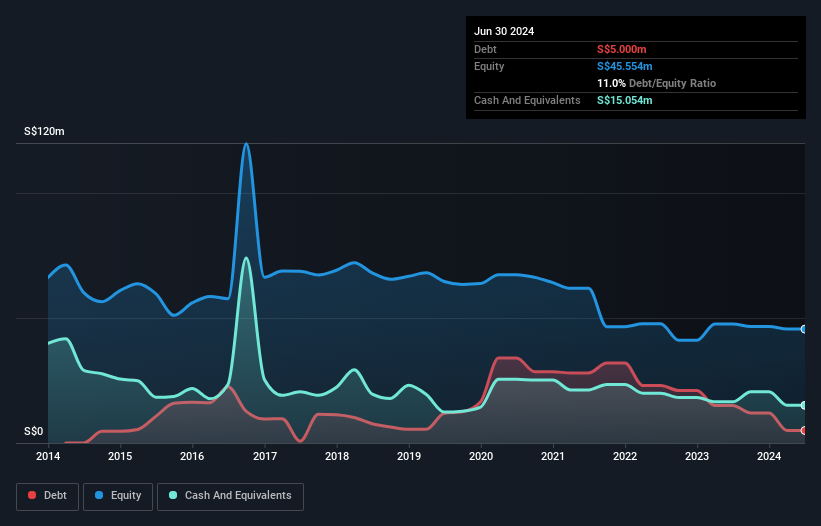

Nera Telecommunications Ltd, with a market cap of SGD36.91 million, has seen its debt-to-equity ratio improve from 18.4% to 11% over five years and maintains more cash than total debt. However, the company is unprofitable, with losses increasing at 20.7% annually over the past five years. Despite having short-term assets exceeding both long-term and short-term liabilities, it faces challenges in profitability and dividend sustainability (4.67%). Recent developments include a significant board reshuffle and Ennoconn Solutions Singapore acquiring a controlling stake for SGD14.5 million in October 2024, indicating strategic shifts ahead for the company.

- Dive into the specifics of Nera Telecommunications here with our thorough balance sheet health report.

- Learn about Nera Telecommunications' historical performance here.

Next Steps

- Dive into all 5,796 of the Penny Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hily Holding PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:HH

Hily Holding PJSC

Manages securities portfolios in the United Arab Emirates, the Kingdom of Saudi Arabia, Kuwait, and Bahrain.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives