- United Arab Emirates

- /

- Oil and Gas

- /

- ADX:DANA

3 Middle Eastern Dividend Stocks With Yields Up To 8.7%

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently experienced a boost, with the UAE indices gaining ground due to potential trade talks between the U.S. and China, lifting market sentiment and contributing to positive investor outlooks. In such a dynamic environment, dividend stocks can offer stability and income potential, making them an attractive option for investors seeking reliable returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 4.25% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.46% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.35% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.27% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.08% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.05% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.00% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 8.99% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.83% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 6.06% | ★★★★★☆ |

Click here to see the full list of 73 stocks from our Top Middle Eastern Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Dana Gas PJSC (ADX:DANA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dana Gas PJSC operates in the exploration, production, and sale of natural gas and petroleum products across the UAE, Iraq, and Egypt with a market cap of AED5.16 billion.

Operations: Dana Gas PJSC generates revenue through its integrated oil and gas operations, amounting to $336 million.

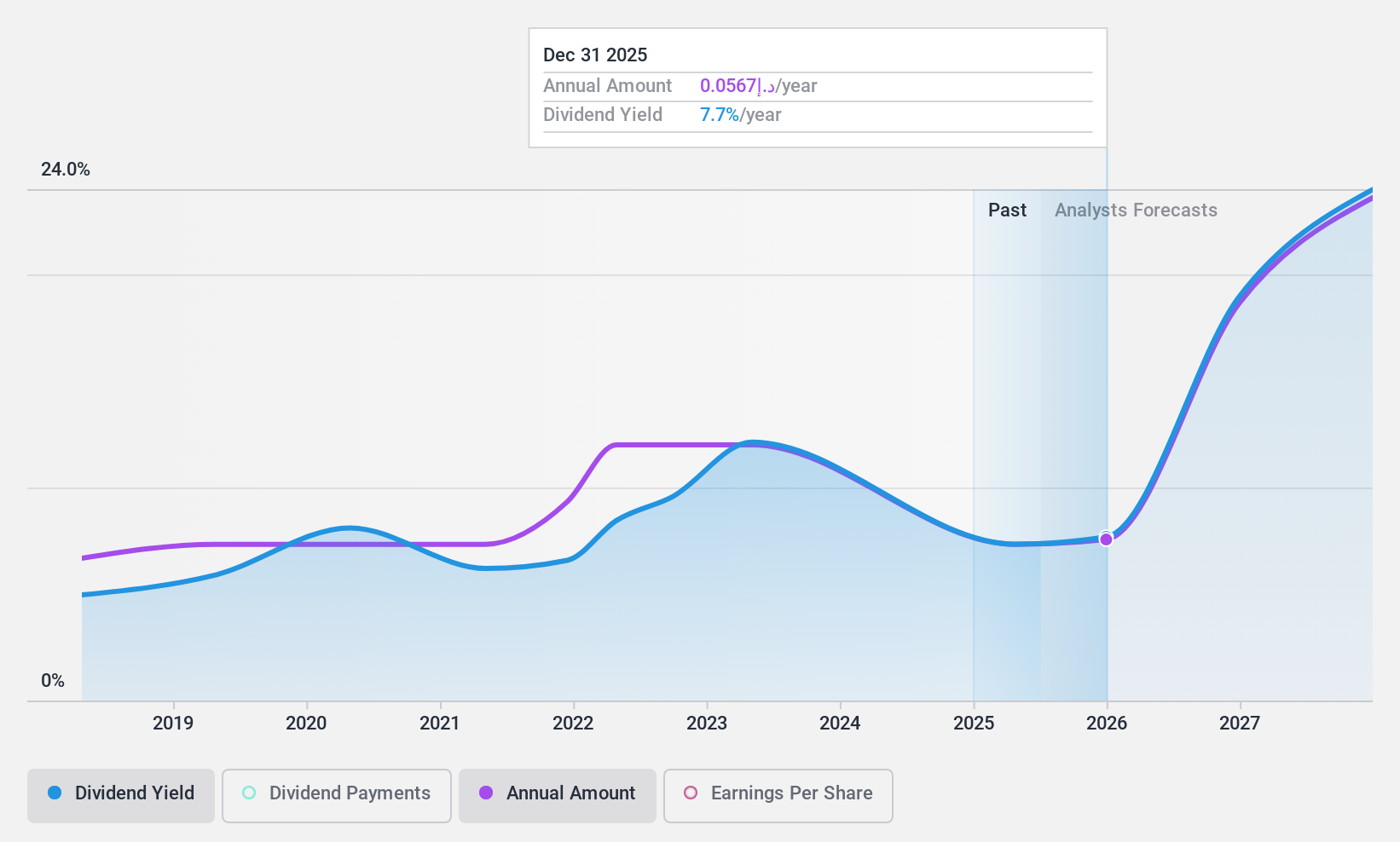

Dividend Yield: 7.5%

Dana Gas PJSC has a mixed dividend profile, with recent approval of a 5.5 fils per share dividend for 2024, amounting to AED 384.75 million. The company maintains good coverage of dividends through earnings and cash flows, with payout ratios of 69.4% and 53.2%, respectively. However, its dividend history is volatile over the past seven years despite being in the top quartile for yield in the AE market at 7.45%.

- Take a closer look at Dana Gas PJSC's potential here in our dividend report.

- The analysis detailed in our Dana Gas PJSC valuation report hints at an deflated share price compared to its estimated value.

Mashreqbank PSC (DFM:MASQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mashreqbank PSC offers a range of banking and financial services to individuals and corporates, with a market cap of AED48.15 billion.

Operations: Mashreqbank PSC generates revenue from its diverse banking and financial services offerings tailored to both individual and corporate clients.

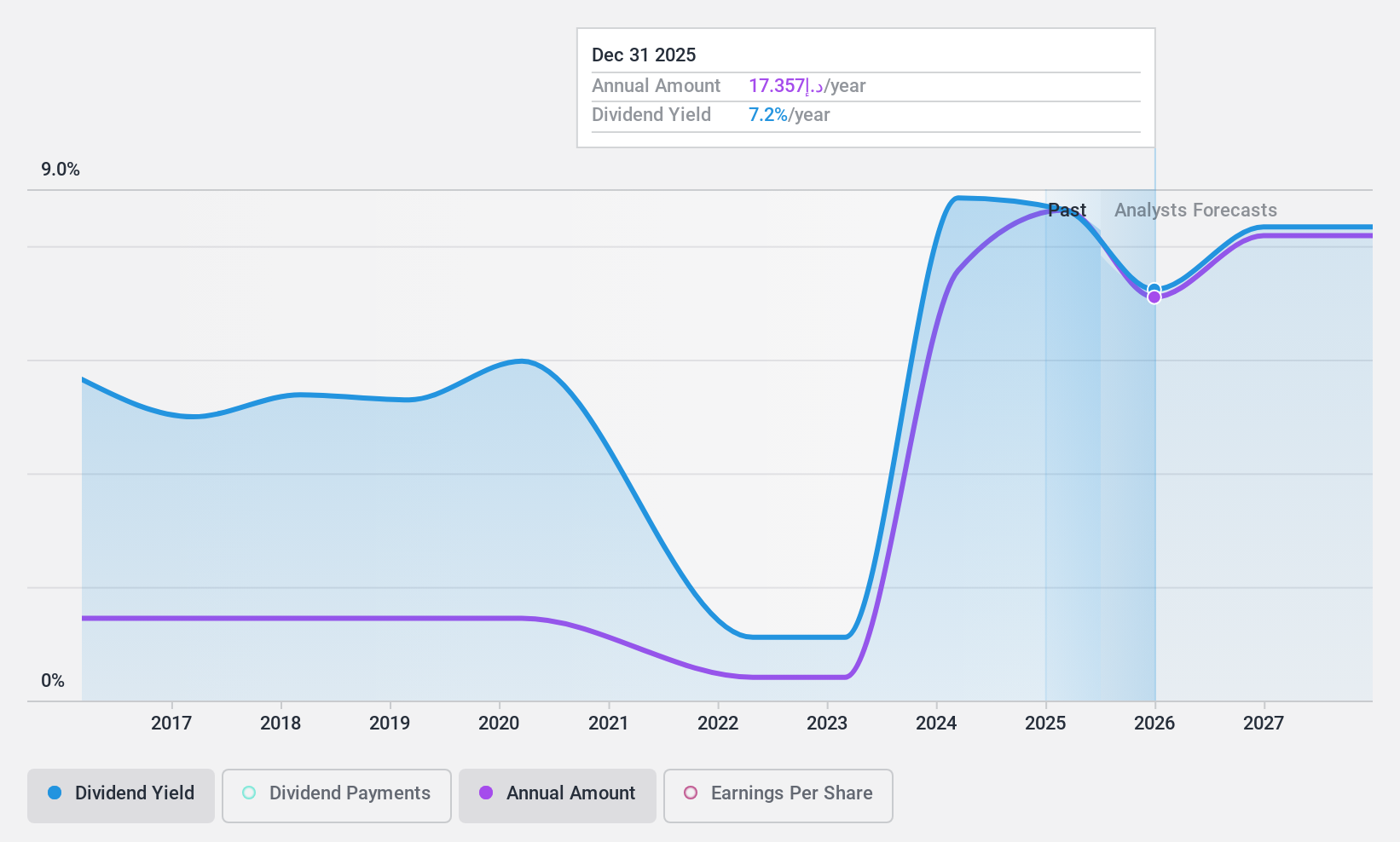

Dividend Yield: 8.8%

Mashreqbank PSC offers a high dividend yield of 8.79%, placing it in the top 25% of dividend payers in the AE market. Despite this, its dividend history has been volatile over the past decade, with fluctuations exceeding 20%. The bank's dividends are currently well-covered by earnings with a payout ratio of 48.8%, and future coverage is expected to remain sustainable at around 53.4%. Recent earnings show a decline, impacting net income and EPS compared to last year.

- Click here to discover the nuances of Mashreqbank PSC with our detailed analytical dividend report.

- Our valuation report here indicates Mashreqbank PSC may be undervalued.

Bank Hapoalim B.M (TASE:POLI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank Hapoalim B.M., along with its subsidiaries, offers a range of banking and financial services both in Israel and internationally, with a market cap of ₪69.29 billion.

Operations: Bank Hapoalim B.M.'s revenue segments include Israel - Households - Other (₪5.72 billion), Israel - Small and Micro Business - Other (₪3.58 billion), Israel - Big Business - Construction and Real Estate (₪2 billion), Overseas - Business Activity (₪879 million), and several other banking services across various sectors in both domestic and international markets.

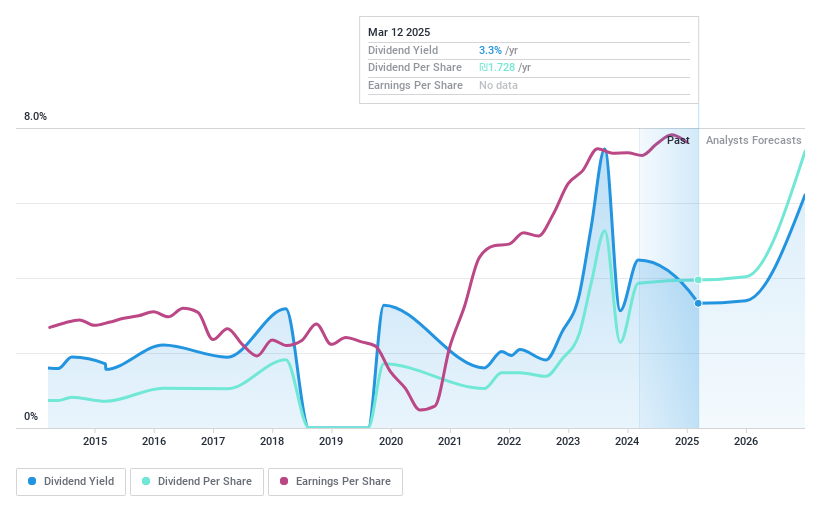

Dividend Yield: 3.3%

Bank Hapoalim B.M. trades at 23.6% below its estimated fair value, offering potential value for investors. Its dividend yield of 3.29% is modest compared to top IL market payers, and while dividends have grown over the past decade, they have been volatile and unreliable with significant annual drops. The payout ratio stands at a sustainable 30.2%, with future coverage expected to remain solid at 50%. Recent earnings guidance projects net profits between ILS 8.5 billion and ILS 9.5 billion for upcoming years, indicating stable financial health despite past income fluctuations.

- Get an in-depth perspective on Bank Hapoalim B.M's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Bank Hapoalim B.M's current price could be inflated.

Key Takeaways

- Take a closer look at our Top Middle Eastern Dividend Stocks list of 73 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:DANA

Dana Gas PJSC

Engages in the exploration, production, ownership, transportation, processing, distribution, marketing, and sale of natural gas and petroleum related products in the United Arab Emirates, Iraq, and Egypt.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives