In the wake of a significant political shift in the U.S., global markets are experiencing notable movements, with U.S. stocks reaching record highs amid expectations of accelerated economic growth and tax reforms. As investors navigate these dynamic conditions, dividend stocks can offer a compelling option for those seeking stability and income, particularly given their potential to provide consistent returns even amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.03% | ★★★★★★ |

| Globeride (TSE:7990) | 4.02% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.17% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.57% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.92% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

Click here to see the full list of 1939 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Dubai Islamic Bank P.J.S.C (DFM:DIB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dubai Islamic Bank P.J.S.C., along with its subsidiaries, operates in corporate, retail, and investment banking both within the United Arab Emirates and internationally, with a market capitalization of AED46.90 billion.

Operations: Dubai Islamic Bank P.J.S.C.'s revenue segments include Consumer Banking (AED4.59 billion), Corporate Banking (AED3.00 billion), Treasury (AED2.37 billion), and Real Estate Development (AED530.10 million).

Dividend Yield: 6.9%

Dubai Islamic Bank P.J.S.C. offers a dividend yield of 6.93%, placing it in the top quartile among AE market dividend payers. Despite its unstable dividend history, the payout ratio remains low at 46.6%, suggesting dividends are well covered by earnings and forecasted to remain so with a 53.5% payout ratio in three years. Recent earnings showed growth, with net income rising to AED 2 billion in Q3 2024 from AED 1.65 billion a year earlier, supporting its current dividend strategy amidst volatile past payments and high bad loan levels of 4.8%.

- Unlock comprehensive insights into our analysis of Dubai Islamic Bank P.J.S.C stock in this dividend report.

- The analysis detailed in our Dubai Islamic Bank P.J.S.C valuation report hints at an deflated share price compared to its estimated value.

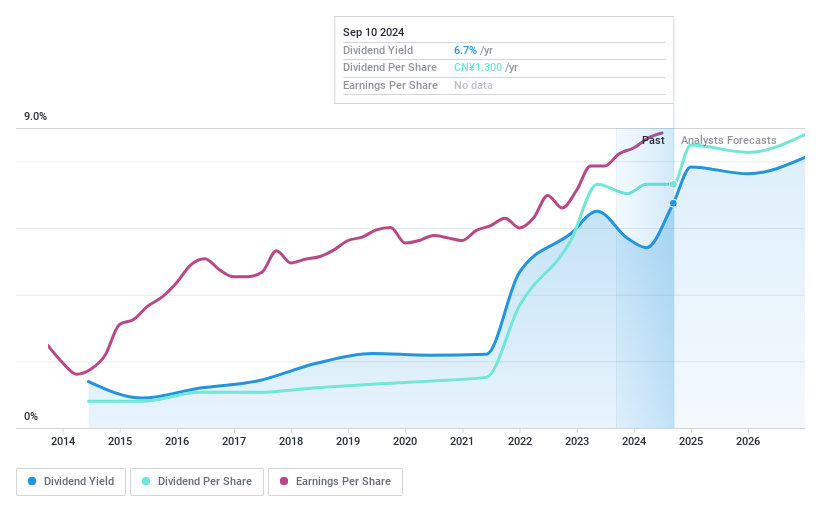

Jiang Zhong PharmaceuticalLtd (SHSE:600750)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiang Zhong Pharmaceutical Co., Ltd focuses on the research, development, production, and sale of Chinese patent medicines and health foods in Mainland China, with a market cap of CN¥13.62 billion.

Operations: Jiang Zhong Pharmaceutical Co., Ltd generates revenue from its operations in the Chinese patent medicines and health foods sectors within Mainland China.

Dividend Yield: 5.5%

Jiang Zhong Pharmaceutical Ltd. offers a dividend yield of 5.49%, ranking it among the top 25% in the CN market. However, its dividends are not well covered by earnings or free cash flow, with a high payout ratio of 100.9%. Despite this, dividends have been stable and growing over the past decade. Recent earnings showed net income growth to CNY 634.34 million for nine months ending September 2024, although sales decreased compared to last year.

- Click here and access our complete dividend analysis report to understand the dynamics of Jiang Zhong PharmaceuticalLtd.

- Our valuation report here indicates Jiang Zhong PharmaceuticalLtd may be undervalued.

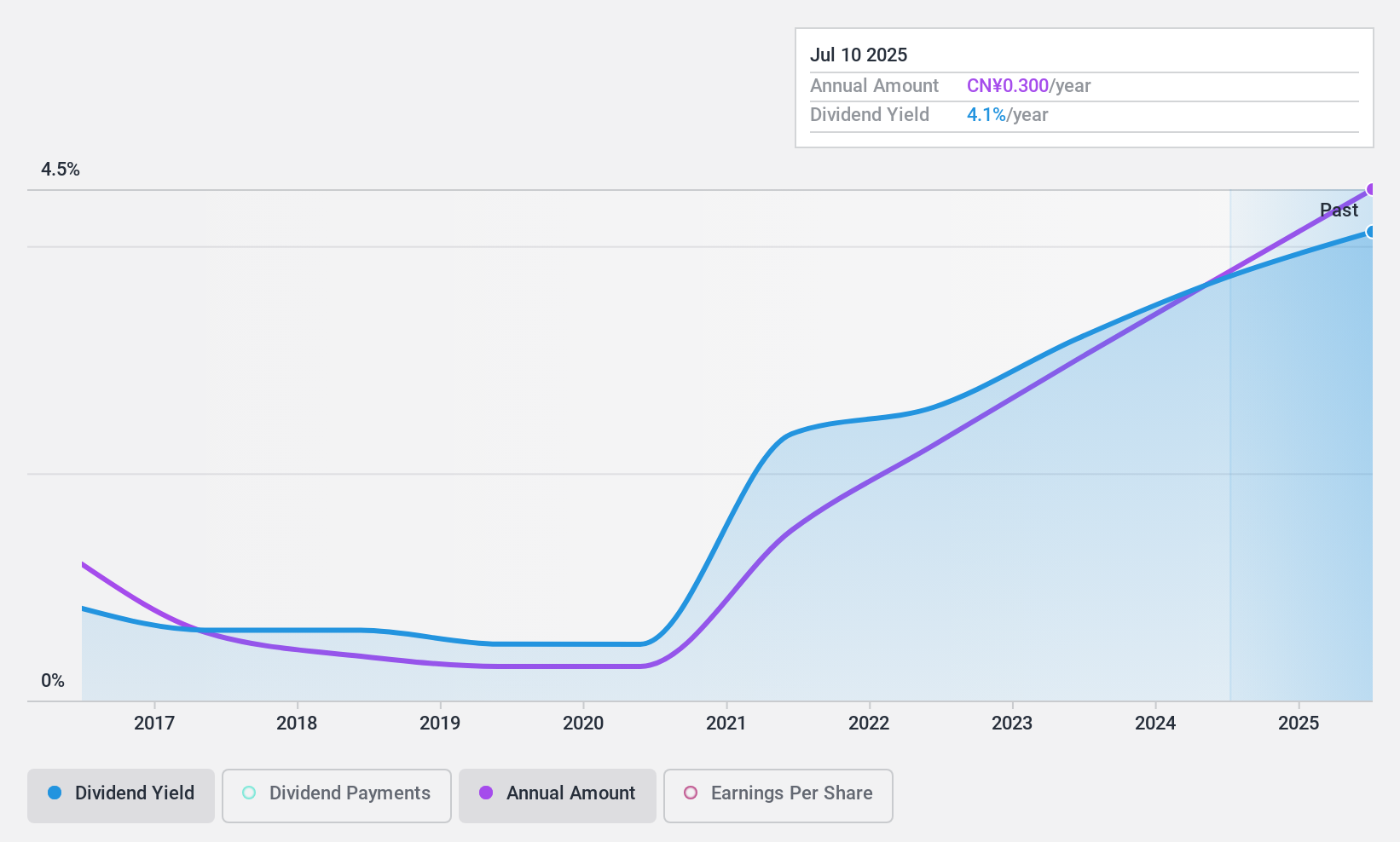

Changhong Huayi Compressor (SZSE:000404)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Changhong Huayi Compressor Co., Ltd. develops, manufactures, and sells various compressors both in China and internationally, with a market cap of CN¥5.38 billion.

Operations: Changhong Huayi Compressor Co., Ltd. generates its revenue through the development, manufacturing, and sale of compressors across domestic and international markets.

Dividend Yield: 3.2%

Changhong Huayi Compressor's dividend yield of 3.23% places it in the top 25% of CN market payers, with a sustainable payout ratio of 37.6% supported by earnings and a low cash payout ratio of 19.3%. Despite past volatility in dividend payments, they have grown over the last decade. Recent earnings for nine months ending September 2024 showed net income growth to CNY 375.94 million, although sales decreased from the previous year.

- Delve into the full analysis dividend report here for a deeper understanding of Changhong Huayi Compressor.

- Our expertly prepared valuation report Changhong Huayi Compressor implies its share price may be lower than expected.

Taking Advantage

- Get an in-depth perspective on all 1939 Top Dividend Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000404

Changhong Huayi Compressor

Develops, manufactures, and sells various compressors in China and internationally.

Flawless balance sheet, undervalued and pays a dividend.