- United Arab Emirates

- /

- Banks

- /

- DFM:AJMANBANK

Undiscovered Gems in the Middle East for September 2025

Reviewed by Simply Wall St

As Gulf markets experience a downturn with fading optimism over rate cuts and the Saudi index hitting near two-year lows, investors are reevaluating their strategies amidst broad-based sectoral losses. In this environment, identifying stocks that offer resilience and growth potential becomes crucial, especially those that can navigate market volatility effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| C. Mer Industries | 109.27% | 13.77% | 72.47% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Ajman Bank PJSC (DFM:AJMANBANK)

Simply Wall St Value Rating: ★★★★☆☆

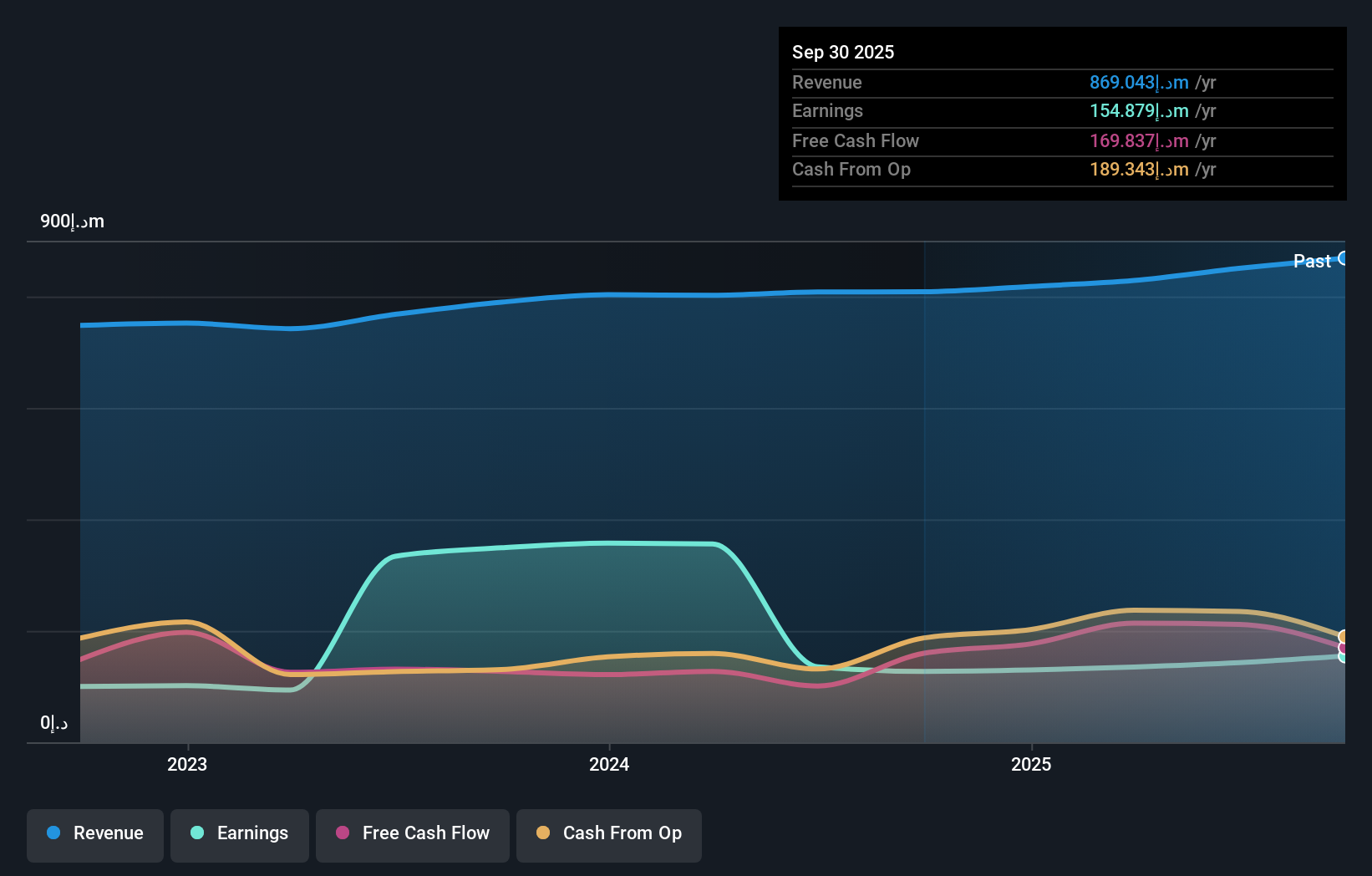

Overview: Ajman Bank PJSC offers a range of banking products and services to individuals, businesses, and government institutions in the United Arab Emirates, with a market capitalization of AED3.88 billion.

Operations: Revenue streams for Ajman Bank PJSC include Treasury (AED139.57 million), Consumer Banking (AED302.69 million), and Wholesale Banking (AED395.46 million).

Ajman Bank, a notable player in the Middle East's financial landscape, showcases a solid foundation with total assets of AED26.6 billion and equity of AED3.2 billion. Despite a high level of bad loans at 9.8%, it maintains primarily low-risk funding through customer deposits, accounting for 89% of liabilities. The bank's price-to-earnings ratio stands at an attractive 9x compared to the AE market average of 12.7x, suggesting potential value for investors. While profitability has been achieved recently, challenges remain due to its low allowance for bad loans at just 46%.

Dubai Refreshment (P.J.S.C.) (DFM:DRC)

Simply Wall St Value Rating: ★★★★★★

Overview: Dubai Refreshment (P.J.S.C.) is involved in the bottling and distribution of Pepsi Cola International products within the United Arab Emirates and globally, with a market capitalization of AED 1.94 billion.

Operations: The company generates revenue primarily from canning, bottling, distribution, and trading of soft drinks and related beverage products, amounting to AED 850.52 million.

Dubai Refreshment, a noteworthy player in the Middle East's consumer sector, has seen its earnings grow by 5.6% over the past year, outpacing the industry average of 2.8%. Trading at 78.5% below its estimated fair value, this debt-free company seems to offer significant upside potential. Recent results show a robust performance with second-quarter sales reaching AED 238 million and net income climbing to AED 47.88 million from AED 40.03 million a year ago. Despite high share price volatility recently, Dubai Refreshment's strong earnings quality and positive free cash flow position it as an intriguing prospect for investors seeking value plays in emerging markets.

Al Masane Al Kobra Mining (SASE:1322)

Simply Wall St Value Rating: ★★★★★★

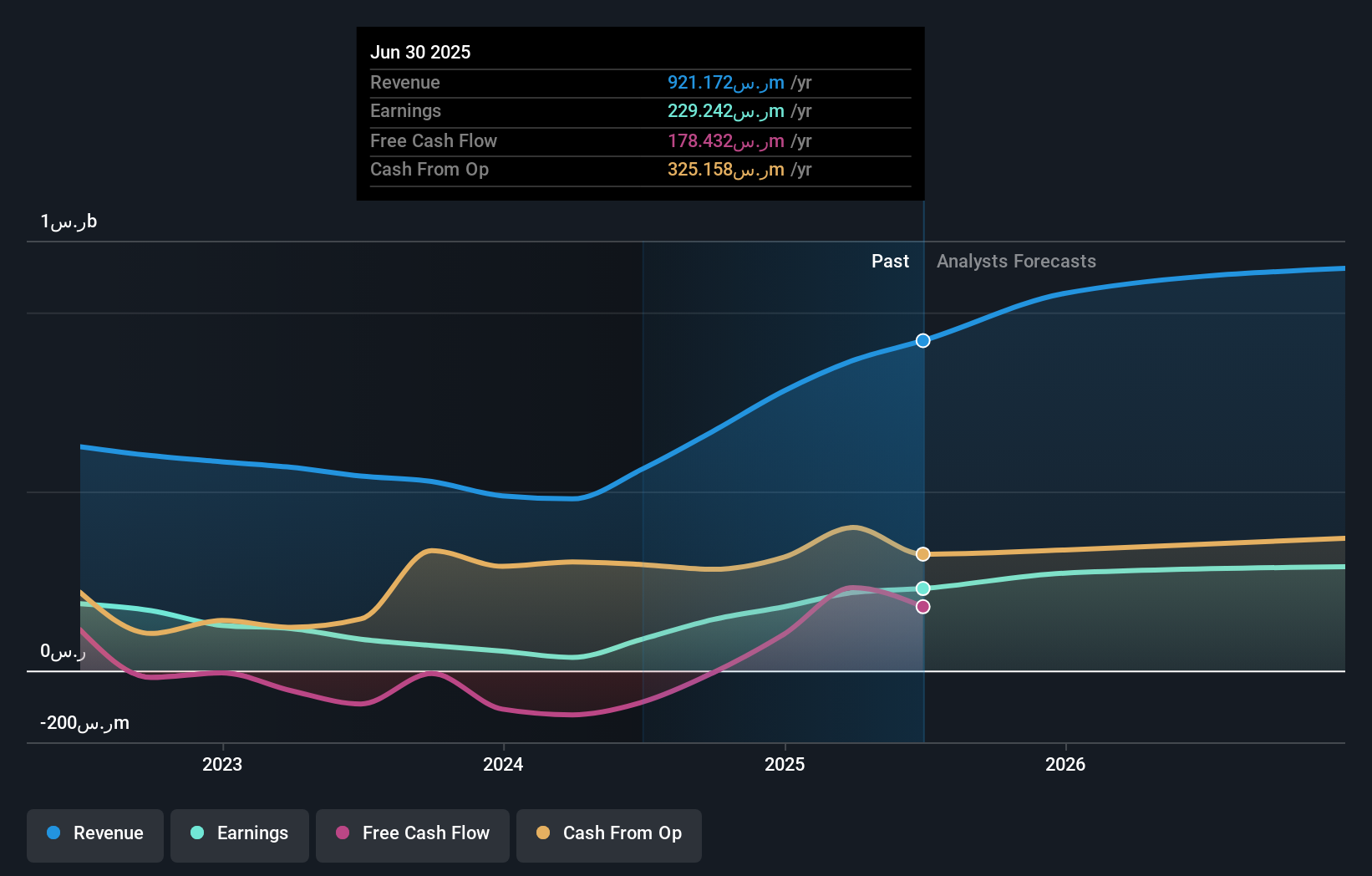

Overview: Al Masane Al Kobra Mining Company operates in the Kingdom of Saudi Arabia, focusing on the production of non-ferrous metal ores and precious metals, with a market capitalization of SAR5.99 billion.

Operations: Revenue primarily comes from three mining operations: Al Masane Mine (SAR330.70 million), Mount Guyan Mine (SAR311.37 million), and Moyeath Min (SAR279.10 million).

Al Masane Al Kobra Mining, a notable player in the Middle East's mining sector, showcases robust financial health with a net debt to equity ratio of 8.2%, which is satisfactory. The company's price-to-earnings ratio stands at 25.9x, offering good value compared to the industry's average of 30.6x. Over the past year, earnings surged by 160%, outpacing industry growth of 9%. Recent earnings reports reveal a significant increase in sales and net income for Q2 and H1 of 2025, with sales reaching SAR 258 million and SAR 478 million respectively, indicating strong operational performance and promising future prospects.

Make It Happen

- Gain an insight into the universe of 201 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:AJMANBANK

Ajman Bank PJSC

Provides various banking products and services for individuals, businesses, and government institutions in the United Arab Emirates.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives