- United Arab Emirates

- /

- Banks

- /

- ADX:NBQ

Discovering Undiscovered Gems with Promising Potential In August 2024

Reviewed by Simply Wall St

As global markets face a downturn driven by surprising economic data and a cooling labor market, the small-cap Russell 2000 Index has notably pulled back sharply. Despite this, opportunities still exist for discerning investors willing to explore lesser-known stocks with robust fundamentals. In such volatile times, identifying undiscovered gems requires focusing on companies with strong financial health, innovative business models, and potential for sustainable growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Al Sagr Cooperative Insurance | NA | 10.32% | 28.04% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Amana Cooperative Insurance | NA | 2.55% | 12.80% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| MOBI Industry | 28.24% | 6.15% | 18.49% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 8.04% | -3.72% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

National Bank of Umm Al-Qaiwain (PSC) (ADX:NBQ)

Simply Wall St Value Rating: ★★★★☆☆

Overview: National Bank of Umm Al-Qaiwain (PSC) provides retail and corporate banking services in the United Arab Emirates and has a market cap of AED 4.38 billion.

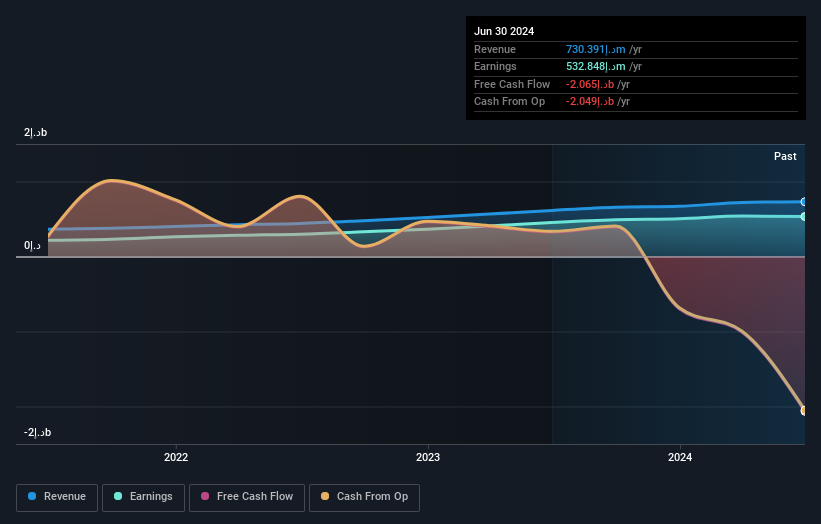

Operations: The bank's revenue streams are primarily from Treasury and Investments (AED 391.30 million) and Retail and Corporate Banking (AED 193.23 million). The total revenue amounts to AED 726.54 million.

National Bank of Umm Al-Qaiwain (PSC) boasts high-quality earnings and a favorable price-to-earnings ratio of 8.2x, below the AE market's 13.1x. With AED15.6B in total assets and AED5.6B in equity, its liabilities are primarily low-risk customer deposits (95%). Despite a high level of bad loans at 4.4%, NBQ has seen steady growth with earnings increasing by 9.6% annually over five years and reaching a net income of AED285M for the first half of 2024.

FDH Bank (MAL:FDHB)

Simply Wall St Value Rating: ★★★★★☆

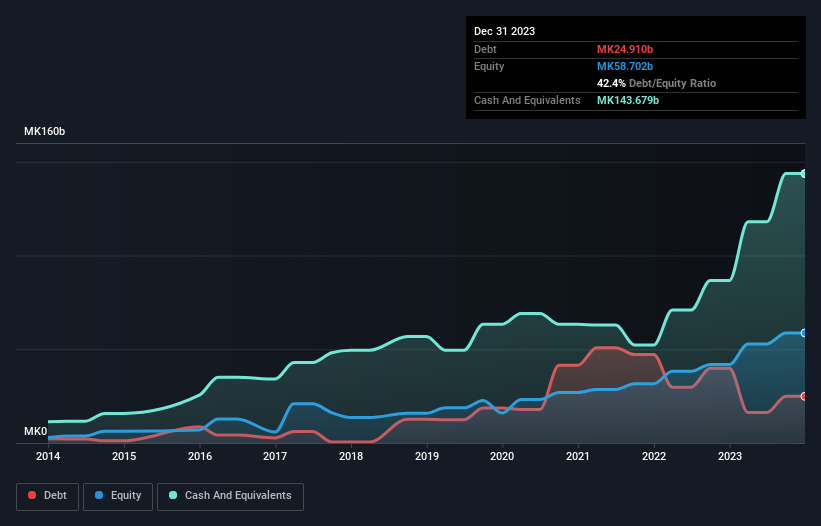

Overview: FDH Bank Plc offers personal, business, corporate, and SME banking services in Malawi with a market cap of MWK897.13 billion.

Operations: FDH Bank Plc generates revenue primarily from its banking segment, which reported MWK101.62 billion. The company's market cap stands at MWK897.13 billion.

FDH Bank, with total assets of MWK566.1B and total equity of MWK58.7B, has shown impressive growth with earnings up 55.4% over the past year, outpacing the Banks industry at 52.2%. Total deposits stand at MWK444.0B against total loans of MWK135.8B, highlighting a robust deposit base primarily from low-risk customer deposits (88% of liabilities). The bank's non-performing loans are appropriately managed at 1.5%, reflecting strong asset quality despite recent share price volatility.

- Click to explore a detailed breakdown of our findings in FDH Bank's health report.

Assess FDH Bank's past performance with our detailed historical performance reports.

Presco (NGSE:PRESCO)

Simply Wall St Value Rating: ★★★★★☆

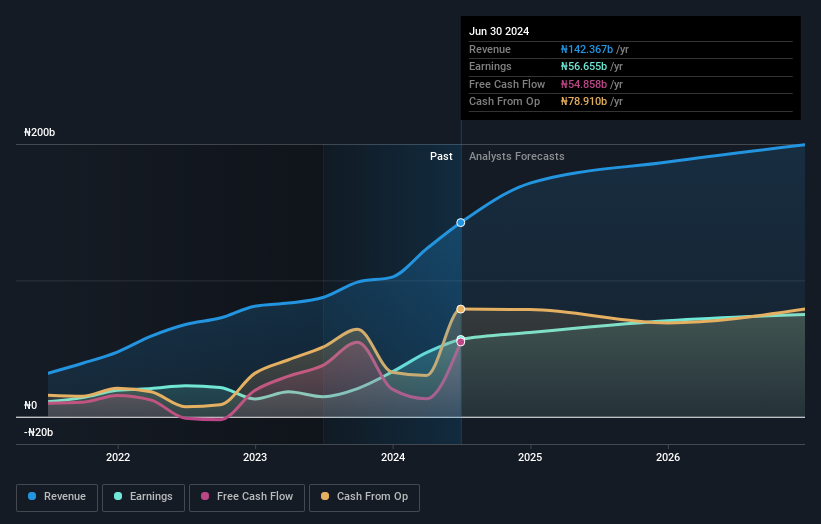

Overview: Presco Plc operates in Nigeria, focusing on oil palm plantations development, palm oil milling, palm kernel processing, and vegetable oil refining with a market cap of NGN485.10 billion.

Operations: Presco Plc generates revenue primarily from its food processing segment, amounting to NGN142.37 billion. The company has a market cap of NGN485.10 billion.

Presco has demonstrated impressive growth, with earnings skyrocketing by 287% over the past year, significantly outpacing the Food industry’s 58%. The company reported net income of NGN 14.82 billion for Q2 2024, up from NGN 5.12 billion a year ago. Despite its high net debt to equity ratio of 57.7%, its interest payments are well covered by EBIT at a multiple of 9.3x, indicating strong financial health and operational efficiency.

- Unlock comprehensive insights into our analysis of Presco stock in this health report.

Evaluate Presco's historical performance by accessing our past performance report.

Where To Now?

- Reveal the 4715 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Bank of Umm Al-Qaiwain (PSC) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:NBQ

National Bank of Umm Al-Qaiwain (PSC)

Engages in the provision of retail and corporate banking services in the United Arab Emirates.

Adequate balance sheet average dividend payer.