- United States

- /

- Marine and Shipping

- /

- NYSE:ZIM

ZIM Integrated Shipping Services (NYSE:ZIM) Reports Q1 Net Income of US$295 Million

Reviewed by Simply Wall St

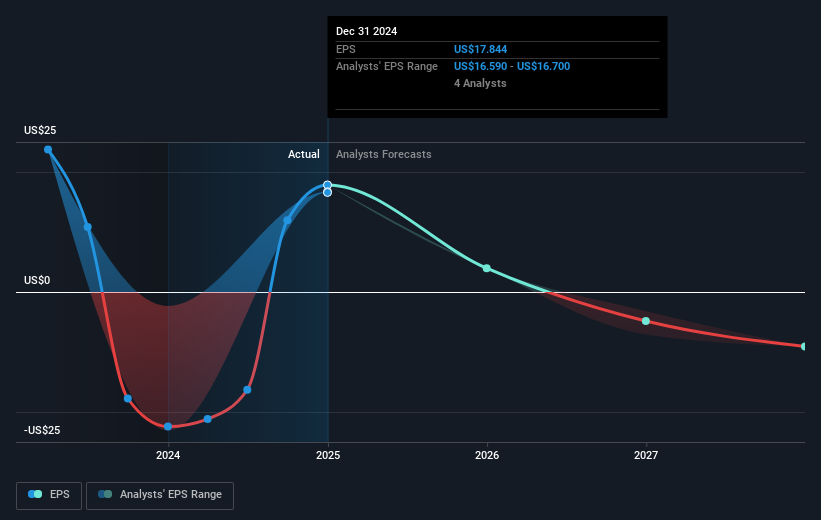

ZIM Integrated Shipping Services (NYSE:ZIM) recently announced strong earnings for Q1 2025, with net income rising significantly to $295 million from $90 million the previous year. This impressive financial performance is likely a key factor behind the company's 40% share price increase over the last month, a far steeper rise than the 1.6% uptick observed in the broader market. While the market itself has experienced steady growth over the past year, ZIM's substantial earnings increase and proactive communication strategy have added notable weight to its stock's impressive performance in the short term.

ZIM Integrated Shipping Services has experienced a substantial share price increase of 40% in the past month, attributing much to its strong Q1 2025 earnings. However, longer-term performance reflects a dramatic 56.39% total return over the past year, incorporating both share price and dividend returns. Despite ZIM's impressive short-term gains, it's important to note that its one-year gains contrast sharply with the broader US Shipping industry, which saw a downturn of 17.3% during the same period.

The recent news surrounding increased earnings could impact ZIM's revenue and earnings forecasts, especially as analysts expect a significant decrease in revenue (-24.5% per year) over the next three years. Projected new port charges and the possibility of trade wars introduce risks that might offset advancements in cost efficiency, thereby affecting future earnings. The share price, currently at US$14.72, is slightly above the analyst consensus price target of US$14.25, suggesting a potential stabilization in its market value. These factors, combined with a forecast decline in earnings growth, emphasize the need for investors to evaluate the company's ability to manage incoming challenges effectively.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZIM Integrated Shipping Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZIM

ZIM Integrated Shipping Services

Provides container shipping and related services in Israel and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives