- United States

- /

- Biotech

- /

- NasdaqGM:ZLAB

Zai Lab Limited's (NASDAQ:ZLAB) Shift From Loss To Profit

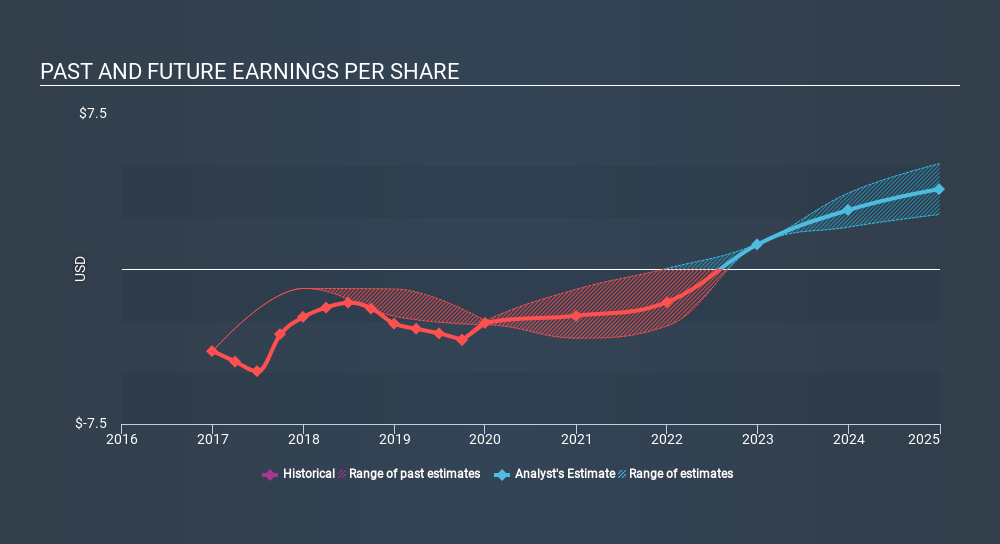

Zai Lab Limited's (NASDAQ:ZLAB): Zai Lab Limited, a biopharmaceutical company, engages in discovering or licensing, developing, and commercializing proprietary therapeutics that address medical needs in the fields of oncology, infectious, and autoimmune diseases in China and internationally. The US$3.9b market-cap posted a loss in its most recent financial year of -US$139.1m and a latest trailing-twelve-month loss of -US$212.0m leading to an even wider gap between loss and breakeven. The most pressing concern for investors is ZLAB’s path to profitability – when will it breakeven? In this article, I will touch on the expectations for ZLAB’s growth and when analysts expect the company to become profitable.

Check out our latest analysis for Zai Lab

According to the 8 industry analysts covering ZLAB, the consensus is breakeven is near. They expect the company to post a final loss in 2021, before turning a profit of US$96m in 2022. So, ZLAB is predicted to breakeven approximately 2 years from now. In order to meet this breakeven date, I calculated the rate at which ZLAB must grow year-on-year. It turns out an average annual growth rate of 54% is expected, which signals high confidence from analysts. If this rate turns out to be too aggressive, ZLAB may become profitable much later than analysts predict.

I’m not going to go through company-specific developments for ZLAB given that this is a high-level summary, though, keep in mind that typically a biotech has lumpy cash flows which are contingent on the product type and stage of development the company is in. So, a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.

One thing I’d like to point out is that ZLAB has managed its capital judiciously, with debt making up 1.9% of equity. This means that ZLAB has predominantly funded its operations from equity capital,and its low debt obligation reduces the risk around investing in the loss-making company.

Next Steps:

There are key fundamentals of ZLAB which are not covered in this article, but I must stress again that this is merely a basic overview. For a more comprehensive look at ZLAB, take a look at ZLAB’s company page on Simply Wall St. I’ve also put together a list of key factors you should further research:

- Valuation: What is ZLAB worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether ZLAB is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Zai Lab’s board and the CEO’s back ground.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGM:ZLAB

Zai Lab

A biopharmaceutical company, focuses on discovering, developing, and commercializing products that address medical conditions in the areas of oncology, immunology, neuroscience, and infectious diseases.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Goldman Sachs Group (GS) The Titan Reclaims Its Crown: Return to Core Excellence

Parker-Hannifin (PH) The Industrial Alchemist: Transforming Motion into Margin

Monolithic Power Systems (MPWR) Powering the Hyperscale Era: The Efficiency Moat

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion