- United States

- /

- IT

- /

- NasdaqGS:VNET

You Might Like 21Vianet Group, Inc. (NASDAQ:VNET) But Do You Like Its Debt?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Investors are always looking for growth in small-cap stocks like 21Vianet Group, Inc. (NASDAQ:VNET), with a market cap of US$819m. However, an important fact which most ignore is: how financially healthy is the business? Given that VNET is not presently profitable, it’s crucial to understand the current state of its operations and pathway to profitability. We'll look at some basic checks that can form a snapshot the company’s financial strength. However, this is not a comprehensive overview, so I recommend you dig deeper yourself into VNET here.

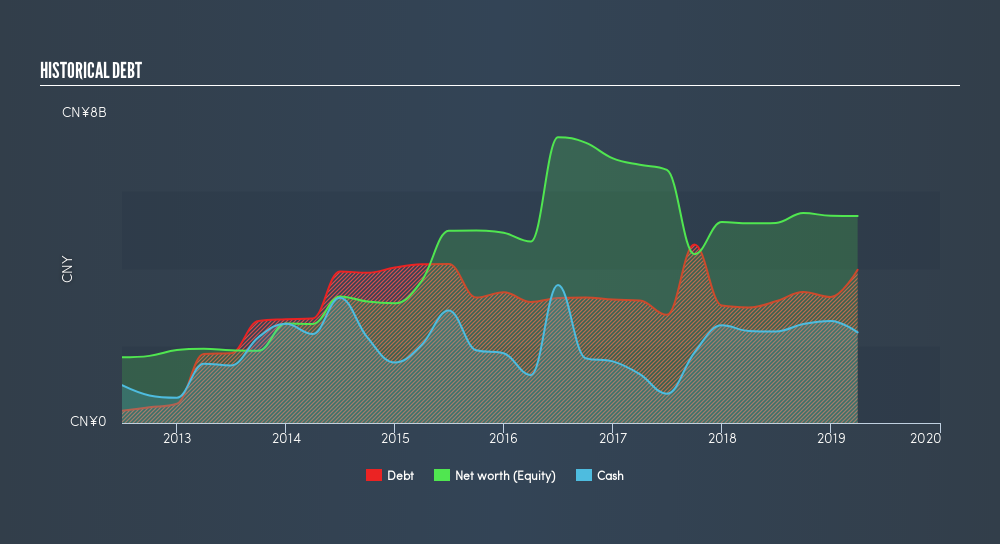

Does VNET Produce Much Cash Relative To Its Debt?

VNET's debt levels surged from CN¥3.0b to CN¥4.0b over the last 12 months , which includes long-term debt. With this rise in debt, the current cash and short-term investment levels stands at CN¥2.3b to keep the business going. Additionally, VNET has produced cash from operations of CN¥642m during the same period of time, leading to an operating cash to total debt ratio of 16%, indicating that VNET’s operating cash is less than its debt.

Does VNET’s liquid assets cover its short-term commitments?

With current liabilities at CN¥2.3b, it appears that the company has been able to meet these obligations given the level of current assets of CN¥4.5b, with a current ratio of 1.97x. The current ratio is calculated by dividing current assets by current liabilities. For IT companies, this ratio is within a sensible range since there is a bit of a cash buffer without leaving too much capital in a low-return environment.

Is VNET’s debt level acceptable?

With debt reaching 74% of equity, VNET may be thought of as relatively highly levered. This is a bit unusual for a small-cap stock, since they generally have a harder time borrowing than large more established companies. However, since VNET is presently unprofitable, there’s a question of sustainability of its current operations. Maintaining a high level of debt, while revenues are still below costs, can be dangerous as liquidity tends to dry up in unexpected downturns.

Next Steps:

VNET’s high cash coverage means that, although its debt levels are high, the company is able to utilise its borrowings efficiently in order to generate cash flow. Since there is also no concerns around VNET's liquidity needs, this may be its optimal capital structure for the time being. This is only a rough assessment of financial health, and I'm sure VNET has company-specific issues impacting its capital structure decisions. You should continue to research 21Vianet Group to get a more holistic view of the small-cap by looking at:

- Future Outlook: What are well-informed industry analysts predicting for VNET’s future growth? Take a look at our free research report of analyst consensus for VNET’s outlook.

- Historical Performance: What has VNET's returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:VNET

VNET Group

An investment holding company, provides hosting and related services in China.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives