- United Kingdom

- /

- Software

- /

- AIM:ZOO

Would ZOO Digital Group (LON:ZOO) Be Better Off With Less Debt?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, ZOO Digital Group plc (LON:ZOO) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for ZOO Digital Group

What Is ZOO Digital Group's Debt?

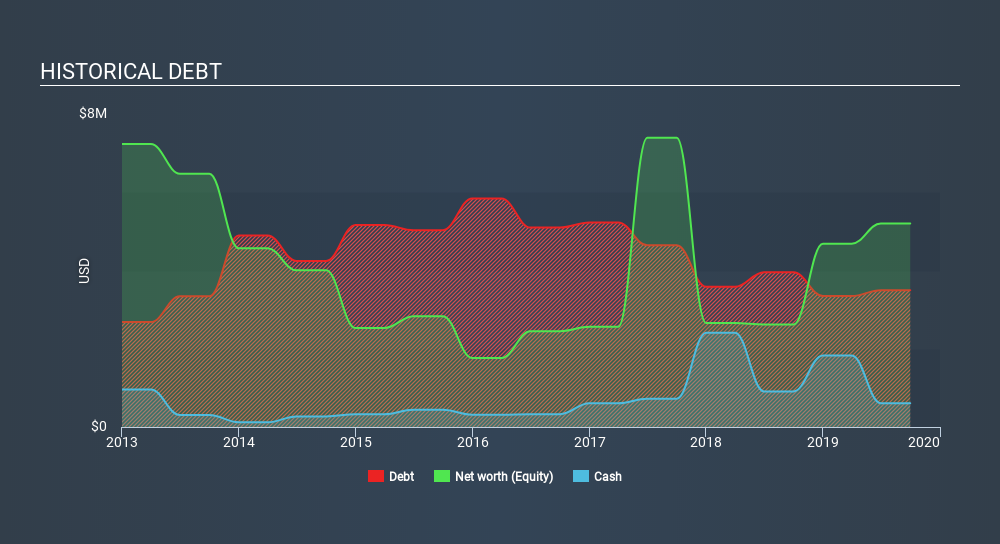

You can click the graphic below for the historical numbers, but it shows that ZOO Digital Group had US$3.50m of debt in September 2019, down from US$4.20m, one year before. However, it does have US$607.0k in cash offsetting this, leading to net debt of about US$2.89m.

How Healthy Is ZOO Digital Group's Balance Sheet?

We can see from the most recent balance sheet that ZOO Digital Group had liabilities of US$7.09m falling due within a year, and liabilities of US$8.07m due beyond that. On the other hand, it had cash of US$607.0k and US$8.23m worth of receivables due within a year. So its liabilities total US$6.33m more than the combination of its cash and short-term receivables.

Of course, ZOO Digital Group has a market capitalization of US$78.7m, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine ZOO Digital Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year ZOO Digital Group had negative earnings before interest and tax, and actually shrunk its revenue by 8.3%, to US$28m. We would much prefer see growth.

Caveat Emptor

Importantly, ZOO Digital Group had negative earnings before interest and tax (EBIT), over the last year. Indeed, it lost US$522k at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. Surprisingly, we note that it actually reported positive free cash flow of US$1.3m and a profit of US$2.2m. So one might argue that there's still a chance it can get things on the right track. For riskier companies like ZOO Digital Group I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:ZOO

ZOO Digital Group

Together with subsidiaries, provides productivity tools and media services in the United Kingdom, the United State, India, Italy, Germany, South Korea, and internationally.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Qantas: A Stronger Post-COVID Airline with Sustainable Earnings Power

My view on CSL Limited is positive. It’s a high-quality growth stock with strong barriers to entry through its global plasma network.

Nu holdings will continue to disrupt the South American banking market

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion