- United States

- /

- Food and Staples Retail

- /

- NYSE:WMK

Would Weis Markets, Inc. (NYSE:WMK) Be Valuable To Income Investors?

Today we'll take a closer look at Weis Markets, Inc. (NYSE:WMK) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

A high yield and a long history of paying dividends is an appealing combination for Weis Markets. It would not be a surprise to discover that many investors buy it for the dividends. Some simple research can reduce the risk of buying Weis Markets for its dividend - read on to learn more.

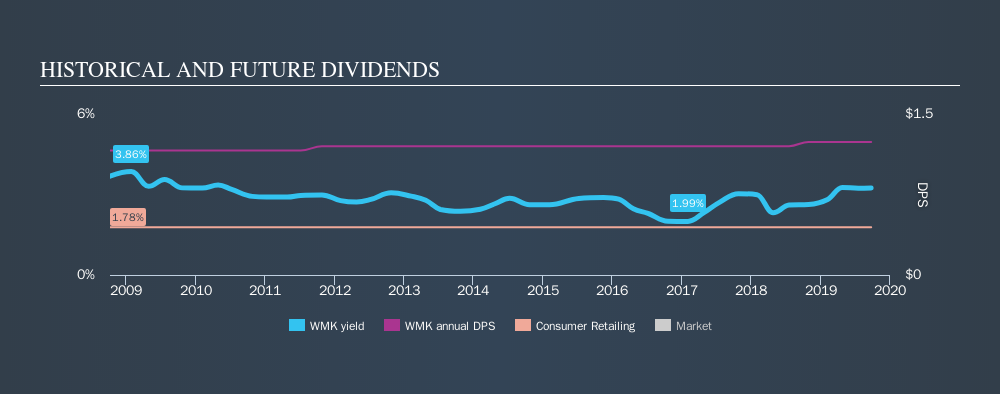

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Looking at the data, we can see that 53% of Weis Markets's profits were paid out as dividends in the last 12 months. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Weis Markets paid out 70% of its cash flow as dividends last year, which is within a reasonable range for the average corporation. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

While the above analysis focuses on dividends relative to a company's earnings, we do note Weis Markets's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Weis Markets has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. During this period the dividend has been stable, which could imply the business could have relatively consistent earnings power. During the past ten-year period, the first annual payment was US$1.16 in 2009, compared to US$1.24 last year. Its dividends have grown at less than 1% per annum over this time frame.

Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think is seriously impressive.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. In the last five years, Weis Markets's earnings per share have shrunk at approximately 3.2% per annum. If earnings continue to decline, the dividend may come under pressure. Every investor should make an assessment of whether the company is taking steps to stabilise the situation.

Conclusion

To summarise, shareholders should always check that Weis Markets's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. First, we think Weis Markets is paying out an acceptable percentage of its cashflow and profit. Second, earnings per share have actually shrunk, but at least the dividends have been relatively stable. Ultimately, Weis Markets comes up short on our dividend analysis. It's not that we think it is a bad company - just that there are likely more appealing dividend prospects out there on this analysis.

Now, if you want to look closer, it would be worth checking out our free research on Weis Markets management tenure, salary, and performance.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:WMK

Weis Markets

Engages in the retail sale of food through a chain of supermarkets in Pennsylvania.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives