- United States

- /

- Software

- /

- NYSE:WK

Workiva (WK) Unveils AI-Driven Platform Expansion For Enhanced CFO Productivity

Reviewed by Simply Wall St

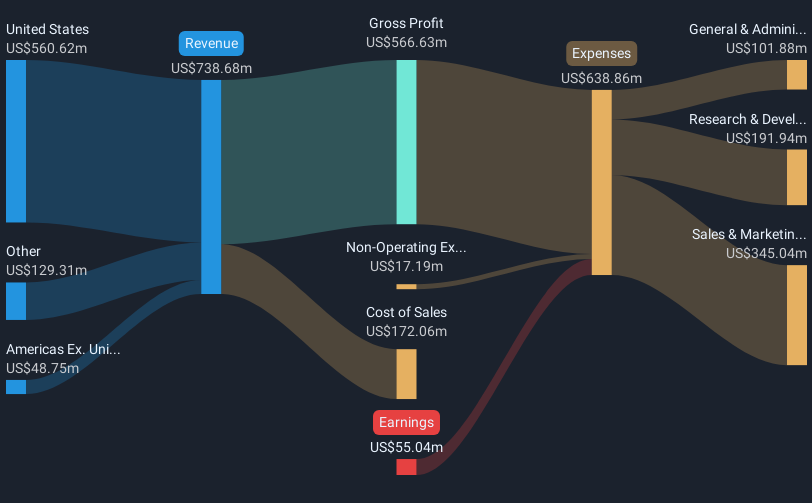

Workiva (WK) recently announced major enhancements to its intelligent platform, at its Amplify conference, introducing innovations like agentic AI and advanced data automation, which could have aligned well with the broader market trends driven by a surge in AI popularity. The company reported robust revenue growth in its Q2 earnings, though it faced a net loss. Despite executive changes and its removal from certain indexes, Workiva's initiatives to address industry challenges and streamline workflows might have contributed to the 14% share price rise over the last quarter. These developments occurred against a backdrop of sectors experiencing record highs fuelled by AI demand.

The recent enhancements to Workiva's intelligent platform, introduced at the Amplify conference, align with the company's focus on multi-solution platforms and expansion. These developments could bolster revenue growth, as they drive contract values and subscription revenues, particularly in sustainability solutions. The integration of AI could enhance operational efficiencies, supporting future earnings projections. Analysts are optimistic, as reflected in the company’s price target of $94.10, indicating a potential upside from the current share price of $77.18.

Over the past five years, Workiva's total return, including dividends and share price changes, was 45.43%, offering a longer-term perspective on its performance. This serves as a contrast to the past year's underperformance relative to the US Software industry, which saw a return of 29.3%. Workiva's stock underperformed both the industry and the broader US market over the past year, where the market saw returns of 20.5%. These figures highlight the variance between long-term resilience and short-term challenges.

The company's recent initiatives come amid these challenges, with revenue currently at $806.98 million and earnings at a US$66.58 million loss. The anticipated expansion and technological advancements are expected to influence future revenue and earning forecasts positively. If these innovations succeed in driving subscription revenue, they could potentially support the analyst consensus price target increase. The disparity between the current share price and the consensus target suggests investors may expect further growth from these strategic developments.

Take a closer look at Workiva's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workiva might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WK

Workiva

Provides cloud-based reporting solutions in the Americas and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives