- United States

- /

- Banks

- /

- NasdaqCM:BOTJ

With EPS Growth And More, Bank of the James Financial Group (NASDAQ:BOTJ) Is Interesting

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like Bank of the James Financial Group (NASDAQ:BOTJ), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Bank of the James Financial Group

How Quickly Is Bank of the James Financial Group Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. As a tree reaches steadily for the sky, Bank of the James Financial Group's EPS has grown 20% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

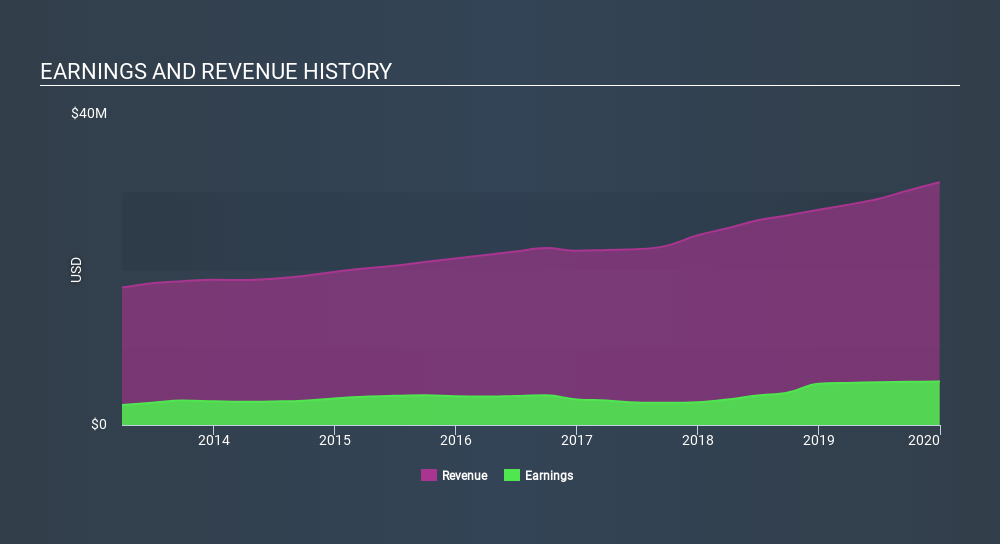

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Bank of the James Financial Group's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Bank of the James Financial Group's EBIT margins were flat over the last year, revenue grew by a solid 13% to US$31m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Bank of the James Financial Group is no giant, with a market capitalization of US$66m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Bank of the James Financial Group Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Any way you look at it Bank of the James Financial Group shareholders can gain quiet confidence from the fact that insiders shelled out US$200k to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. Zooming in, we can see that the biggest insider purchase was by Lydia Langley for US$72k worth of shares, at about US$14.39 per share.

Is Bank of the James Financial Group Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Bank of the James Financial Group's strong EPS growth. The growth rate whets my appetite for research, and the insider buying only increases my interest in the stock. To put it succinctly; Bank of the James Financial Group is a strong candidate for your watchlist. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Bank of the James Financial Group. You might benefit from giving it a glance today.

As a growth investor I do like to see insider buying. But Bank of the James Financial Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:BOTJ

Bank of the James Financial Group

Operates as the bank holding company for Bank of the James that provides general retail and commercial banking services to individuals, businesses, associations and organizations, and governmental authorities in Virginia, the United States.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives