Will 8K Miles Software Services (NSE:8KMILES) Multiply In Value Going Forward?

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. In light of that, when we looked at 8K Miles Software Services (NSE:8KMILES) and its ROCE trend, we weren't exactly thrilled.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for 8K Miles Software Services:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.17 = ₹180m ÷ (₹2.4b - ₹1.4b) (Based on the trailing twelve months to September 2020).

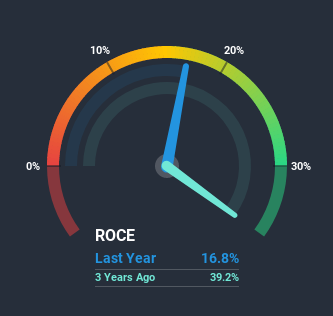

So, 8K Miles Software Services has an ROCE of 17%. On its own, that's a standard return, however it's much better than the 11% generated by the Software industry.

See our latest analysis for 8K Miles Software Services

Historical performance is a great place to start when researching a stock so above you can see the gauge for 8K Miles Software Services' ROCE against it's prior returns. If you're interested in investigating 8K Miles Software Services' past further, check out this free graph of past earnings, revenue and cash flow.

What Does the ROCE Trend For 8K Miles Software Services Tell Us?

We're a bit concerned with the trends, because the business is applying 52% less capital than it was five years ago and returns on that capital have stayed flat. To us that doesn't look like a multi-bagger because the company appears to be selling assets and it's returns aren't increasing. So if this trend continues, don't be surprised if the business is smaller in a few years time.

Another point to note, we noticed the company has increased current liabilities over the last five years. This is intriguing because if current liabilities hadn't increased to 56% of total assets, this reported ROCE would probably be less than17% because total capital employed would be higher.The 17% ROCE could be even lower if current liabilities weren't 56% of total assets, because the the formula would show a larger base of total capital employed. So with current liabilities at such high levels, this effectively means the likes of suppliers or short-term creditors are funding a meaningful part of the business, which in some instances can bring some risks.The Bottom Line On 8K Miles Software Services' ROCE

It's a shame to see that 8K Miles Software Services is effectively shrinking in terms of its capital base. Moreover, since the stock has crumbled 86% over the last five years, it appears investors are expecting the worst. On the whole, we aren't too inspired by the underlying trends and we think there may be better chances of finding a multi-bagger elsewhere.

If you want to know some of the risks facing 8K Miles Software Services we've found 3 warning signs (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

While 8K Miles Software Services may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you’re looking to trade 8K Miles Software Services, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:SECURKLOUD

SecureKloud Technologies

Provides information and technology services in India and the United States.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Santos: Undervalued After Takeover Fallout

Realty Income - A Fundamental and Historical Valuation

A Structured Counter‑Analysis of "The Leaking Dreadnought"

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks