Larry Diamond is the CEO of Zip Co Limited (ASX:Z1P). First, this article will compare CEO compensation with compensation at similar sized companies. After that, we will consider the growth in the business. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This method should give us information to assess how appropriately the company pays the CEO.

See our latest analysis for Zip Co

How Does Larry Diamond's Compensation Compare With Similar Sized Companies?

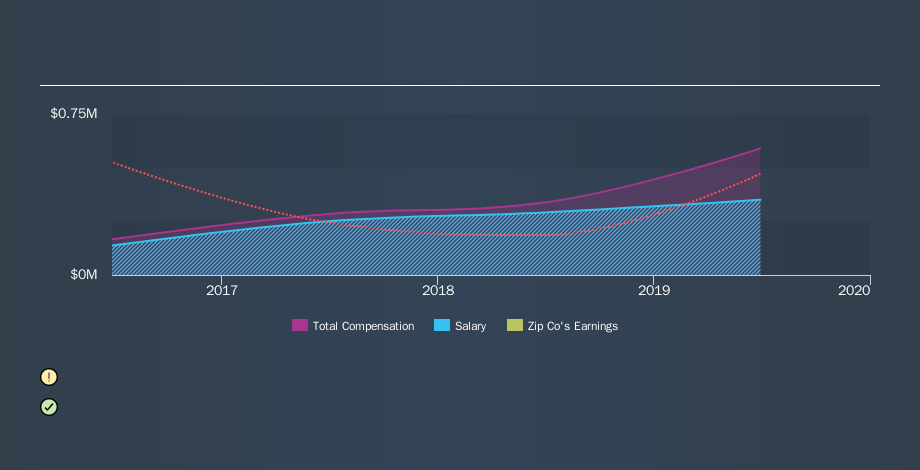

According to our data, Zip Co Limited has a market capitalization of AU$1.5b, and paid its CEO total annual compensation worth AU$590k over the year to June 2019. We note that's an increase of 75% above last year. While we always look at total compensation first, we note that the salary component is less, at AU$350k. When we examined a selection of companies with market caps ranging from AU$584m to AU$2.3b, we found the median CEO total compensation was AU$1.5m.

A first glance this seems like a real positive for shareholders, since Larry Diamond is paid less than the average total compensation paid by similar sized companies. Though positive, it's important we delve into the performance of the actual business.

You can see, below, how CEO compensation at Zip Co has changed over time.

Is Zip Co Limited Growing?

Zip Co Limited has increased its earnings per share (EPS) by an average of 7.7% a year, over the last three years (using a line of best fit). It achieved revenue growth of 111% over the last year.

It's great to see that revenue growth is strong. Combined with modest EPS growth, we get a good impression of the company. I'd stop short of saying the business performance is amazing, but there are enough positives to justify further research, or even adding the stock to your watch-list. It could be important to check this free visual depiction of what analysts expect for the future.

Has Zip Co Limited Been A Good Investment?

Most shareholders would probably be pleased with Zip Co Limited for providing a total return of 372% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

It appears that Zip Co Limited remunerates its CEO below most similar sized companies.

Larry Diamond is paid less than what is normal at similar size companies, and the total shareholder return has been pleasing over the last three years. So, while it might be nice to have better EPS growth, on our analysis the CEO compensation is quite modest. If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Zip Co.

Important note: Zip Co may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:ZIP

Zip Co

Engages in the provision of digital retail finance and payments solutions to consumers, and small and medium sized merchants (SMEs) in Australia, New Zealand, Canada, and the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives