Howard Lorber became the CEO of Vector Group Ltd. (NYSE:VGR) in 2006. First, this article will compare CEO compensation with compensation at similar sized companies. After that, we will consider the growth in the business. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This method should give us information to assess how appropriately the company pays the CEO.

View our latest analysis for Vector Group

How Does Howard Lorber's Compensation Compare With Similar Sized Companies?

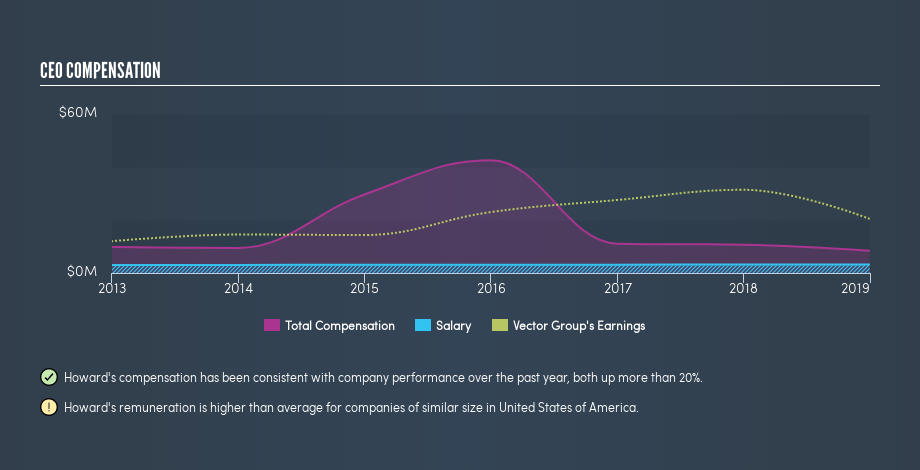

Our data indicates that Vector Group Ltd. is worth US$1.7b, and total annual CEO compensation is US$8.4m. (This figure is for the year to December 2018). While we always look at total compensation first, we note that the salary component is less, at US$3.2m. When we examined a selection of companies with market caps ranging from US$1.0b to US$3.2b, we found the median CEO total compensation was US$4.1m.

Thus we can conclude that Howard Lorber receives more in total compensation than the median of a group of companies in the same market, and of similar size to Vector Group Ltd.. However, this doesn't necessarily mean the pay is too high. We can get a better idea of how generous the pay is by looking at the performance of the underlying business.

You can see a visual representation of the CEO compensation at Vector Group, below.

Is Vector Group Ltd. Growing?

Over the last three years Vector Group Ltd. has grown its earnings per share (EPS) by an average of 4.9% per year (using a line of best fit). It achieved revenue growth of 6.4% over the last year.

I'm not particularly impressed by the revenue growth, but I'm happy with the modest EPS growth. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information.

Has Vector Group Ltd. Been A Good Investment?

With a three year total loss of 17%, Vector Group Ltd. would certainly have some dissatisfied shareholders. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

We compared total CEO remuneration at Vector Group Ltd. with the amount paid at companies with a similar market capitalization. As discussed above, we discovered that the company pays more than the median of that group.

While we have not been overly impressed by the business performance, the shareholder returns, over three years, have been disappointing. Considering this, we have the opinion that the CEO pay is more on the generous side, than the modest side. So you may want to check if insiders are buying Vector Group shares with their own money (free access).

Important note: Vector Group may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:VGR

Vector Group

Through its subsidiaries, engages in the manufacture and sale of cigarettes in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Swiped Left by Wall Street: The BMBL Rebound Trade

Bayer to Achieve Fair Value of €40 Boosting Growth and Investor Confidence

Despite short-term challenges, Chipotle is well positioned for sustainable long-term growth.

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Trending Discussion

Now what would you view be if it was discovered and become apparent that Iluka have not had an access agreement to where they mined on Jennings Farm in Eneabba for many years and in addition the 'stockpile of hidden treasure' did not all belong to them either? The tailings belong in the void from where it was taken. Are you aware?