Savaria Corporation (TSE:SIS), which is in the machinery business, and is based in Canada, saw a decent share price growth in the teens level on the TSX over the last few months. With many analysts covering the stock, we may expect any price-sensitive announcements have already been factored into the stock’s share price. But what if there is still an opportunity to buy? Let’s take a look at Savaria’s outlook and value based on the most recent financial data to see if the opportunity still exists.

See our latest analysis for Savaria

What is Savaria worth?

Great news for investors – Savaria is still trading at a fairly cheap price. According to my valuation, the intrinsic value for the stock is CA$17.55, which is above what the market is valuing the company at the moment. This indicates a potential opportunity to buy low. What’s more interesting is that, Savaria’s share price is theoretically quite stable, which could mean two things: firstly, it may take the share price a while to move to its intrinsic value, and secondly, there may be less chances to buy low in the future once it reaches that value. This is because the stock is less volatile than the wider market given its low beta.

What kind of growth will Savaria generate?

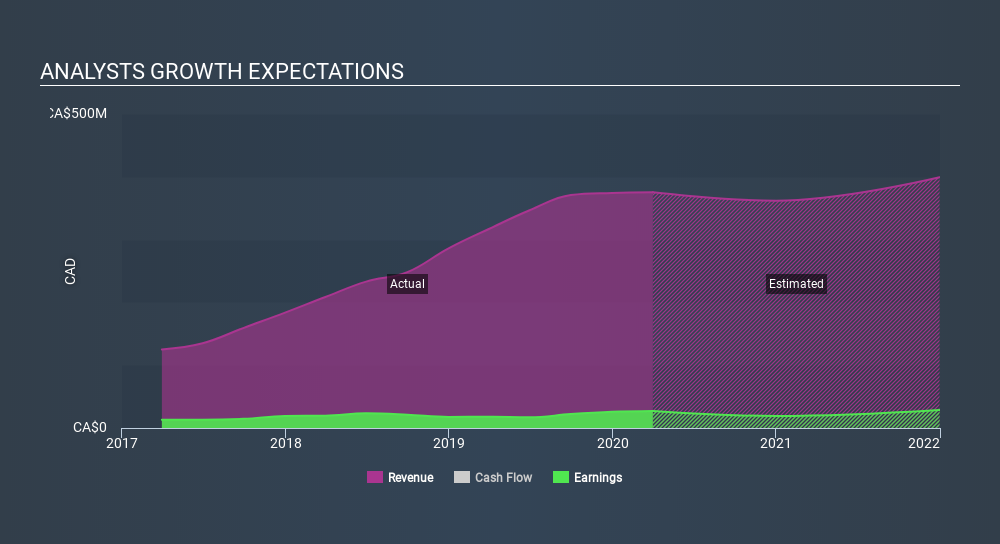

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. However, with an extremely negative double-digit change in profit expected next year, near-term growth is certainly not a driver of a buy decision. It seems like high uncertainty is on the cards for Savaria, at least in the near future.

What this means for you:

Are you a shareholder? Although SIS is currently undervalued, the negative outlook does bring on some uncertainty, which equates to higher risk. Consider whether you want to increase your portfolio exposure to SIS, or whether diversifying into another stock may be a better move for your total risk and return.

Are you a potential investor? If you’ve been keeping an eye on SIS for a while, but hesitant on making the leap, I recommend you research further into the stock. Given its current undervaluation, now is a great time to make a decision. But keep in mind the risks that come with negative growth prospects in the future.

Price is just the tip of the iceberg. Dig deeper into what truly matters – the fundamentals – before you make a decision on Savaria. You can find everything you need to know about Savaria in the latest infographic research report. If you are no longer interested in Savaria, you can use our free platform to see my list of over 50 other stocks with a high growth potential.

When trading Savaria or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:SIS

Savaria

Provides accessibility solutions for the elderly and physically challenged people in Canada, the United States, Europe, and internationally.

Established dividend payer and good value.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

EDP as a safe capital allocation with a potential upside of 28% with steady dividends

#1 Silver Play with Positive Cashflow Gold Miner (Top Notch Team)

Near-Restart Producer Mexico Silver Miner

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I wrote the latest analysis on DSV, all I can say this is my #1 stock pick, my largest hold. Latest : https://simplywall.st/community/narratives/ca/materials/tsx-dsv/discovery-silver-shares/ha9axhmi-1-silver-play-with-positive-cashflow-gold-miner-top-notch-team-moui/updates/5-discovery-silver-corp-tsx-dsv-discovery-silver-is-now?utm_source=share&utm_medium=web