- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLXS

Why Plexus Corp.'s (NASDAQ:PLXS) CEO Pay Matters To You

In 2016 Todd Kelsey was appointed CEO of Plexus Corp. (NASDAQ:PLXS). First, this article will compare CEO compensation with compensation at similar sized companies. Next, we'll consider growth that the business demonstrates. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This process should give us an idea about how appropriately the CEO is paid.

View our latest analysis for Plexus

How Does Todd Kelsey's Compensation Compare With Similar Sized Companies?

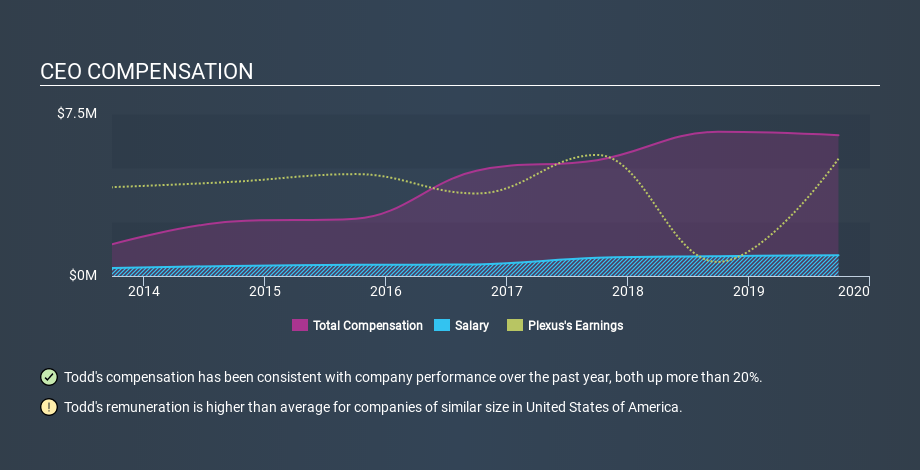

According to our data, Plexus Corp. has a market capitalization of US$2.2b, and paid its CEO total annual compensation worth US$6.5m over the year to September 2019. That's less than last year. We think total compensation is more important but we note that the CEO salary is lower, at US$959k. Importantly, there may be performance hurdles relating to the non-salary component of the total compensation. We examined companies with market caps from US$1.0b to US$3.2b, and discovered that the median CEO total compensation of that group was US$3.8m.

It would therefore appear that Plexus Corp. pays Todd Kelsey more than the median CEO remuneration at companies of a similar size, in the same market. However, this fact alone doesn't mean the remuneration is too high. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous.

You can see, below, how CEO compensation at Plexus has changed over time.

Is Plexus Corp. Growing?

Plexus Corp. has increased its earnings per share (EPS) by an average of 25% a year, over the last three years (using a line of best fit). It achieved revenue growth of 9.6% over the last year.

This demonstrates that the company has been improving recently. A good result. It's also good to see modest revenue growth, suggesting the underlying business is healthy. You might want to check this free visual report on analyst forecasts for future earnings.

Has Plexus Corp. Been A Good Investment?

With a total shareholder return of 28% over three years, Plexus Corp. shareholders would, in general, be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

We compared total CEO remuneration at Plexus Corp. with the amount paid at companies with a similar market capitalization. We found that it pays well over the median amount paid in the benchmark group.

However we must not forget that the EPS growth has been very strong over three years. We also note that, over the same time frame, shareholder returns haven't been bad. You might wish to research management further, but on this analysis, considering the EPS growth, we wouldn't call the CEO pay problematic. So you may want to check if insiders are buying Plexus shares with their own money (free access).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:PLXS

Plexus

Provides electronic manufacturing services in the United States, the Asia-Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Xero: Growth Was Priced In — Execution Is Not

Rio Tinto (RIO): Cash Machine with a China Beta Problem — and a Copper Glow-Up

Inotiv NAMs Test Center

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion