- Greece

- /

- Personal Products

- /

- ATSE:PAP

Why Papoutsanis S.A.'s (ATH:PAP) High P/E Ratio Isn't Necessarily A Bad Thing

The goal of this article is to teach you how to use price to earnings ratios (P/E ratios). We'll look at Papoutsanis S.A.'s (ATH:PAP) P/E ratio and reflect on what it tells us about the company's share price. Papoutsanis has a P/E ratio of 23.49, based on the last twelve months. That is equivalent to an earnings yield of about 4.3%.

See our latest analysis for Papoutsanis

How Do You Calculate A P/E Ratio?

The formula for P/E is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for Papoutsanis:

P/E of 23.49 = €1.775 ÷ €0.076 (Based on the year to March 2020.)

(Note: the above calculation results may not be precise due to rounding.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio implies that investors pay a higher price for the earning power of the business. That is not a good or a bad thing per se, but a high P/E does imply buyers are optimistic about the future.

How Does Papoutsanis's P/E Ratio Compare To Its Peers?

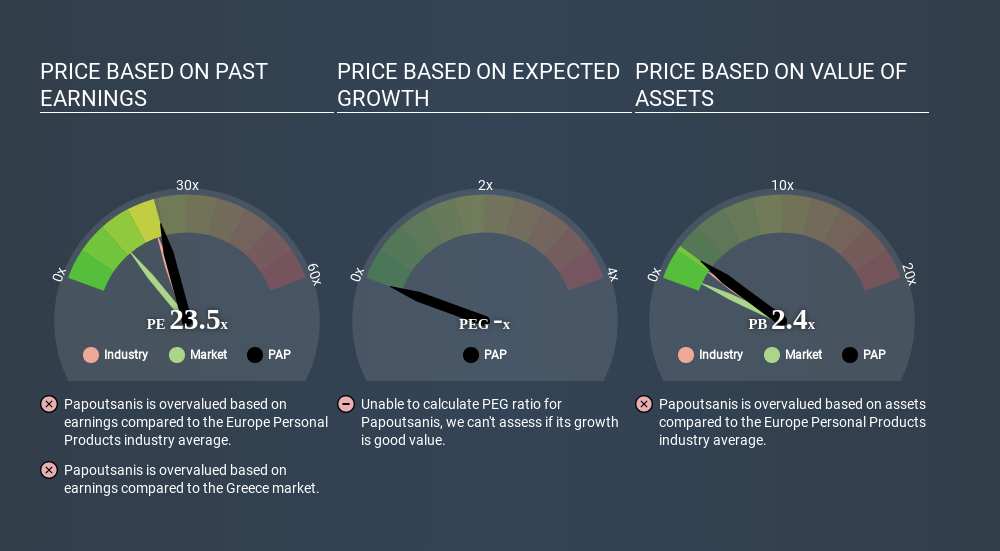

We can get an indication of market expectations by looking at the P/E ratio. The image below shows that Papoutsanis has a P/E ratio that is roughly in line with the personal products industry average (24.8).

Its P/E ratio suggests that Papoutsanis shareholders think that in the future it will perform about the same as other companies in its industry classification. If the company has better than average prospects, then the market might be underestimating it. I would further inform my view by checking insider buying and selling., among other things.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. Earnings growth means that in the future the 'E' will be higher. And in that case, the P/E ratio itself will drop rather quickly. Then, a lower P/E should attract more buyers, pushing the share price up.

In the last year, Papoutsanis grew EPS like Taylor Swift grew her fan base back in 2010; the 116% gain was both fast and well deserved.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

The 'Price' in P/E reflects the market capitalization of the company. Thus, the metric does not reflect cash or debt held by the company. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

Papoutsanis's Balance Sheet

Papoutsanis has net debt worth 15% of its market capitalization. That's enough debt to impact the P/E ratio a little; so keep it in mind if you're comparing it to companies without debt.

The Bottom Line On Papoutsanis's P/E Ratio

Papoutsanis has a P/E of 23.5. That's higher than the average in its market, which is 13.3. The company is not overly constrained by its modest debt levels, and its recent EPS growth is nothing short of stand-out. So to be frank we are not surprised it has a high P/E ratio.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. We don't have analyst forecasts, but you might want to assess this data-rich visualization of earnings, revenue and cash flow.

But note: Papoutsanis may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ATSE:PAP

Papoutsanis

Engages in the production and sale of soaps and liquid cosmetics in Greece.

Solid track record and good value.

Market Insights

Community Narratives