- Croatia

- /

- Electrical

- /

- ZGSE:KOEI

Why Koncar - Elektroindustrija d.d.'s (ZGSE:KOEI) High P/E Ratio Isn't Necessarily A Bad Thing

This article is written for those who want to get better at using price to earnings ratios (P/E ratios). To keep it practical, we'll show how Koncar - Elektroindustrija d.d.'s (ZGSE:KOEI) P/E ratio could help you assess the value on offer. Koncar - Elektroindustrija d.d has a price to earnings ratio of 49.31, based on the last twelve months. That corresponds to an earnings yield of approximately 2.0%.

View our latest analysis for Koncar - Elektroindustrija d.d

How Do I Calculate A Price To Earnings Ratio?

The formula for P/E is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for Koncar - Elektroindustrija d.d:

P/E of 49.31 = HRK472.000 ÷ HRK9.572 (Based on the trailing twelve months to March 2020.)

(Note: the above calculation results may not be precise due to rounding.)

Is A High P/E Ratio Good?

A higher P/E ratio means that investors are paying a higher price for each HRK1 of company earnings. All else being equal, it's better to pay a low price -- but as Warren Buffett said, 'It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price'.

How Does Koncar - Elektroindustrija d.d's P/E Ratio Compare To Its Peers?

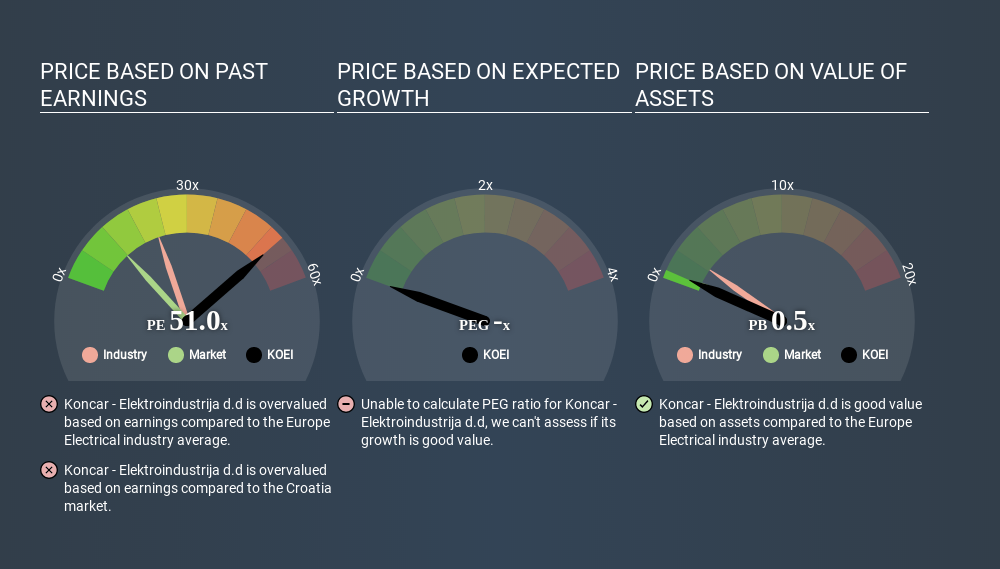

We can get an indication of market expectations by looking at the P/E ratio. As you can see below, Koncar - Elektroindustrija d.d has a higher P/E than the average company (23.4) in the electrical industry.

Its relatively high P/E ratio indicates that Koncar - Elektroindustrija d.d shareholders think it will perform better than other companies in its industry classification. The market is optimistic about the future, but that doesn't guarantee future growth. So investors should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

When earnings fall, the 'E' decreases, over time. Therefore, even if you pay a low multiple of earnings now, that multiple will become higher in the future. Then, a higher P/E might scare off shareholders, pushing the share price down.

Koncar - Elektroindustrija d.d shrunk earnings per share by 74% over the last year. And EPS is down 30% a year, over the last 5 years. This could justify a pessimistic P/E.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

The 'Price' in P/E reflects the market capitalization of the company. That means it doesn't take debt or cash into account. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

Is Debt Impacting Koncar - Elektroindustrija d.d's P/E?

With net cash of HRK350m, Koncar - Elektroindustrija d.d has a very strong balance sheet, which may be important for its business. Having said that, at 29% of its market capitalization the cash hoard would contribute towards a higher P/E ratio.

The Verdict On Koncar - Elektroindustrija d.d's P/E Ratio

Koncar - Elektroindustrija d.d's P/E is 49.3 which is way above average (11.5) in its market. The recent drop in earnings per share would make some investors cautious, but the net cash position means the company has time to improve: and the high P/E suggests the market thinks it will.

Investors have an opportunity when market expectations about a stock are wrong. People often underestimate remarkable growth -- so investors can make money when fast growth is not fully appreciated. Although we don't have analyst forecasts you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course you might be able to find a better stock than Koncar - Elektroindustrija d.d. So you may wish to see this free collection of other companies that have grown earnings strongly.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ZGSE:KOEI

KONCAR - Elektroindustrija d.d

Provides products, services, and solutions for power generation, power transmission and distribution, urban mobility and infrastructure, and digital solutions and platforms in Croatia.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives