- United States

- /

- Aerospace & Defense

- /

- NYSE:HII

Why Huntington Ingalls Industries, Inc.'s (NYSE:HII) CEO Pay Matters To You

Mike Petters became the CEO of Huntington Ingalls Industries, Inc. (NYSE:HII) in 2011. This analysis aims first to contrast CEO compensation with other large companies. After that, we will consider the growth in the business. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. The aim of all this is to consider the appropriateness of CEO pay levels.

View our latest analysis for Huntington Ingalls Industries

How Does Mike Petters's Compensation Compare With Similar Sized Companies?

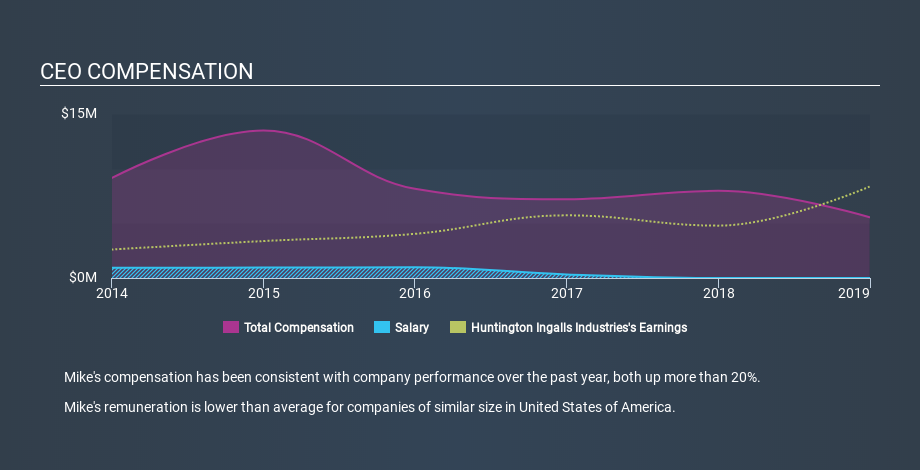

At the time of writing, our data says that Huntington Ingalls Industries, Inc. has a market cap of US$11b, and reported total annual CEO compensation of US$5.6m for the year to December 2018. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at US$1.0. Importantly, there may be performance hurdles relating to the non-salary component of the total compensation. We took a group of companies with market capitalizations over US$8.0b, and calculated the median CEO total compensation to be US$11m. Once you start looking at very large companies, you need to take a broader range, because there simply aren't that many of them.

This would give shareholders a good impression of the company, since most large companies pay more, leaving less for shareholders. However, before we heap on the praise, we should delve deeper to understand business performance.

You can see, below, how CEO compensation at Huntington Ingalls Industries has changed over time.

Is Huntington Ingalls Industries, Inc. Growing?

Huntington Ingalls Industries, Inc. has increased its earnings per share (EPS) by an average of 17% a year, over the last three years (using a line of best fit). In the last year, its revenue is up 8.9%.

This demonstrates that the company has been improving recently. A good result. It's nice to see a little revenue growth, as this is consistent with healthy business conditions. You might want to check this free visual report on analyst forecasts for future earnings.

Has Huntington Ingalls Industries, Inc. Been A Good Investment?

Most shareholders would probably be pleased with Huntington Ingalls Industries, Inc. for providing a total return of 51% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

It appears that Huntington Ingalls Industries, Inc. remunerates its CEO below most large companies.

Since the business is growing, many would argue this suggests the pay is modest. The strong history of shareholder returns might even have some thinking that Mike Petters deserves a raise! It's not often we see shareholders do so well, and yet the CEO is paid modestly. But it is even better if company insiders are also buying shares with their own money. So you may want to check if insiders are buying Huntington Ingalls Industries shares with their own money (free access).

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:HII

Huntington Ingalls Industries

Designs, builds, overhauls, and repairs military ships in the United States.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives